CVS 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

2014 Annual Report

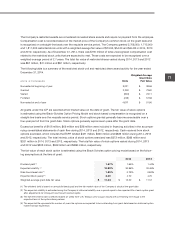

5 | Borrowing and Credit Agreements

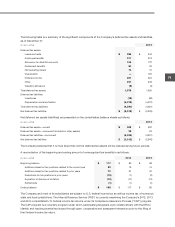

The following table is a summary of the Company’s borrowings as of December 31:

IN MILLIONS 2014 2013

Commercial paper

$ 685

$ —

4.875% senior notes due 2014

—

550

3.25% senior notes due 2015

550

550

6.125% senior notes due 2016

421

421

1.2% senior notes due 2016

750

750

5.75% senior notes due 2017

1,080

1,310

2.25% senior notes due 2018

1,250

1,250

6.6% senior notes due 2019

394

394

2.25% senior notes due 2019

850

—

4.75% senior notes due 2020

450

450

4.125% senior notes due 2021

550

550

2.75% senior notes due 2022

1,250

1,250

4.0% senior notes due 2023

1,250

1,250

3.375% senior notes due 2024

650

—

6.25% senior notes due 2027

453

1,000

6.125% senior notes due 2039

734

1,500

5.75% senior notes due 2041

493

950

5.3% senior notes due 2043

750

750

Capital lease obligations

391

390

Other

4

87

12,955

13,402

Less:

Short-term debt (commercial paper)

(685)

—

Current portion of long-term debt

(575)

(561)

Long-term debt

$ 11,695

$ 12,841

The Company had $685 million of commercial paper outstanding at a weighted average interest rate of 0.55% as

of December 31, 2014. In connection with its commercial paper program, the Company maintains a $1.25 billion,

five-year unsecured back-up credit facility, which expires on February 17, 2017, a $1.0 billion, five-year unsecured

back-up credit facility, which expires on May 23, 2018, and a $1.25 billion, five-year unsecured back-up credit

facility, which expires on July 24, 2019. The credit facilities allow for borrowings at various rates that are dependent,

in part, on the Company’s public debt ratings and require the Company to pay a weighted average quarterly facility

fee of approximately 0.03%, regardless of usage. As of December 31, 2014, there were no borrowings outstanding

under the back-up credit facilities. The weighted average interest rate for short-term debt outstanding during the

year ended December 31, 2014 and 2013 was 0.36% and 0.27%, respectively.

On August 7, 2014, the Company issued $850 million of 2.25% unsecured senior notes due August 12, 2019 and

$650 million of 3.375% unsecured senior notes due August 12, 2024 (collectively, the “2014 Notes”) for total proceeds

of approximately $1.5 billion, net of discounts and underwriting fees. The 2014 Notes pay interest semi-annually and