CVS 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CVS CAREMARK 55 2011 ANNUAL REPORT

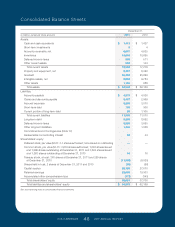

Redeemable noncontrolling interest – The Company

has an approximately 60% ownership interest in Generation

Health, Inc. (“Generation Health”) and consolidates Generation

Health in its consolidated financial statements. The noncon-

trolling shareholders of Generation Health hold put rights for

the remaining interest in Generation Health that if exercised

would require the Company to purchase the remaining inter-

est in Generation Health in 2015 for a minimum of $27 million

and a maximum of $159 million, depending on certain financial

metrics of Generation Health in 2014. Since the noncontrolling

shareholders of Generation Health have a redemption feature

as a result of the put rights, the Company has classified the

Revenue Recognition

Pharmacy Services Segment – The PSS sells prescription

drugs directly through its mail service pharmacies and indi-

rectly through its retail pharmacy network. The PSS rec-

ognizes revenues from prescription drugs sold by its mail

service pharmacies and under retail pharmacy network con-

tracts where the PSS is the principal using the gross method

at the contract prices negotiated with its clients. Net rev-

enue from the PSS includes: (i) the portion of the price the

client pays directly to the PSS, net of any volume-related or

other discounts paid back to the client (see “Drug Discounts”

later in this document), (ii) the price paid to the PSS (“Mail

Co-Payments”) or a third party pharmacy in the PSS’ retail

pharmacy network (“Retail Co-Payments”) by individuals

included in its clients’ benefit plans, and (iii) administrative

fees for retail pharmacy network contracts where the PSS is

not the principal as discussed below.

The PSS recognizes revenue when: (i) persuasive evidence of

an arrangement exists, (ii) delivery has occurred or services

have been rendered, (iii) the seller’s price to the buyer is fixed

or determinable, and (iv) collectability is reasonably assured.

redeemable noncontrolling interest in Generation Health in the

mezzanine section of the consolidated balance sheet outside

of shareholders’ equity. The Company initially recorded the

redeemable noncontrolling interest at a fair value of $37 million

on the date of acquisition which was determined using inputs

classified as Level 3 in the fair value hierarchy. At the end of

each reporting period, if the estimated accreted redemption

value exceeds the carrying value of the noncontrolling interest,

the difference is recorded as a reduction of retained earnings.

Any such reductions in retained earnings would also reduce

income attributable to CVS Caremark in the Company’s

earnings per share calculations.

The Company has established the following revenue recogni-

tion policies for the PSS:

• Revenues generated from prescription drugs sold by mail

service pharmacies are recognized when the prescription

is shipped. At the time of shipment, the Company has

performed substantially all of its obligations under its

client contracts and does not experience a significant

level of reshipments.

• Revenues generated from prescription drugs sold by third

party pharmacies in the PSS’ retail pharmacy network and

associated administrative fees are recognized at the PSS’

point-of-sale, which is when the claim is adjudicated by the

PSS’ online claims processing system.

