CVS 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS CAREMARK 61 2011 ANNUAL REPORT

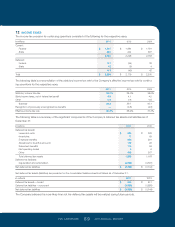

5 SHARE REPURCHASE PROGRAMS

On August 23, 2011, the Company’s Board of Directors

authorized a share repurchase program for up to $4.0 bil-

lion of outstanding common stock (the “2011 Repurchase

Program”). The share repurchase authorization under the

2011 Repurchase Program, which was effective immediately,

permits the Company to effect repurchases from time to

time through a combination of open market repurchases, pri-

vately negotiated transactions, accelerated share repurchase

transactions, and/or other derivative transactions. The 2011

Repurchase Program may be modified or terminated by the

Board of Directors at any time.

Pursuant to the authorization under the 2011 Repurchase

Program, on August 24, 2011, the Company entered into a

$1.0 billion fixed dollar accelerated share repurchase (“ASR”)

agreement with Barclays Bank PLC (“Barclays”). The ASR

agreement contained provisions that establish the minimum

and maximum number of shares to be repurchased dur-

ing its term. Pursuant to the ASR agreement, on August 25,

2011, the Company paid $1.0 billion to Barclays in exchange

for Barclays delivering 20.3 million shares of common stock

to the Company. On September 16, 2011, upon establish-

ment of the minimum number of shares to be repurchased,

Barclays delivered an additional 5.4 million shares of com-

mon stock to the Company. The Company received an addi-

tional 1.6 million shares of common stock on December

29, 2011, due to the fluctuation in market price of common

stock over the term of the ASR agreement, which concluded

on December 28, 2011. The total of 27.3 million shares of

common stock delivered to the Company by Barclays over

the term of the ASR agreement were placed into treasury

stock. The Company accounted for the ASR agreement as

two separate transactions: (i) as shares of common stock

acquired in a treasury stock transaction and (ii) as a forward

contract indexed to the Company’s own common stock. As

such, the Company accounted for the shares that it received

under the ASR agreement as a repurchase of its common

stock for the purpose of calculating earnings per share. The

Company has determined that the forward contract indexed

to the Company’s common stock met all of the applicable

criteria for equity classification.

On June 14, 2010, the Company’s Board of Directors autho-

rized a share repurchase program for up to $2.0 billion of out-

standing common stock (the “2010 Repurchase Program”).

The share repurchase authorization under the 2010

Repurchase Program, which was effective immediately and

expired at the end of 2011, permitted the Company to effect

repurchases from time to time through a combination of open

market repurchases, privately negotiated transactions, accel-

erated share repurchase transactions, and/or other derivative

transactions. During the year ended December 31, 2011, the

Company repurchased an aggregate of 56.4 million shares of

common stock for approximately $2.0 billion, completing the

2010 Repurchase Program. The Company did not make any

share repurchases under the 2010 Repurchase Program dur-

ing the year ended December 31, 2010.

On November 4, 2009, the Company’s Board of Directors

authorized a share repurchase program for up to $2.0 bil-

lion of its outstanding common stock (the “2009 Repurchase

Program”). From November 4, 2009 through December 31,

2009, the Company repurchased 16.1 million shares of com-

mon stock for approximately $500 million under the 2009

Repurchase Program. During the year ended December 31,

2010, the Company repurchased 42.4 million shares of com-

mon stock for approximately $1.5 billion, completing the

2009 Repurchase Program.

On May 7, 2008, the Company’s Board of Directors autho-

rized, effective May 21, 2008, a share repurchase program

for up to $2.0 billion of its outstanding common stock (the

“2008 Repurchase Program”). From May 21, 2008 through

December 31, 2008, the Company repurchased approxi-

mately 0.6 million shares of common stock for $23 million

under the 2008 Repurchase Program. During the year ended

December 31, 2009, the Company repurchased approxi-

mately 57.0 million shares of common stock for approximately

$2.0 billion, completing the 2008 Repurchase Program.

127087_Financial.indd 61 3/9/12 9:42 PM