CVS 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS Health

74

Notes to Consolidated Financial Statements

7 | Medicare Part D

The Company offers Medicare Part D benefits through SilverScript, which has contracted with CMS to be a PDP

and, pursuant to the Medicare Prescription Drug, Improvement and Modernization Act of 2003, must be a risk-bear-

ing entity regulated under state insurance laws or similar statutes.

SilverScript is a licensed domestic insurance company under the applicable laws and regulations. Pursuant to these

laws and regulations, SilverScript must file quarterly and annual reports with the National Association of Insurance

Commissioners (“NAIC”) and certain state regulators, must maintain certain minimum amounts of capital and surplus

under a formula established by the NAIC and must, in certain circumstances, request and receive the approval of

certain state regulators before making dividend payments or other capital distributions to the Company. The

Company does not believe these limitations on dividends and distributions materially impact its financial position.

The Company has recorded estimates of various assets and liabilities arising from its participation in the Medicare

Part D program based on information in its claims management and enrollment systems. Significant estimates

arising from its participation in this program include: (i) estimates of low-income cost subsidy, reinsurance amounts,

and coverage gap discount amounts ultimately payable to or receivable from CMS based on a detailed claims

reconciliation that will occur in the following year; (ii) an estimate of amounts receivable from or payable to CMS

under a risk-sharing feature of the Medicare Part D program design, referred to as the risk corridor and (iii) estimates

for claims that have been reported and are in the process of being paid or contested and for our estimate of claims

that have been incurred but have not yet been reported.

As of December 31, 2014 and 2013, amounts due from CMS included in accounts receivable were $1.8 billion and

$2.4 billion, respectively.

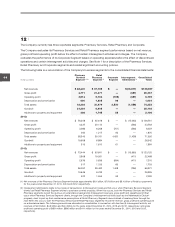

8 | Pension Plans and Other Postretirement Benefits

Defined Contribution Plans

The Company sponsors voluntary 401(k) savings plans that cover all employees who meet plan eligibility require-

ments. The Company makes matching contributions consistent with the provisions of the plans.

At the participant’s option, account balances, including the Company’s matching contribution, can be transferred

without restriction among various investment options, including the Company’s common stock fund under one of

the defined contribution plans. The Company also maintains a nonqualified, unfunded Deferred Compensation Plan

for certain key employees. This plan provides participants the opportunity to defer portions of their eligible compen-

sation and receive matching contributions equivalent to what they could have received under the CVS Health 401(k)

Plan absent certain restrictions and limitations under the Internal Revenue Code. The Company’s contributions

under the above defined contribution plans were $238 million, $235 million and $199 million in 2014, 2013 and

2012, respectively.

Other Postretirement Benefits

The Company provides postretirement health care and life insurance benefits to certain retirees who meet eligibility

requirements. The Company’s funding policy is generally to pay covered expenses as they are incurred. For retiree

medical plan accounting, the Company reviews external data and its own historical trends for health care costs to

determine the health care cost trend rates. As of December 31, 2014 and 2013, the Company’s other postretirement

benefits have an accumulated postretirement benefit obligation of $31 million and $27 million, respectively. Net

periodic benefit costs related to these other postretirement benefits were $1 million in 2014, $11 million in 2013,

and $1 million in 2012. The net periodic benefit costs for 2013 include a settlement loss of $8 million.