CVS 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS CAREMARK 65 2011 ANNUAL REPORT

the dividends received and contributions from the Company

to repay the ESOP Notes. As the ESOP Notes were repaid,

ESOP Preference Stock was allocated to plan participants

based on (i) the ratio of each year’s debt service payment

to total current and future debt service payments multiplied

by (ii) the number of unallocated shares of ESOP Preference

Stock in the plan.

ESOP expense recognized is equal to (i) the interest incurred

on the ESOP Notes plus (ii) the higher of (a) the principal

repayments or (b) the cost of the shares allocated, less

(iii) the dividends paid. Similarly, the guaranteed ESOP obliga-

tion is reduced by the higher of (i) the principal payments or

(ii) the cost of shares allocated.

On January 30, 2009, pursuant to the Company’s Amended

and Restated Certificate of Incorporation (the “Charter”),

the Company informed the trustee of the ESOP Trust of

its intent to redeem for cash all of the outstanding shares

of ESOP Preference Stock on February 24, 2009 (the

“Redemption Date”). Under the Charter, at any time prior

to the Redemption Date, the trustee had the right to convert

the ESOP Preference Stock into shares of the Company’s

common stock. The conversion rate at the time of the notice

was 4.628 shares of common stock for each share of ESOP

Preference Stock. The trustee exercised its right of conversion

on February 23, 2009, and all of the approximately 4 million

outstanding shares of ESOP Preference Stock were converted

into approximately 17 million shares of common stock which

were recorded as treasury stock. As of December 31, 2011,

2010 and 2009, no shares of ESOP Preference Stock were

outstanding and allocated to plan participants.

10 PENSION PLANS AND OTHER

POSTRETIREMENT BENEFITS

Defined Contribution Plans

The Company sponsors voluntary 401(k) savings plans that

cover substantially all employees who meet plan eligibility

requirements. The Company makes matching contributions

consistent with the provisions of the plans.

At the participant’s option, account balances, including the

Company’s matching contribution, can be moved without

restriction among various investment options, including the

Company’s common stock. The Company also maintains a

nonqualified, unfunded Deferred Compensation Plan for certain

key employees. This plan provides participants the opportu-

nity to defer portions of their eligible compensation and receive

matching contributions equivalent to what they could have

received under the CVS Caremark 401(k) Plan absent certain

restrictions and limitations under the Internal Revenue Code.

The Company’s contributions under the previously mentioned

defined contribution plans were $187 million, $186 million and

$173 million in 2011, 2010 and 2009, respectively.

Other Postretirement Benefits

The Company provides postretirement health care and life

insurance benefits to certain retirees who meet eligibility

requirements. The Company’s funding policy is generally to pay

covered expenses as they are incurred. For retiree medical plan

accounting, the Company reviews external data and its own

historical trends for health care costs to determine the health

care cost trend rates. As of December 31, 2011 and 2010, the

Company’s postretirement medical plans have an accumulated

postretirement benefit obligation of $17 million. Net periodic

benefit costs related to these postretirement medical plans

were approximately $1 million for 2011, 2010 and 2009.

Pursuant to various labor agreements, the Company also

contributes to multiemployer health and welfare plans that

cover union-represented employees. The plans provide post-

retirement health care and life insurance benefits to certain

employees who meet eligibility requirements. Total Company

contributions to multiemployer health and welfare plans were

$47 million, $46 million and $47 million in 2011, 2010 and

2009, respectively.

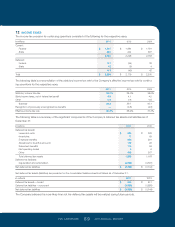

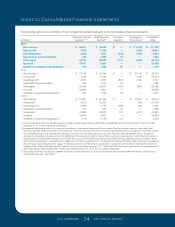

Pension Plans

The Company sponsors nine defined benefit pension plans

that cover certain full-time employees. Three of the plans are

tax-qualified plans that are funded based on actuarial calcu-

lations and applicable federal laws and regulations. The other

six plans are unfunded nonqualified supplemental retirement

plans. All of the plans were frozen in prior periods, except

one of the nonqualified plans.

As of December 31, 2011, the Company’s pension plans

had a projected benefit obligation of $685 million and plan

assets of $463 million. As of December 31, 2010, the

Company’s pension plans had a projected benefit obligation

of $659 million and plan assets of $426 million. Actual return

on plan assets was $37 million and $45 million in 2011 and

2010, respectively. Net periodic pension costs related to

these pension plans were $49 million, $36 million and

$16 million in 2011, 2010 and 2009, respectively. The net

periodic pension costs for 2011 and 2010 includes settle-

ment losses of $25 million and $12 million, respectively, due

to the impact of lump sum payouts.

127087_Financial.indd 65 3/9/12 9:42 PM