CVS 2014 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2014 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS Health

78

Notes to Consolidated Financial Statements

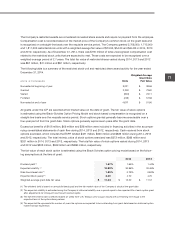

As of December 31, 2014, unrecognized compensation expense related to unvested options totaled $121 million,

which the Company expects to be recognized over a weighted-average period of 1.7 years. After considering

anticipated forfeitures, the Company expects approximately 16 million of the unvested stock options to vest over

the requisite service period.

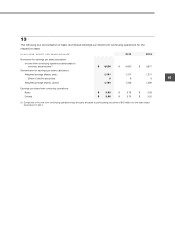

The following table is a summary of the Company’s stock option activity for the year ended December 31, 2014:

Weighted Average

Weighted Average Remaining Aggregate

SHARES IN THOUSANDS Shares Exercise Price Contractual Term Intrinsic Value

Outstanding at December 31, 2013 34,738 $ 41.40

Granted 4,525 $ 74.96

Exercised (9,563) $ 37.30

Forfeited (1,202) $ 50.15

Expired (332) $ 36.93

Outstanding at December 31, 2014 28,166 $ 47.87 4.15 $ 1,364,408,886

Exercisable at December 31, 2014 11,634 $ 37.86 2.82 $ 679,995,090

Vested at December 31, 2014 and expected

to vest in the future 27,394 $ 47.51 4.11 $ 1,336,774,863

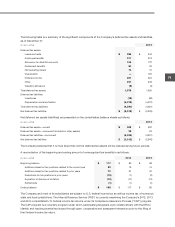

10 | Income Taxes

The income tax provision for continuing operations consisted of the following for the years ended December 31:

IN MILLIONS 2014 2013 2012

Current:

Federal

$ 2,581

$ 2,623 $ 2,226

State

495

437 410

3,076

3,060 2,636

Deferred:

Federal

(43)

(115) (182)

State

—

(17) (18)

(43)

(132) (200)

Total

$ 3,033

$ 2,928 $ 2,436

The following table is a reconciliation of the statutory income tax rate to the Company’s effective income tax rate for

continuing operations for the years ended December 31:

2014 2013 2012

Statutory income tax rate

35.0 %

35.0 % 35.0 %

State income taxes, net of federal tax benefit

4.3

4.0 3.9

Other

0.2

(0.1) (0.3)

Effective income tax rate

39.5 %

38.9 % 38.6 %