CVS 2014 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2014 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

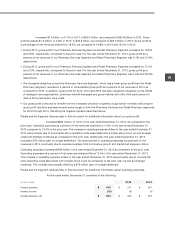

increases. Hepatitis C drugs such as Sovaldi® and

Harvoni™ as well as PCSK9 inhibitors, an anticipated

new class of drugs for lowering cholesterol, are notable

examples of high-cost therapies expected to drive the

rapid growth in specialty pharmacy.

This trend imposes a substantial burden on both patients

and payors as they seek ways to control costs. Our

clients count on us to manage these expensive specialty

medications to ensure appropriate utilization through a

combination of prior authorization, formulary manage-

ment, and other innovative clinical programs. That’s why

we’ve been working hard to reinvent specialty pharmacy.

In specialty, we led the market in 2013 with formulary

strategies using clinically appropriate and cost-effective

solutions and we continued to lead in 2014. We also

have unparalleled capabilities to manage specialty

patients holistically, not just their drug costs, and our

clinical support and site-of-care management helps drive

superior outcomes. We’ve integrated our Accordant rare

disease care management services to enhance care

and reduce costs, rolled out Specialty Connect, and

made key acquisitions such as Coram and NovoLogix

to broaden our portfolio.

CVS/pharmacy posted solid results despite exit from

tobacco category and continued to gain share

CVS/pharmacy continued to gain market share in both

the pharmacy and the front of the store in 2014 even

as consumers remained cost conscious. Our core

pharmacy business has grown three times faster than

that of other drug chains over the same period, and we

hold a 21 percent share of the U.S. retail prescription

drug market.

For the year, same-store sales rose 2.1 percent, with

the pharmacy up 4.8 percent and the front of the store

down 4.0 percent. Our underlying front store growth

was obscured by the negative impact on revenue from

exiting the tobacco category. It has now been five

months since we became the first national pharmacy

chain to eliminate cigarettes and other tobacco products

from our shelves, a move that reflects our corporate

purpose and is expected to help drive long-term growth.

As expected, exiting the tobacco category will cost us

approximately $2 billion in revenues on an annualized

basis—$1.5 billion from tobacco sales specifically and

approximately another $500 million from the rest of those

shoppers’ baskets. That amounted to about 8 cents in

earnings per share in 2014, and it is expected to cost

an incremental 8 to 9 cents per share in 2015 for a total

annual impact of approximately 17 cents per share. Yet

our decision better aligns us with payors and providers

as they search for ways to improve health outcomes

and control costs. That should make us a more attractive

partner for dispensing and other services, ultimately

helping us recapture this lost revenue elsewhere across

the enterprise.

Health and beauty remained key drivers of front store

sales in 2014, with market shares rising to 36 and

40 percent, respectively. Our store brands continued

to generate profitable sales growth, accounting for

19 percent of front store sales. Given our success,

we’ve set a new goal of increasing store brand

penetration to 25 percent of front store sales. Like

generic drugs in the pharmacy, store brands provide

significantly higher margins than national brands while

also saving our customers money. The past year saw

our successful launch of the Makeup Academy™

and radiance® PLATINUM lines as well as more than

40 items under the new Gold Emblem Abound™

healthy snack brand.

As we look to the future, we will continue to provide our

customers with additional healthy options. Our goal is to

make CVS/pharmacy the convenience destination for

more, better, and healthier choices. In research we have

conducted since the tobacco announcement, custom-

ers have made healthy food their number one choice

among offerings they would like to see added. More-

over, these products are less sensitive to promotion,

which aligns with our strategy to drive profitable growth.

Our adherence programs and partnerships

are providing value to our PBM and non-PBM

patients alike

Our channel-agnostic pharmacy care model has played

a key role in enhancing member services and driving

share gains. Plan members are embracing our unique

offerings, and we’ve also endeavored to improve our

value to our retail customers who are covered by other

PBMs. They are benefiting from our best-in-class clinical

17

2014 Annual Report

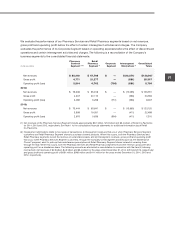

FOCUS ON SHAREHOLDER VALUE

More than $7 billion is

expected to be returned to

our shareholders through

dividends and share

repurchases in 2015.