CVS 2011 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2011 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

CVS CAREMARK 24 2011 ANNUAL REPORT

Gross profit increased $342 million in 2011, to $20.6 billion or

19.2% of net revenues as compared to $20.2 billion in 2010.

Gross profit decreased $139 million in 2010, to $20.2 billion

or 21.1% of net revenues, as compared to 2009.

• During 2011, gross profit in our Retail Pharmacy segment

increased by 2.5% offset by declines in our Pharmacy

Services segment of 1.1%, compared to the prior year.

• During 2010, gross profit in our Retail Pharmacy segment

increased by 2.7% offset by declines in our Pharmacy

Services segment of 13.1%, compared to the prior year.

• The decline in gross profit as a percent of net revenues

was driven by the increased weighting toward Pharmacy

Services whose gross profit margin tends to be lower than

that of the Retail Pharmacy segment.

• In addition, for the three years 2009 through 2011, our

gross profit continued to benefit from the increased utiliza-

tion of generic drugs (which normally yield a higher gross

profit rate than equivalent brand name drugs) in both the

Pharmacy Services and Retail Pharmacy segments.

Please see the Segment Analysis later in this document for

additional information about our gross profit.

Net revenues increased $11.3 billion in 2011 compared to

2010, and decreased $2.4 billion in 2010 compared to 2009.

As you review our performance in this area, we believe you

should consider the following important information:

• During 2011, net revenues in our Retail Pharmacy seg-

ment increased 3.9% and net revenues in our Pharmacy

Services segment increased 24.9% compared to the

prior year.

• During 2010, net revenues in our Retail Pharmacy seg-

ment increased by 3.6% which was offset by a decline in

our Pharmacy Services segment of 6.7%, compared to the

prior year.

• The increase in our generic dispensing rates in both of our

operating segments continues to have an adverse effect

on net revenue in 2011 as compared to 2010, as well as in

2010 as compared to 2009.

Please see the Segment Analysis later in this document for

additional information about our net revenues.

Results of Operations

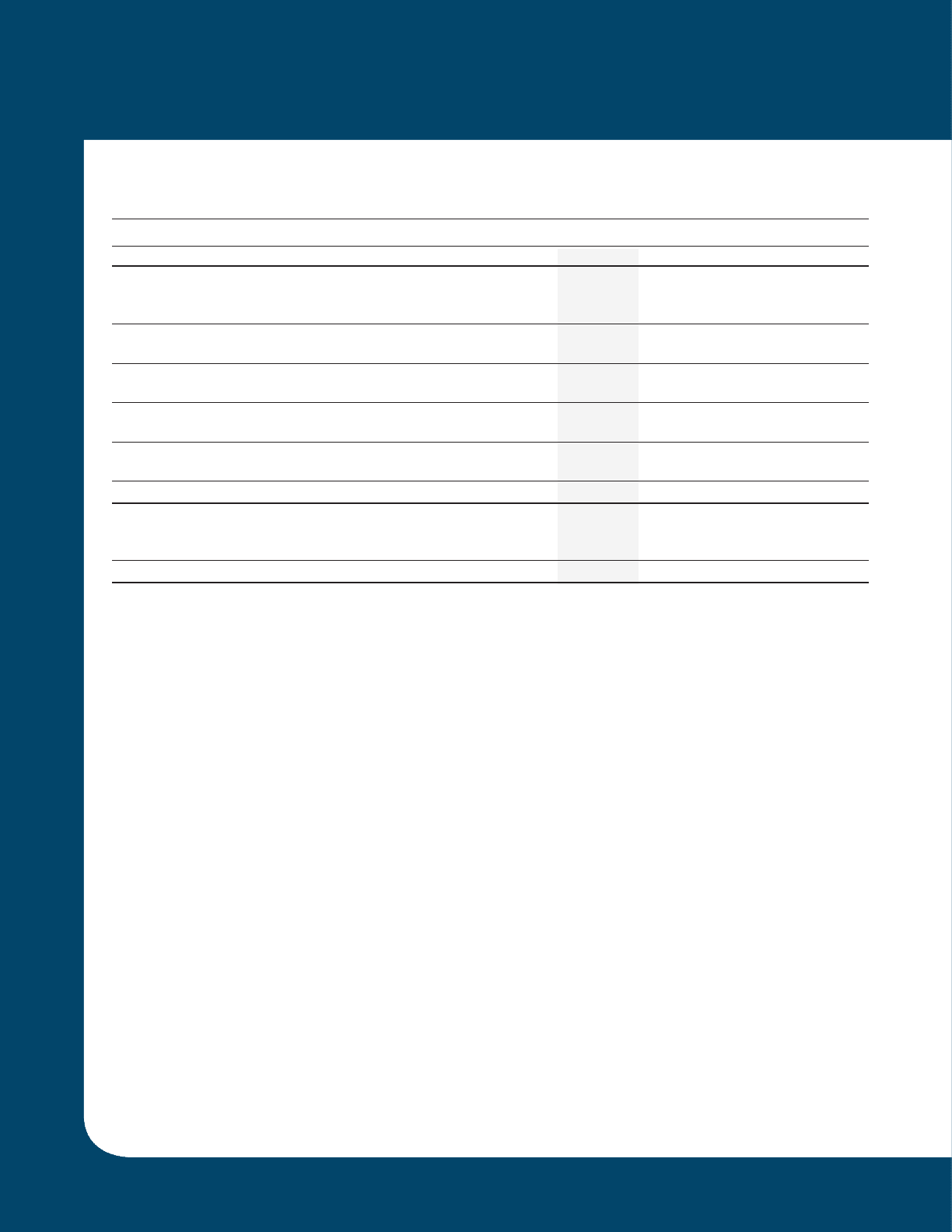

SUMMARY OF OUR CONSOLIDATED FINANCIAL RESULTS

Year Ended December 31,

in millions, except per common share amounts 2011 2010 2009

Net revenues $ 107,100 $ 95,778 $ 98,215

Gross profit 20,561 20,219 20,358

Operating expenses 14,231 14,082 13,933

Operating profit 6,330 6,137 6,425

Interest expense, net 584 536 525

Income before income tax provision 5,746 5,601 5,900

Income tax provision 2,258 2,179 2,200

Income from continuing operations 3,488 3,422 3,700

Income (loss) from discontinued operations, net of tax (31) 2 (4)

Net income 3,457 3,424 3,696

Net loss attributable to noncontrolling interest 4 3 —

Net income attributable to CVS Caremark $ 3,461 $ 3,427 $ 3,696

Diluted earnings per common share:

Income from continuing operations attributable to CVS Caremark $ 2.59 $ 2.49 $ 2.55

Loss from discontinued operations attributable to CVS Caremark (0.02) — —

Net income attributable to CVS Caremark $ 2.57 $ 2.49 $ 2.55

127087_Financial.indd 24 3/9/12 9:42 PM