CVS 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

2014 Annual Report

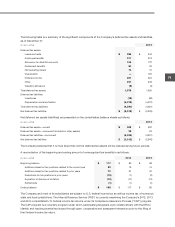

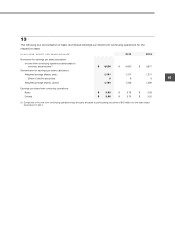

The following table is a summary of the significant components of the Company’s deferred tax assets and liabilities

as of December 31:

IN MILLIONS 2014 2013

Deferred tax assets:

Lease and rents

$ 396

$ 344

Employee benefits

311

213

Allowance for doubtful accounts

164

172

Retirement benefits

80

79

Net operating losses

74

10

Depreciation

—

192

Deferred income

261

220

Other

297

378

Valuation allowance

(5)

(3)

Total deferred tax assets

1,578

1,605

Deferred tax liabilities:

Inventories

(18)

(69)

Depreciation and amortization

(4,572)

(4,512)

Total deferred tax liabilities

(4,590)

(4,581)

Net deferred tax liabilities

$ (3,012)

$ (2,976)

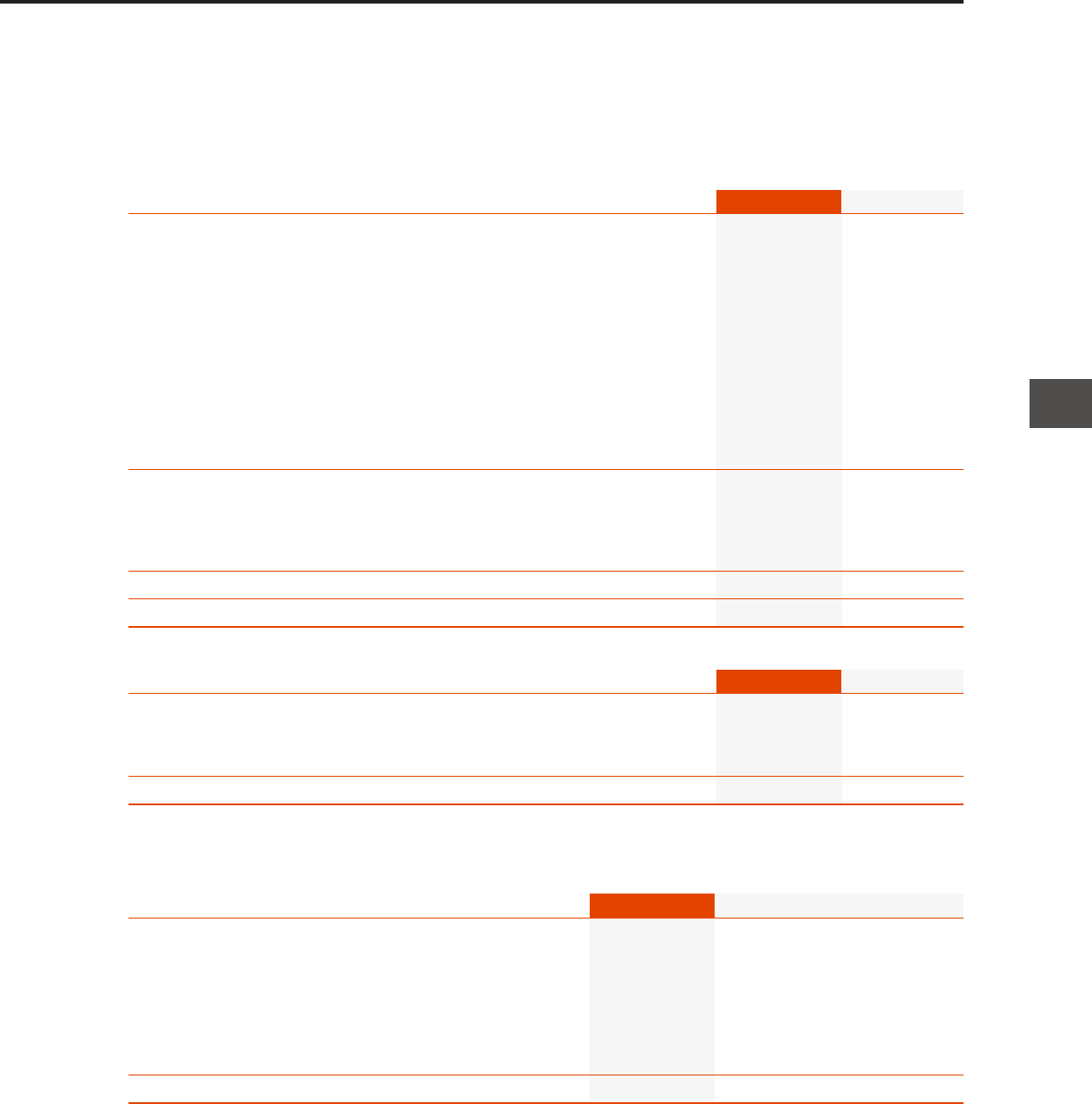

Net deferred tax assets (liabilities) are presented on the consolidated balance sheets as follows:

IN MILLIONS

2014 2013

Deferred tax assets—current

$ 985

$ 902

Deferred tax assets—noncurrent (included in other assets)

39

23

Deferred tax liabilities—noncurrent

(4,036)

(3,901)

Net deferred tax liabilities

$ (3,012)

$ (2,976)

The Company believes that it is more likely than not the deferred tax assets will be realized during future periods.

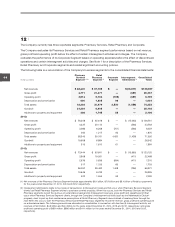

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

IN MILLIONS

2014 2013 2012

Beginning balance

$ 117

$ 80 $ 38

Additions based on tax positions related to the current year

32

19 15

Additions based on tax positions related to prior years

70

37 42

Reductions for tax positions of prior years

(15)

(1) (2)

Expiration of statutes of limitation

(15)

(17) (12)

Settlements

(1)

(1) (1)

Ending balance

$ 188

$ 117 $ 80

The Company and most of its subsidiaries are subject to U.S. federal income tax as well as income tax of numerous

state and local jurisdictions. The Internal Revenue Service (“IRS”) is currently examining the Company’s 2012, 2013

and 2014 consolidated U.S. federal income tax returns under its Compliance Assurance Process (“CAP”) program.

The CAP program is a voluntary program under which participating taxpayers work collaboratively with the IRS to

identify and resolve potential tax issues through open, cooperative and transparent interaction prior to the filing of

their federal income tax return.