CVS 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

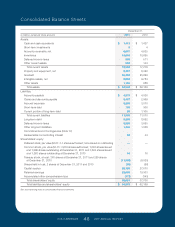

Consolidated Balance Sheets

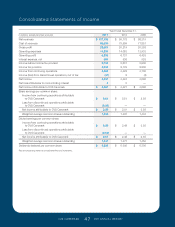

Year Ended December 31,

in millions, except per share amounts 2010 2009

2008

Net revenues $ 96,413 $ 98,729 $ 87,472

Cost of revenues 76,156 78,349 69,182

Gross profit 20,257 20,380 18,290

Operating expenses 14,092 13,942 12,244

Operating profit 6,165 6,438 6,046

Interest expense, net 536 525 509

Income before income tax provision 5,629 5,913 5,537

Income tax provision 2,190 2,205 2,193

Income from continuing operations 3,439 3,708 3,344

Loss from discontinued operations, net of income tax benefit (15) (12) (132)

Net income 3,424 3,696 3,212

Net loss attributable to noncontrolling interest 3 – –

Preference dividends, net of income tax benefit – – (14)

Net income attributable to CVS Caremark $ 3,427 $ 3,696 $ 3,198

Basic earnings per common share:

Income from continuing operations attributable to CVS Caremark $ 2.52 $ 2.59 $ 2.32

Loss from discontinued operations attributable to

CVS Caremark (0.01) (0.01) (0.09)

Net income attributable to CVS Caremark $ 2.51 $ 2.58 $ 2.23

Weighted average common shares outstanding 1,367 1,434 1,434

Diluted earnings per common share:

Income from continuing operations attributable to CVS Caremark $ 2.50 $ 2.56 $ 2.27

Loss from discontinued operations attributable to CVS Caremark (0.01) (0.01) (0.09)

Net income attributable to CVS Caremark $ 2.49 $ 2.55 $ 2.18

Weighted average common shares outstanding 1,377 1,450 1,469

Dividends declared per common share $ 0.350 $ 0.305 $ 0.258

See accompanying notes to consolidated financial statements.

CVS CAREMARK 45 2011 ANNUAL REPORT

Management’s Report on Internal Control

Over Financial Reporting

We are responsible for establishing and maintaining adequate internal control over financial reporting. Our Company’s

internal control over financial reporting includes those policies and procedures that pertain to the Company’s ability to

record, process, summarize and report a system of internal accounting controls and procedures to provide reason-

able assurance, at an appropriate cost/benefit relationship, that the unauthorized acquisition, use or disposition of

assets are prevented or timely detected and that transactions are authorized, recorded and reported properly to per-

mit the preparation of financial statements in accordance with generally accepted accounting principles (GAAP) and

receipt and expenditures are duly authorized. In order to ensure the Company’s internal control over financial report-

ing is effective, management regularly assesses such controls and did so most recently for its financial reporting as of

December 31, 2011.

We conducted an assessment of the effectiveness of our internal controls over financial reporting based on the cri-

teria set forth in Internal Control — Integrated Framework issued by the Committee of Sponsoring Organizations of

the Treadway Commission. This evaluation included review of the documentation, evaluation of the design effectiveness

and testing of the operating effectiveness of controls. Our system of internal control over financial reporting is enhanced

by periodic reviews by our internal auditors, written policies and procedures and a written Code of Conduct adopted

by our Company’s Board of Directors, applicable to all employees of our Company. In addition, we have an internal

Disclosure Committee, comprised of management from each functional area within the Company, which performs a

separate review of our disclosure controls and procedures. There are inherent limitations in the effectiveness of any

system of internal controls over financial reporting.

Based on our assessment, we conclude our Company’s internal control over financial reporting is effective and pro-

vides reasonable assurance that assets are safeguarded and that the financial records are reliable for preparing financial

statements as of December 31, 2011.

Ernst & Young LLP, independent registered public accounting firm, is appointed by the Board of Directors and ratified by

our Company’s shareholders. They were engaged to render an opinion regarding the fair presentation of our consolidated

financial statements as well as conducting an audit of internal control over financial reporting. Their accompanying report

is based upon an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board

(United States).

February 17, 2012

127087_Financial.indd 45 3/9/12 9:42 PM