CVS 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS CAREMARK 69 2011 ANNUAL REPORT

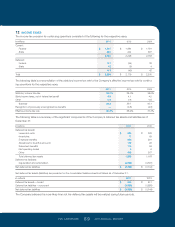

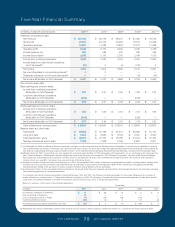

12 INCOME TAXES

The income tax provision for continuing operations consisted of the following for the respective years:

in millions 2011 2010 2009

Current:

Federal $ 1,807 $ 1,884 $ 1,761

State 338 344 397

2,145 2,228 2,158

Deferred:

Federal 101 (44) 38

State 12 (5) 4

113 (49) 42

Total $ 2,258 $ 2,179 $ 2,200

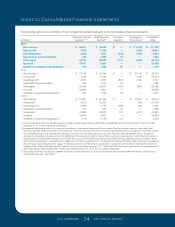

The following table is a reconciliation of the statutory income tax rate to the Company’s effective income tax rate for continu-

ing operations for the respective years:

2011 2010 2009

Statutory income tax rate 35.0% 35.0% 35.0%

State income taxes, net of federal tax benefit 3.9 4.1 4.5

Other 0.4 0.6 0.6

Subtotal 39.3 39.7 40.1

Recognition of previously unrecognized tax benefits — (0.8) (2.8)

Effective income tax rate 39.3% 38.9% 37.3%

The following table is a summary of the significant components of the Company’s deferred tax assets and liabilities as of

December 31:

in millions 2011 2010

Deferred tax assets:

Lease and rents $ 325 $ 325

Inventories 77 69

Employee benefits 253 261

Allowance for doubtful accounts 112 96

Retirement benefits 114 99

Net operating losses 6 6

Other 315 307

Total deferred tax assets 1,202 1,163

Deferred tax liabilities:

Depreciation and amortization (4,552) (4,307)

Net deferred tax liabilities $ (3,350) $ (3,144)

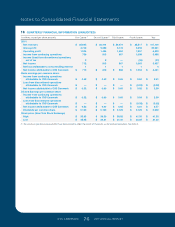

Net deferred tax assets (liabilities) are presented on the consolidated balance sheets as follows as of December 31:

in millions 2011 2010

Deferred tax assets – current $ 503 $ 511

Deferred tax liabilities – noncurrent (3,853) (3,655)

Net deferred tax liabilities $ (3,350) $ (3,144)

The Company believes it is more likely than not the deferred tax assets will be realized during future periods.

127087_Financial.indd 69 3/9/12 9:42 PM