CVS 2011 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2011 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

CVS CAREMARK 26 2011 ANNUAL REPORT

See Note 3 “Discontinued Operations” to the consolidated

financial statements for additional information about dis-

continued operations and Note 13 “Commitments and

Contingencies” for additional information about our

lease guarantees.

Net loss attributable to noncontrolling interest represents

the minority shareholders’ portion of the net loss from our

majority owned subsidiary, Generation Health, Inc., which

we acquired in the fourth quarter of 2009. The net loss

attributable to noncontrolling interest for the years ended

December 31, 2011 and 2010 was $4 million and $3 mil-

lion, respectively, and was de minimis in 2009.

Net income attributable to CVS Caremark increased $34 mil-

lion or 1.0% to $3.5 billion (or $2.57 per diluted share) in 2011.

This compares to $3.4 billion (or $2.49 per diluted share) in

2010 and $3.7 billion (or $2.55 per diluted share) in 2009. As

previously noted, net income attributable to CVS Caremark in

2010 and 2009 both benefited from previously unrecognized

tax benefits.

Segment Analysis

We evaluate the performance of our Pharmacy Services and

Retail Pharmacy segments based on net revenues, gross

profit and operating profit before the effect of certain inter-

segment activities and charges. The Company evaluates the

performance of its Corporate segment based on operating

expenses before the effect of discontinued operations and

certain intersegment activities and charges. The following is

a reconciliation of the Company’s business segments to the

consolidated financial statements:

