CVS 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

2014 Annual Report

6 | Leases

The Company leases most of its retail and mail order locations, ten of its distribution centers and certain corporate

offices under noncancelable operating leases, typically with initial terms of 15 to 25 years and with options that

permit renewals for additional periods. The Company also leases certain equipment and other assets under noncan-

celable operating leases, typically with initial terms of 3 to 10 years. Minimum rent is expensed on a straight-line

basis over the term of the lease. In addition to minimum rental payments, certain leases require additional payments

based on sales volume, as well as reimbursement for real estate taxes, common area maintenance and insurance,

which are expensed when incurred.

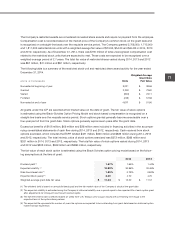

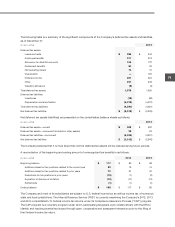

The following table is a summary of the Company’s net rental expense for operating leases for the years ended

December 31:

IN MILLIONS

2014 2013 2012

Minimum rentals

$ 2,320

$ 2,210 $ 2,165

Contingent rentals

36

41 48

2,356

2,251 2,213

Less: sublease income

(21)

(21) (20)

$ 2,335

$ 2,230 $ 2,193

The following table is a summary of the future minimum lease payments under capital and operating leases as of

December 31, 2014:

Capital Operating

IN MILLIONS Leases Leases (1)

2015 $ 47 $ 2,279

2016 47 2,220

2017 47 2,121

2018 48 2,007

2019 48 1,861

Thereafter 573 16,794

Total future lease payments 810 $ 27,282

Less: imputed interest (419)

Present value of capital lease obligations $ 391

(1) Future operating lease payments have not been reduced by minimum sublease rentals of $203 million due in the future under

noncancelable subleases.

The Company finances a portion of its store development program through sale-leaseback transactions. The proper-

ties are generally sold at net book value, which generally approximates fair value, and the resulting leases generally

qualify and are accounted for as operating leases. The operating leases that resulted from these transactions are

included in the above table. The Company does not have any retained or contingent interests in the stores and

does not provide any guarantees, other than a guarantee of lease payments, in connection with the sale-leaseback

transactions. Proceeds from sale-leaseback transactions totaled $515 million in 2014, $600 million in 2013 and

$529 million in 2012.