CVS 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

CVS CAREMARK 58 2011 ANNUAL REPORT

than the average market price of the common shares and,

therefore, the effect would be antidilutive.

New Accounting Pronouncements

In January 2010, the Financial Accounting Standards Board

(“FASB”) issued Accounting Standards Update (“ASU”)

2010-06, Fair Value Measurements and Disclosures:

Improving Disclosures about Fair Value Measurements,

(“ASU 2010-06”). ASU 2010-06 expanded the required dis-

closures about fair value measurements by requiring (i) sepa-

rate disclosure of the amounts of significant transfers in and

out of Level 1 and Level 2 fair value measurements along

with the reasons for such transfers, (ii) information about pur-

chases, sales, issuances and settlements to be presented

separately in the reconciliation for Level 3 fair value measure-

ments, (iii) expanded fair value measurement disclosures for

each class of assets and liabilities, and (iv) disclosures about

the valuation techniques and inputs used to measure fair

value for both recurring and nonrecurring fair value measure-

ments that fall in either Level 2 or Level 3. ASU 2010-06

was effective for annual reporting periods beginning after

December 15, 2009, except for (ii) above which is effective for

fiscal years beginning after December 15, 2010. The adop-

tion of ASU 2010-06 did not have a material impact on the

Company’s financial statement disclosures.

In May 2011, the FASB issued ASU 2011-05, Presentation

of Comprehensive Income (“ASU 2011-05”). ASU 2011-05

eliminates the current option to report other comprehen-

sive income and its components in the statement of share-

holders’ equity. Instead, an entity will have the option to

present the total of comprehensive income, the compo-

nents of net income, and the components of other compre-

hensive income either in a single continuous statement of

comprehensive income or in two separate but consecutive

statements. ASU 2011-05 also required entities to present

reclassification adjustments out of accumulated other com-

prehensive income by component in both the statement in

which net income is presented and the statement in which

other comprehensive is presented. In December 2011, the

FASB issued ASU 2011-12 Deferral of the Effective Date

for Amendments to the Presentation of Reclassification of

Items Out of Accumulated Other Comprehensive Income in

Accounting Standards Update No. 2011-05, which indefi-

nitely defers the guidance related to the presentation of

reclassification adjustments. ASU 2011-05 is effective for

interim and annual periods beginning after December 15,

2011 and should be applied retrospectively. The Company

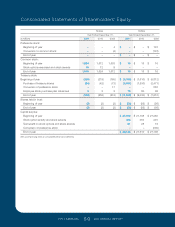

Accumulated other comprehensive loss – Accumulated

other comprehensive loss consists of changes in the net

actuarial gains and losses associated with pension and

other postretirement benefit plans, and unrealized losses

on derivatives. The amount included in accumulated other

comprehensive loss related to the Company’s pension and

postretirement plans was $250 million pre-tax ($152 million

after-tax) as of December 31, 2011 and $217 million pre-tax

($132 million after-tax) as of December 31, 2010. The net

impact on cash flow hedges totaled $32 million pre-tax

($20 million after-tax) and $18 million pre-tax ($11 million

after-tax) as of December 31, 2011 and 2010, respectively.

Stock-based compensation – Stock-based compensa-

tion expense is measured at the grant date based on the fair

value of the award and is recognized as expense over the

applicable requisite service period of the stock award (gener-

ally 3 to 5 years) using the straight-line method. Stock-based

compensation costs are included in selling, general and

administrative expenses.

Income taxes – The Company provides for federal and state

income taxes currently payable, as well as for those deferred

because of timing differences between reported income and

expenses for financial statement purposes versus tax pur-

poses. Federal and state tax credits are recorded as a reduc-

tion of income taxes. Deferred tax assets and liabilities are

recognized for the future tax consequences attributable to

differences between the carrying amount of assets and liabili-

ties for financial reporting purposes and the amounts used

for income tax purposes. Deferred tax assets and liabilities

are measured using the enacted tax rates expected to apply

to taxable income in the years in which those temporary

differences are expected to be recoverable or settled. The

effect of a change in tax rates is recognized as income or

expense in the period of the change.

Earnings per common share – Basic earnings per com-

mon share is computed by dividing: (i) net earnings by (ii) the

weighted average number of common shares outstanding

during the year (the “Basic Shares”).

Diluted earnings per common share is computed by dividing:

(i) net earnings by (ii) Basic Shares plus the additional shares

that would be issued assuming that all dilutive stock awards

are exercised. Options to purchase 30.5 million, 34.3 million

and 37.7 million shares of common stock were outstand-

ing as of December 31, 2011, 2010 and 2009, respectively,

but were not included in the calculation of diluted earnings

per share because the options’ exercise prices were greater

127087_Financial.indd 58 3/9/12 9:42 PM