CVS 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65 I 2007 Annual Report

In addition to the CAP examination, the IRS is examining

the Company’s consolidated U.S. income tax return for fiscal year

2006 and the consolidated U.S. income tax returns of Caremark

for fiscal years 2004 and 2005, which benefit from net operating

loss carry-forwards going back to 1993. The Company and its

subsidiaries are also currently under examination by various state

and local jurisdictions. As of December 29, 2007, no examination

has resulted in any proposed adjustments that would result in a

material change to the Company’s results of operations, financial

condition or liquidity.

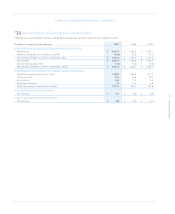

The Company recognizes interest accrued related to unrecognized

tax benefits and penalties in income tax expense. During the

fiscal year ended December 29, 2007, the Company recognized

interest of approximately $17.8 million. The Company had

approximately $44.3 million accrued for interest and penalties

as of December 29, 2007.

There are no material reserves established at December 29,

2007 for income tax positions for which the ultimate deductibility

is highly certain but for which there is uncertainty about the

timing of such deductibility. If present, such items would impact

deferred tax accounting, not the annual effective income tax rate,

and would accelerate the payment of cash to the taxing authority

to an earlier period.

The total amount of unrecognized tax benefits that, if recognized,

would affect the effective income tax rate is approximately

$26.9 million, after considering the federal benefit of state

income taxes.

We are currently unable to estimate if there will be any significant

changes in the amount of unrecognized tax benefits over the next

twelve months. Pursuant to SFAS No. 141, “Business Combinations,”

and EITF No. 93-7, “Uncertainties Related to Income Taxes in a

Purchase Business Combination” (“EITF 93-7”), any income tax

adjustments made in the Company’s 2008 financial statements

that are related to pre-acquisition tax periods will result in

modifications to the assets acquired and liabilities assumed in

the applicable business combination.

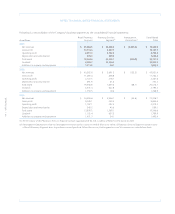

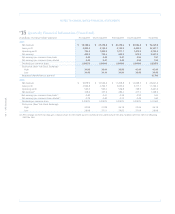

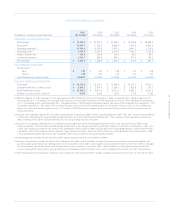

Business Segments

The Company currently operates two business segments:

Retail Pharmacy and Pharmacy Services. The operating segments

are businesses of the Company for which separate financial

information is available and for which operating results are

evaluated on a regular basis by executive management in

deciding how to allocate resources and in assessing performance.

The Company’s business segments offer different products and

services and require distinct technology and marketing strategies.

As of December 29, 2007, the Retail Pharmacy Segment

included 6,245 retail drugstores, the Company’s online retail

website, CVS.com® and its retail healthcare clinics. The retail

drugstores are located in 40 states and the District of Columbia

and operate under the CVS® or CVS/pharmacy® name. The retail

healthcare clinics utilize nationally recognized medical protocols

to diagnose and treat minor health conditions and are staffed by

board-certified nurse practitioners and physician assistants. The

retail healthcare clinics operate under the MinuteClinic® name

and include 462 clinics located in 25 states, 437 of which are

located within the Company’s retail drugstores.

The Pharmacy Services Segment provides a full range of phar-

macy benefit management services to employers, managed care

providers and other organizations. These services include mail

order pharmacy services, specialty pharmacy services, plan design

and administration, formulary management and claims process-

ing, as well as providing insurance and reinsurance services in

conjunction with prescription drug benefit plans. The specialty

pharmacy business focuses on supporting individuals that require

complex and expensive drug therapies. Currently, the Pharmacy

Services Segment operates under the Caremark Pharmacy

Services®, PharmaCare Management Services® and PharmaCare

Pharmacy® names.

As of December 29, 2007, the Pharmacy Services Segment

included 56 retail specialty drugstores, 20 specialty mail order

pharmacies and 9 mail service pharmacies located in 26 states

and the District of Columbia.

The Company evaluates segment performance based on net

revenues, gross profit and operating profit before the effect

of certain intersegment activities and charges. The accounting

policies of the segments are substantially the same as those

described in Note 1.

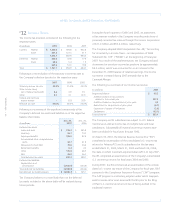

#13