CVS 2014 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2014 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

on early extinguishment of debt in 2014 and the gain

from a legal settlement in 2013). And we achieved this

strong growth even after forgoing approximately 8 cents

in earnings per share from exiting the tobacco category.

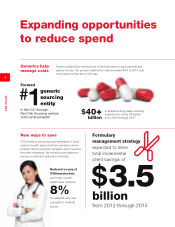

We’ve benefited from a number of growth drivers,

especially our ability to increase enterprise share of

prescriptions dispensed through our many channels.

We also filled more than 80 percent of prescriptions

using generic equivalents, which are more cost effective

for patients and payors and are more profitable for

us than branded drugs. Looking ahead, more than

$40 billion of branded drugs are expected to lose

patent protection and effectively be replaced by generic

equivalents between 2015 and 2017. Furthermore,

we completed the formation of our Red Oak Sourcing

venture with Cardinal Health to create the largest generic

sourcing entity in the United States. Our combined

scale, along with our knowledge and expertise, should

lead to even greater savings for our clients, their

members, and CVS Health.

We generated $6.5 billion in free cash flow in 2014 and

once again returned more than $5 billion to shareholders

through dividends and share repurchases. Our board of

directors increased our quarterly dividend by 22 percent

last year and recently approved a 27 percent increase

for 2015. That marks our 12th consecutive year of

increases and keeps us solidly on track toward our

dividend payout ratio target of 35 percent by 2018.

With our December 2014 announcement of a new

$10 billion share repurchase program, we began 2015

with approximately $12.7 billion available to repurchase

CVS Health shares when we identify favorable oppor-

tunities. More than $7 billion is expected to be returned

to our shareholders through dividends and share

repurchases in 2015.

CVS Health shares produced a total return of 36.6 per-

cent in 2014. Over the same period, the S&P 500

Index and the Dow Jones Industrial Average returned

13.7 percent and 10.0 percent, respectively. We have

outperformed these indices on a three-, five-, and

10-year basis as well. Our 2014 stock performance

also outpaced the 25.3 percent return of the S&P 500

Health Care Index.

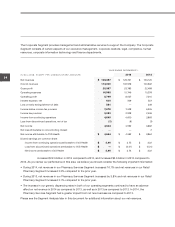

Our core strengths and integrated offerings drove

another successful PBM selling season

Our CVS/caremark PBM offers competitive pricing, high

levels of service and execution, and unmatched services

that continue to resonate with payors. As a result, 2014

revenues increased by 16 percent to $88 billion in our

Pharmacy Services segment. After a successful selling

season, we started 2015 with $7.0 billion in gross new

business spread among health plans, government

payors, and employers. With a 96 percent retention rate,

net new business for 2015 totaled $3.6 billion.

Clients value the strength of CVS/caremark’s adherence

programs, specialty services, and advanced formulary

strategies. Pharmacy Advisor, Maintenance Choice,

Specialty Connect, and our other integrated offerings

have played an increasingly important role in our ability to

win and retain business. At present, no other PBM can

offer these differentiated services and capabilities.

Pharmacy Advisor, our industry-leading clinical program

for plan members with chronic diseases, currently

addresses diabetes, cardiovascular conditions, and

eight other disease states. Now available to our

Medicare and Medicaid plans as well, it is helping them

improve the clinical star measures that impact their

reimbursement rates.

With more than 20 million plan members enrolled in

Maintenance Choice in 2015, growth in participation has

exceeded 85 percent in just three years. We are also

seeing growing interest in our new Specialty Connect

delivery option. Similar to Maintenance Choice, it offers

specialty patients the flexibility to receive their prescrip-

tions by mail or at one of our stores.

CVS/caremark’s retail network claims have risen

significantly over the past six years, from about 575 mil-

lion to 930 million prescriptions. Over the same period,

CVS/pharmacy’s share of the CVS/caremark book of

business has grown from 19 percent to approximately

31 percent. We are gaining a growing share of a

growing business, highlighting the success of our chan-

nel-agnostic approach and the power of our integrated

business model.

PBM clients are also increasingly incorporating

CVS/minuteclinic services into their plans, improving

member access to health care while lowering overall

costs. For example, our pilot plan to reduce or eliminate

co-payments for plan members now covers 1.2 million

lives. That’s up from 88,000 in 2012.

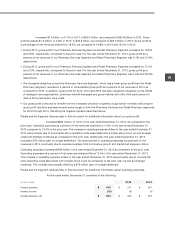

We are reinventing specialty with a unique suite

of assets to address rising costs

Our specialty pharmacy business continues to grow

rapidly, with revenues from the specialty drugs we

dispensed and managed across the enterprise totaling

$31 billion in 2014. The overall specialty market is

projected to reach $235 billion and 50 percent of total

drug spend by 2018—compared with just 38 percent

this past year—as utilization of costly new therapies

16

CVS Health