CVS 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

2014 Annual Report

Operating expenses increased $671 million, or 4.8% to $14.5 billion, or 21.4% as a percentage of net revenues,

in the year ended December 31, 2014, as compared to $13.8 billion, or 21.1% as a percentage of net revenues, in

the prior year. Operating expenses increased $389 million, or 2.9%, to $13.8 billion, or 21.1% as a percentage of

net revenues, in the year ended December 31, 2013, as compared to $13.5 billion, or 21.1% as a percentage of

net revenues, in the prior year. Operating expenses as a percentage of net revenues remained consistent from 2012

through 2013 primarily due to disciplined cost control, despite the negative impact of generics on net revenues.

Operating expenses as a percentage of net revenues increased in 2014 primarily due to reimbursement rate pres-

sure, the implementation of Specialty Connect, which reduced net revenues, and higher legal costs. The increase

in operating expense dollars in 2014 and 2013 was the result of higher store operating costs associated with our

increased store count, as well as higher legal costs. The results for the years ended December 31, 2014 and 2013

include gains from legal settlements of $21 million and $61 million, respectively. Additionally, in September 2014, the

Retail Pharmacy Segment made a charitable contribution of $25 million to the CVS Foundation to fund future charitable

giving. The foundation is a non-profit entity that focuses on health, education and community involvement programs.

Corporate Segment

Operating expenses

increased $45 million, or 6.0%, to $796 million in the year ended December 31, 2014, as

compared to the prior year. Operating expenses increased $57 million, or 8.3%, to $751 million in the year ended

December 31, 2013. Operating expenses within the Corporate Segment include executive management, corporate

relations, legal, compliance, human resources, corporate information technology and finance related costs. The

increase in operating expenses in 2014 and 2013 was primarily due to increased strategic initiatives, benefits costs,

facilities management and information technology costs.

Liquidity and Capital Resources

We maintain a level of liquidity sufficient to allow us to cover our cash needs in the short-term. Over the long-term,

we manage our cash and capital structure to maximize shareholder return, maintain our financial position and

maintain flexibility for future strategic initiatives. We continuously assess our working capital needs, debt and

leverage levels, capital expenditure requirements, dividend payouts, potential share repurchases and future invest-

ments or acquisitions. We believe our operating cash flows, commercial paper program, sale-leaseback program,

as well as any potential future borrowings, will be sufficient to fund these future payments and long-term initiatives.

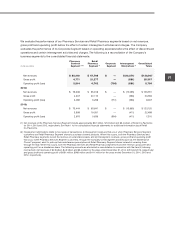

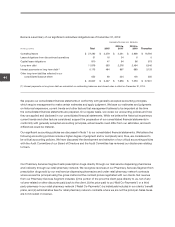

The change in cash and cash equivalents is as follows:

YEAR ENDED DECEMBER 31,

IN MILLIONS

2014 2013 2012

Net cash provided by operating activities

$ 8,137

$ 5,783 $ 6,671

Net cash used in investing activities

(4,045)

(1,835) (1,849)

Net cash used in financing activities

(5,694)

(1,237) (4,860)

Effect of exchange rate changes on cash and cash equivalents

(6)

3 —

Net increase (decrease) in cash and cash equivalents

$ (1,608)

$ 2,714 $ (38)

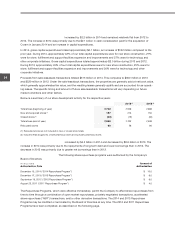

Net cash provided by operating activities

increased by $2.4 billion in 2014 and decreased by $0.9 billion in

2013. The increase in 2014 was primarily due to increased net income and increased accounts payable due to

payables management and timing. The decrease in 2013 was primarily due to increased accounts receivable

due to the timing of payments from CMS in connection with our Medicare Part D operations, partially offset by

improved inventory management.