The PSS determines whether it is the principal or agent for

its retail pharmacy network transactions on a contract by

contract basis. In the majority of its contracts, the PSS has

determined it is the principal due to it: (i) being the primary

obligor in the arrangement, (ii) having latitude in establish-

ing the price, changing the product or performing part of the

service, (iii) having discretion in supplier selection, (iv) having

involvement in the determination of product or service specifi-

cations, and (v) having credit risk. The PSS’ obligations under

its client contracts for which revenues are reported using the

gross method are separate and distinct from its obligations

to the third party pharmacies included in its retail pharmacy

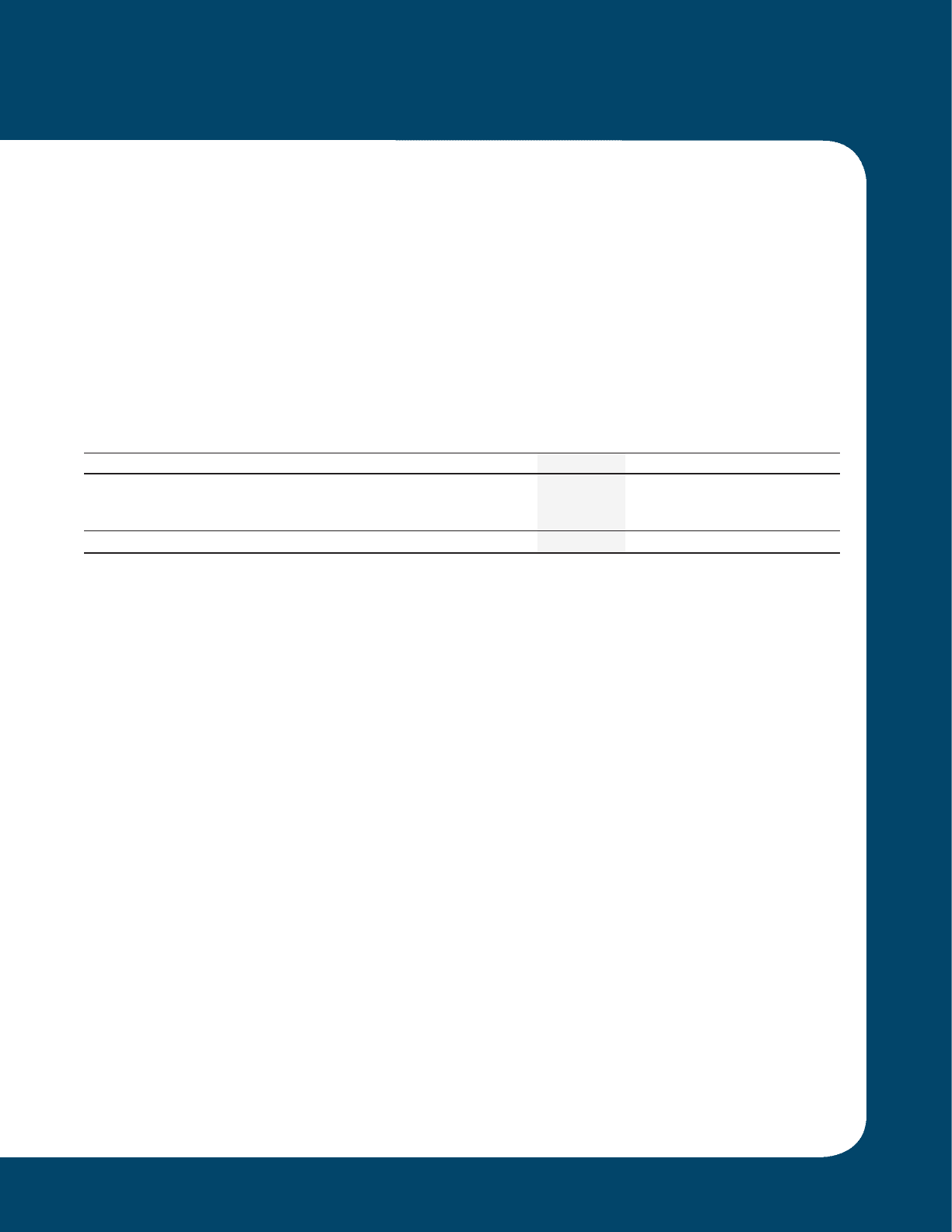

The following is a reconciliation of the changes in the redeemable noncontrolling interest:

in millions 2011 2010 2009

Beginning balance $ 34 $ 37 $ —

Acquisition of Generation Health — — 37

Net loss attributable to noncontrolling interest (4) (3) —

Ending balance $ 30 $ 34 $ 37

127087_Financial.indd 55 3/9/12 9:42 PM