CVS 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fair Value Hierarchy – The Company utilizes the three-level

valuation hierarchy for the recognition and disclosure of fair

value measurements. The categorization of assets and liabili-

ties within this hierarchy is based upon the lowest level of

input that is significant to the measurement of fair value. The

three levels of the hierarchy consist of the following:

• Level 1 – Inputs to the valuation methodology are unad-

justed quoted prices in active markets for identical assets

or liabilities that the Company has the ability to access at

the measurement date.

• Level 2 – Inputs to the valuation methodology are quoted

prices for similar assets and liabilities in active markets,

quoted prices in markets that are not active or inputs that

are observable for the asset or liability, either directly or

indirectly, for substantially the full term of the instrument.

• Level 3 – Inputs to the valuation methodology are unob-

servable inputs based upon management’s best estimate

of inputs market participants could use in pricing the asset

or liability at the measurement date, including assumptions

about risk.

Cash and cash equivalents – Cash and cash equivalents

consist of cash and temporary investments with maturities of

three months or less when purchased. The Company invests

in short-term money market funds, commercial paper, time

deposits, as well as other debt securities that are classified as

cash equivalents within the accompanying consolidated bal-

ance sheets, as these funds are highly liquid and readily con-

vertible to known amounts of cash. These investments are

classified within Level 1 of the fair value hierarchy because

they are valued using quoted market prices.

Short-term investments – The Company’s short-term

investments consist of certificate of deposits with initial maturi-

ties of greater than three months when purchased. These

investments, which were classified as available-for-sale within

Level 1 of the fair value hierarchy, were carried at historical

cost, which approximated fair value at December 31, 2011

and 2010.

Fair value of financial instruments – As of December 31,

2011, the Company’s financial instruments include cash and

cash equivalents, accounts receivable, accounts payable

and short-term debt. Due to the short-term nature of these

instruments, the Company’s carrying value approximates fair

value. The carrying amount and estimated fair value of total

long-term debt was $9.3 billion and $10.8 billion, respec-

tively, as of December 31, 2011. The fair value of long-term

debt was estimated based on rates currently offered to the

Company for debt with similar terms and maturities. The

Company had outstanding letters of credit, which guaran-

teed foreign trade purchases, with a fair value of $6 million as

of December 31, 2011 and 2010. There were no outstand-

ing derivative financial instruments as of December 31, 2011

and 2010.

Accounts receivable – Accounts receivable are stated net

of an allowance for doubtful accounts. The accounts receiv-

able balance primarily includes trade amounts due from third

party providers (e.g., pharmacy benefit managers, insurance

companies and governmental agencies), clients and mem-

bers, as well as vendors and manufacturers.

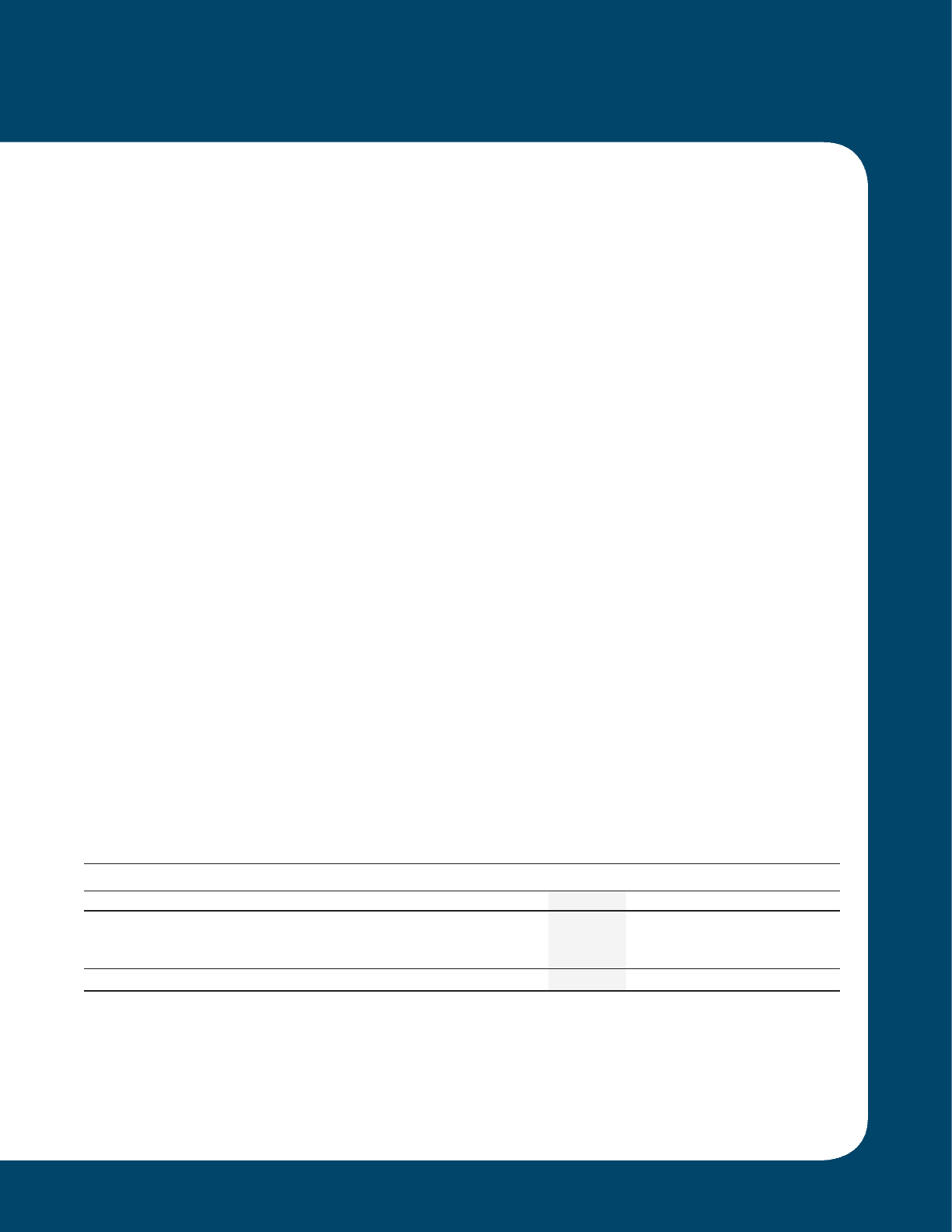

The activity in the allowance for doubtful trade accounts receivable is as follows:

Year Ended December 31,

in millions 2011 2010 2009

Beginning balance $ 182 $ 224 $ 189

Additions charged to bad debt expense 129 73 135

Write-offs charged to allowance (122) (115) (100)

Ending balance $ 189 $ 182 $ 224

CVS CAREMARK 53 2011 ANNUAL REPORT

127087_Financial.indd 53 3/9/12 9:42 PM