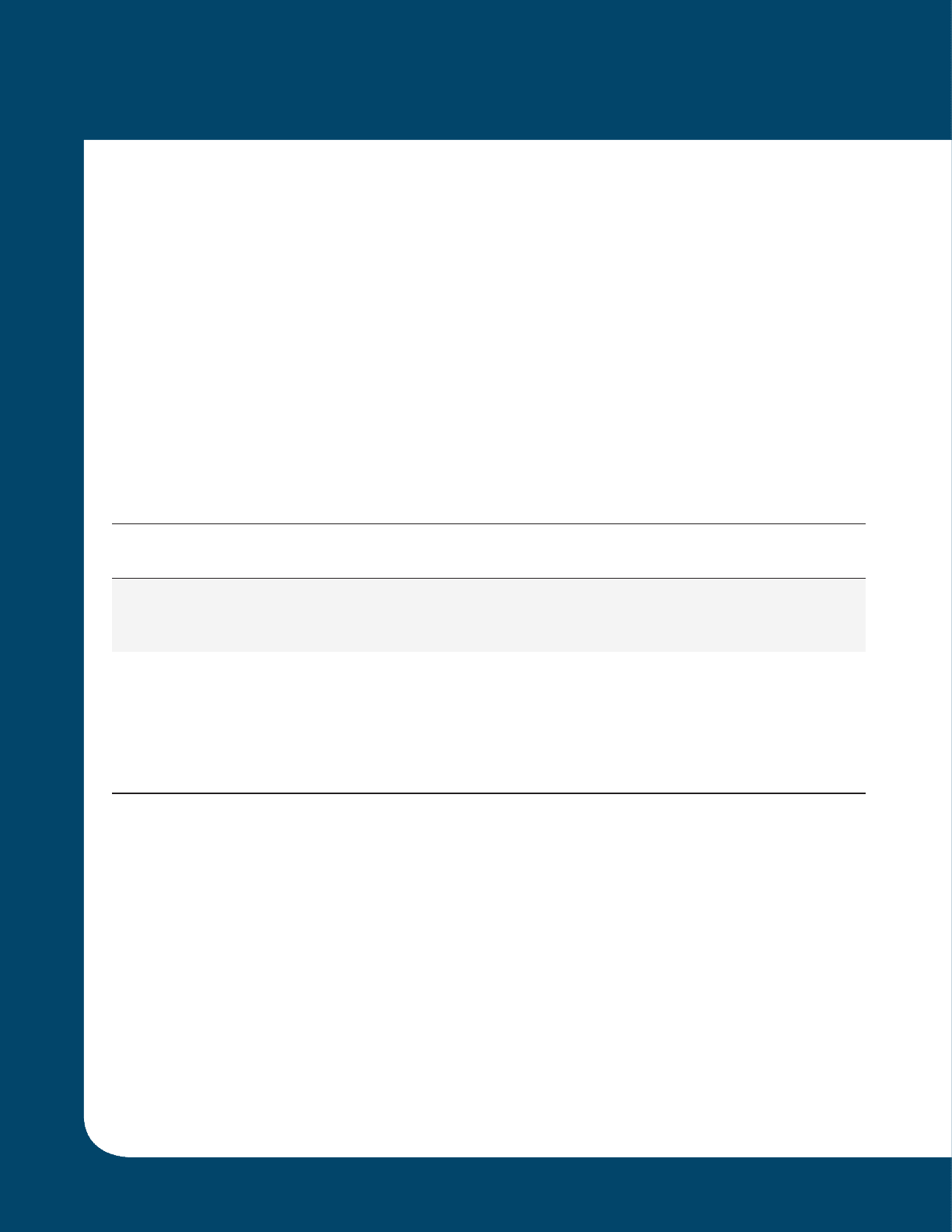

Pharmacy Retail

Services Pharmacy Corporate Intersegment Consolidated

in millions Segment (1)(2)(3) Segment (2) Segment Eliminations (2) Totals

2011:

Net revenues $ 58,874 $ 59,599 $ — $ (11,373) $ 107,100

Gross profit 3,279 17,468 — (186) 20,561

Operating profit 2,220 4,912 (616) (186) 6,330

2010:

Net revenues $ 47,145 $ 57,345 $ — $ (8,712) $ 95,778

Gross profit 3,315 17,039 — (135) 20,219

Operating profit 2,361 4,537 (626) (135) 6,137

2009:

Net revenues $ 50,551 $ 55,355 $ — $ (7,691) $ 98,215

Gross profit 3,813 16,593 — (48) 20,358

Operating profit 2,853 4,159 (539) (48) 6,425

(1) Net revenues of the Pharmacy Services segment include approximately $7.9 billion, $6.6 billion and $6.9 billion of Retail Co-Payments for 2011, 2010 and 2009,

respectively. See Note 1 to the consolidated financial statements for additional information about Retail Co-Payments.

(2) Intersegment eliminations relate to two types of transactions: (i) Intersegment revenues that occur when Pharmacy Services segment customers use Retail

Pharmacy segment stores to purchase covered products. When this occurs, both the Pharmacy Services and Retail Pharmacy segments record the revenue

on a standalone basis, and (ii) Intersegment revenues, gross profit and operating profit that occur when Pharmacy Services segment customers, through the

Company’s intersegment activities (such as the Maintenance Choice® program), elect to pick up their maintenance prescriptions at Retail Pharmacy segment

stores instead of receiving them through the mail. When this occurs, both the Pharmacy Services and Retail Pharmacy segments record the revenue, gross

profit and operating profit on a standalone basis. Beginning in the fourth quarter of 2011, the Maintenance Choice eliminations reflect all discounts available

for the purchase of mail order prescription drugs. The following amounts are eliminated in consolidation in connection with the item (ii) intersegment activity:

net revenues of $2.6 billion, $1.8 billion and $0.7 billion for the years ended December 31, 2011, 2010 and 2009, respectively; gross profit and operating

profit of $186 million, $135 million and $48 million for the years ended December 31, 2011, 2010 and 2009, respectively.

(3) The results of the Pharmacy Services segment for the years ended December 31, 2010 and 2009 have been revised to reflect the results of TheraCom as

discontinued operations. See Note 3 to the consolidated financial statements.

127087_Financial.indd 26 3/9/12 9:42 PM