CVS 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69 I 2007 Annual Report

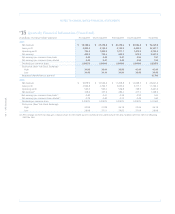

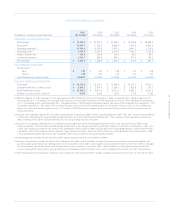

2007 2006 2005 2004 2003

In millions, except per share amounts (52 weeks)(1) (52 weeks) (52 weeks) (52 weeks) (53 weeks)

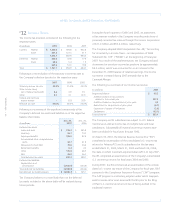

STATEMENT OF OPERATIONS DATA:

Net revenues $ 76,329.5 $ 43,821.4 $ 37,006.7 $ 30,594.6 $ 26,588.2

Gross profit 16,107.7 11,742.2 9,694.6 7,915.9 6,803.0

Operating expenses(2)(3) 11,314.4 9,300.6 7,675.1 6,461.2 5,379.4

Operating profit(4) 4,793.3 2,441.6 2,019.5 1,454.7 1,423.6

Interest expense, net 434.6 215.8 110.5 58.3 48.1

Income tax provision(5) 1,721.7 856.9 684.3 477.6 528.2

Net earnings(6) $ 2,637.0 $ 1,368.9 $ 1,224.7 $ 918.8 $ 847.3

PER COMMON SHARE DATA:

Net earnings:(6)

Basic $ 1.97 $ 1.65 $ 1.49 $ 1.13 $ 1.06

Diluted 1.92 1.60 1.45 1.10 1.03

Cash dividends per common share 0.22875 0.15500 0.14500 0.13250 0.11500

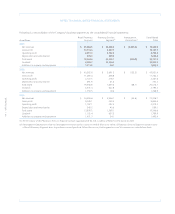

BALANCE SHEET AND OTHER DATA:

Total assets $ 54,721.9 $ 20,574.1 $ 15,246.6 $ 14,513.3 $ 10,543.1

Long-term debt (less current portion) $ 8,349.7 $ 2,870.4 $ 1,594.1 $ 1,925.9 $ 753.1

Total shareholders’ equity $ 31,321.9 $ 9,917.6 $ 8,331.2 $ 6,987.2 $ 6,021.8

Number of stores (at end of period) 6,301 6,205 5,474 5,378 4,182

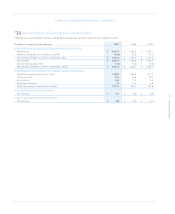

(1) Effective March 22, 2007, pursuant to the Agreement and Plan of Merger dated as of November 1, 2006, as amended (the “Merger Agreement”),

Caremark Rx, Inc. (“Caremark”) was merged with and into a newly formed subsidiary of CVS Corporation, with the CVS subsidiary, Caremark Rx,

L.L.C., continuing as the surviving entity (the “Caremark Merger”). Following the Caremark Merger, the name of the Company was changed to “CVS

Caremark Corporation.” By virtue of the Caremark Merger, each issued and outstanding share of Caremark common stock, par value $0.001 per

share, was converted into the right to receive 1.67 shares of CVS Caremark’s common stock, par value $0.01 per share. Cash was paid in lieu of

fractional shares.

(2) In 2006, the Company adopted the Securities and Exchange Commission (SEC) Staff Accounting Bulletin (“SAB”) No. 108, “Considering the Effects

of Prior Year Misstatements when Qualifying Misstatements in Current Year Financial Statements.” The adoption of this statement resulted in a

$40.2 million pre-tax ($24.7 million after-tax) decrease in operating expenses for 2006.

(3) In 2004, the Company conformed its accounting for operating leases and leasehold improvements to the views expressed by the Office of the

Chief Accountant of the Securities and Exchange Commission to the American Institute of Certified Public Accountants on February 7, 2005. As a

result, the Company recorded a non-cash pre-tax adjustment of $65.9 million ($40.5 million after-tax) to operating expenses, which represents the

cumulative effect of the adjustment for a period of approximately 20 years. Since the effect of this non-cash adjustment was not material to 2004,

or any previously reported fiscal year, the cumulative effect was recorded in the fourth quarter of 2004.

(4) Operating profit includes the pre-tax effect of the charge discussed in Note (2) and Note (3) above.

(5) Income tax provision includes the effect of the following: (i) in 2006, an $11.0 million reversal of previously recorded tax reserves through the tax

provision principally based on resolving certain state tax matters, (ii) in 2005, a $52.6 million reversal of previously recorded tax reserves through

the tax provision principally based on resolving certain state tax matters, and (iii) in 2004, a $60.0 million reversal of previously recorded tax

reserves through the tax provision principally based on finalizing certain tax return years and on a 2004 court decision relevant to the industry.

(6) Net earnings and net earnings per common share include the after-tax effect of the charges and gains discussed in Notes (2), (3), (4) and (5) above.