CVS 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

2014 Annual Report

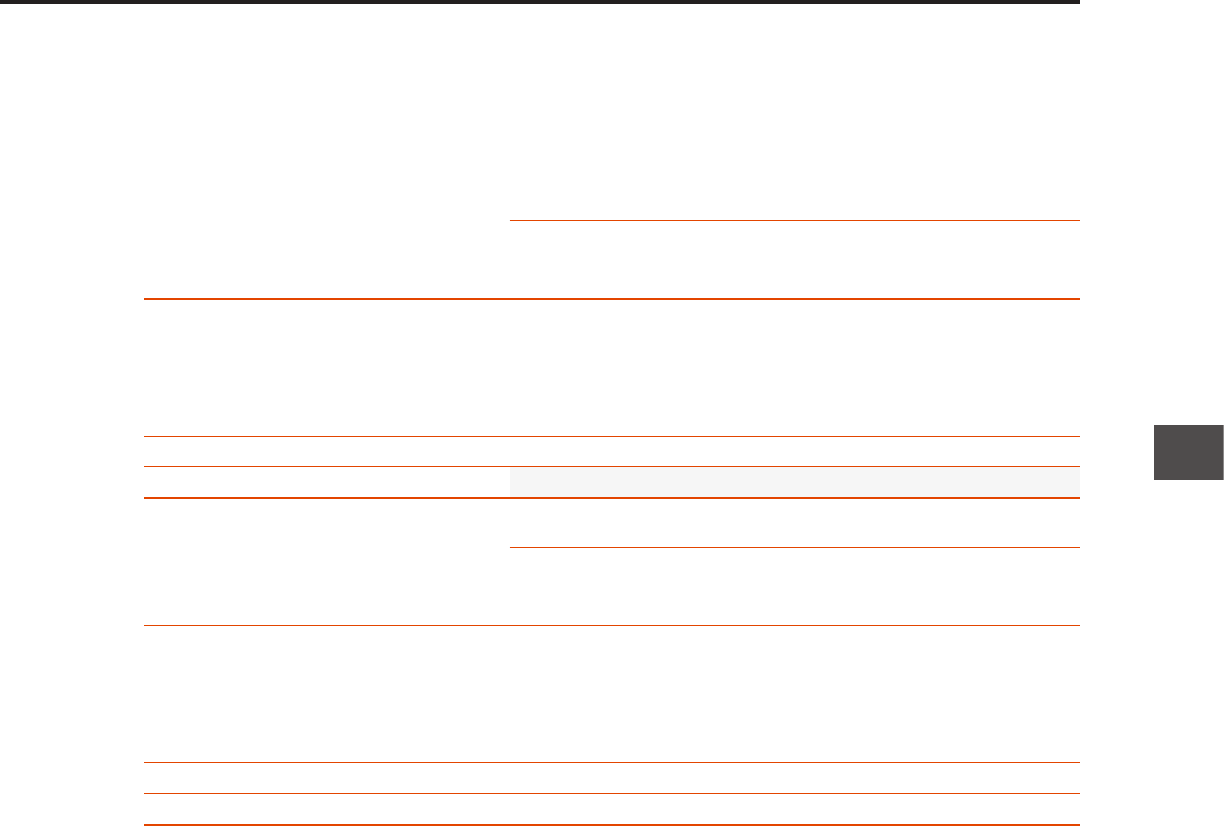

Changes in accumulated other comprehensive income (loss) by component are shown below:

YEAR ENDED DECEMBER 31, 2014(1)

Pension

Losses on and Other

Foreign Cash Flow Postretirement

IN MILLIONS Currency Hedges Benefits Total

Balance, December 31, 2013 $ (30) $ (13) $ (106) $ (149)

Other comprehensive income (loss) before

reclassifications (35) — — (35)

Amounts reclassified from accumulated

other comprehensive income (2) — 4 (37) (33)

Net other comprehensive income (loss) (35) 4 (37) (68)

Balance, December 31, 2014

$ (65) $ (9) $ (143) $ (217)

YEAR ENDED DECEMBER 31, 2013(1)

Pension

Losses on and Other

Foreign Cash Flow Postretirement

IN MILLIONS Currency Hedges Benefits Total

Balance, December 31, 2012 $ — $ (16) $ (165) $ (181)

Other comprehensive income (loss) before

reclassifications (30) — — (30)

Amounts reclassified from accumulated

other comprehensive income (2) — 3 59 62

Net other comprehensive income (loss) (30) 3 59 32

Balance, December 31, 2013 $ (30) $ (13) $ (106) $ (149)

(1) All amounts are net of tax.

(2) The amounts reclassified from accumulated other comprehensive income for cash flow hedges are recorded within interest expense,

net on the consolidated statement of income. The amounts reclassified from accumulated other comprehensive income for pension and

other postretirement benefits are included in operating expenses on the consolidated statement of income.

Stock-based compensation — Stock-based compensation is measured at the grant date based on the fair value

of the award and is recognized as expense over the applicable requisite service period of the stock award (generally

3 to 5 years) using the straight-line method.

Variable interest entity — In July 2014, the Company and Cardinal Health, Inc. (“Cardinal”) established Red Oak

Sourcing, LLC (“Red Oak”), a generic pharmaceutical sourcing entity in which the Company and Cardinal each own

50%. The Red Oak arrangement has an initial term of ten years. Under this arrangement, the Company and Cardinal

contributed their sourcing and supply chain expertise to Red Oak and agreed to source and negotiate generic

pharmaceutical supply contracts for both companies through Red Oak; however, Red Oak does not own or hold

inventory on behalf of either company. No physical assets (e.g., property and equipment) were contributed to Red

Oak by either company and minimal funding was provided to capitalize Red Oak.

The Company has determined that it is the primary beneficiary of this variable interest entity because it has the

ability to direct the activities of Red Oak. Consequently, the Company consolidates Red Oak in its consolidated

financial statements within the Retail Pharmacy Segment. Revenues associated with Red Oak expenses reimbursed

by Cardinal for the year ended December 31, 2014 and amounts due to Cardinal from Red Oak at December 31,

2014 were immaterial.