CVS 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS CAREMARK 59 2011 ANNUAL REPORT

is still evaluating which of the two alternatives it will apply

in reporting comprehensive income. Neither alternative is

expected to have a material impact on the Company’s con-

solidated results of operations and neither alternative will

have an impact on the Company’s financial condition or

cash flows.

In September 2011, the FASB issued ASU 2011-08, Testing

Goodwill for Impairment (“ASU 2011-08”). ASU 2011-08

allows entities to use a qualitative approach to determine

whether it is more likely than not that the fair value of a report-

ing unit is less than its carrying value. If after performing the

qualitative assessment an entity determines it is not more

likely than not that the fair value of a reporting unit is less than

its carrying amount, then performing the two-step goodwill

impairment test is unnecessary. However, if an entity con-

cludes otherwise, then it is required to perform the first step

of the two-step goodwill impairment test. ASU 2011-08 is

effective for annual and interim goodwill impairment tests per-

formed for fiscal years beginning after December 15, 2011.

The Company does not expect the adoption of ASU 2011-08

will have a material impact on the Company’s consolidated

results of operations, financial condition or cash flows.

In September 2011, the FASB issued ASU 2011-09,

Disclosures about an Employer’s Participation in a

Multiemployer Plan (“ASU 2011-09”). ASU 2011-09 requires

additional quantitative and qualitative disclosures of entities

who participate in multiemployer pension and other postre-

tirement plans. ASU 2011-09 is effective for annual periods

ending after December 15, 2011 and should be applied retro-

spectively. The adoption of ASU 2011-09 did not have a mate-

rial impact on the Company’s financial statement disclosures.

2 BUSINESS COMBINATION

On April 29, 2011, the Company acquired the Medicare pre-

scription drug business of Universal American Corp. (the “UAM

Medicare Part D Business”) for approximately $1.3 billion. The

UAM Medicare Part D Business offers prescription drug

plan benefits to Medicare beneficiaries throughout the United

States through its Community CCRSM prescription drug plan.

The fair value of assets acquired and liabilities assumed were

$2.4 billion and $1.1 billion, respectively, which included

identifiable intangible assets of approximately $0.4 billion

and goodwill of approximately $1.0 billion that were recorded

in the PSS. The allocation of the purchase price is prelimi-

nary and is based on information that was available to man-

agement at the time the consolidated financial statements

were prepared, accordingly, the allocation may change. The

Company’s results of operations and cash flows include the

UAM Medicare Part D Business beginning on April 29, 2011.

3 DISCONTINUED OPERATIONS

On November 1, 2011, the Company sold its TheraCom,

L.L.C. (“TheraCom”) subsidiary to AmerisourceBergen

Corporation for $250 million, subject to a working capital

adjustment. TheraCom is a provider of commercialization

support services to the biotech and pharmaceutical indus-

try. As of December 31, 2010, TheraCom had approximately

$0.1 billion of current assets consisting primarily of accounts

receivable and $0.1 billion of current liabilities consisting pri-

marily of accounts payable. The sale of TheraCom resulted

in the derecognition of approximately $0.2 billion of nonde-

ductible goodwill. The TheraCom business had historically

been part of the Company’s Pharmacy Services segment. The

results of the TheraCom business are presented as discontin-

ued operations and have been excluded from both continuing

operations and segment results for all periods presented.

In connection with certain business dispositions completed

between 1991 and 1997, the Company retained guarantees

on store lease obligations for a number of former subsid-

iaries, including Linens ‘n Things which filed for bankruptcy

in 2008. The Company’s income (loss) from discontinued

operations includes lease-related costs which the Company

believes it will likely be required to satisfy pursuant to its

Linens ‘n Things lease guarantees.

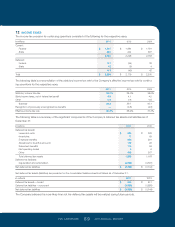

Below is a summary of the results of discontinued operations:

Year Ended December 31,

in millions 2011 2010 2009

Net revenues of TheraCom $ 650 $ 635 $ 514

Income from operations of TheraCom $ 18 $ 28 $ 13

Gain on disposal of TheraCom 53 — —

Loss on disposal of Linens ‘n Things (7) (24) (19)

Income tax benefit (provision) (95) (2) 2

Income (loss) from discontinued operations, net of tax $ (31) $ 2 $ (4)

127087_Financial.indd 59 3/9/12 9:42 PM