CVS 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 I CVS Caremark

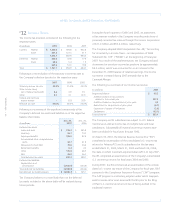

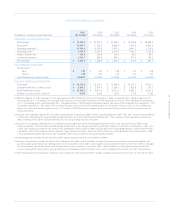

Income Taxes

The income tax provision consisted of the following for the

respective years:

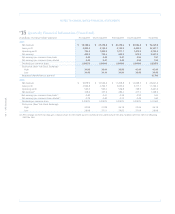

In millions 2007 2006 2005

Current: Federal $ 1,250.8 $ 676.6 $ 632.8

State 241.3 127.3 31.7

1,492.1 803.9 664.5

Deferred: Federal 206.0 47.6 17.9

State 23.6 5.4 1.9

229.6 53.0 19.8

Total $ 1,721.7 $ 856.9 $ 684.3

Following is a reconciliation of the statutory income tax rate to

the Company’s effective tax rate for the respective years:

2007 2006 2005

Statutory income tax rate 35.0% 35.0% 35.0%

State income taxes,

net of federal tax benefit 4.2 3.9 3.9

Other 0.3 0.1 (0.3)

Federal and net State

reserve release – (0.5) (2.8)

Effective tax rate 39.5% 38.5% 35.8%

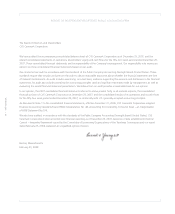

Following is a summary of the significant components of the

Company’s deferred tax assets and liabilities as of the respective

balance sheet dates:

Dec. 29, Dec. 30,

In millions 2007 2006

Deferred tax assets:

Lease and rents $ 276.2 $ 265.8

Inventory 56.7 74.3

Employee benefits 186.0 82.4

Accumulated other comprehensive

items 34.7 41.8

Allowance for bad debt 74.6 36.6

Retirement benefits 6.2 4.0

Other 170.9 68.5

NOL 26.9 26.3

Total deferred tax assets 832.2 599.7

Deferred tax liabilities:

Depreciation and

amortization (3,928.9) (234.6)

Total deferred tax liabilities (3,928.9) (234.6)

Net deferred tax (liability)/assets $ (3,096.7) $ 365.1

The Company believes it is more likely than not the deferred

tax assets included in the above table will be realized during

future periods.

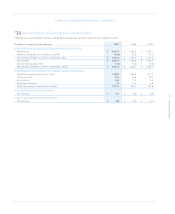

During the fourth quarters of 2006 and 2005, an assessment

of tax reserves resulted in the Company recording reductions of

previously recorded tax reserves through the income tax provision

of $11.0 million and $52.6 million, respectively.

The Company adopted FASB Interpretation No. 48, “Accounting

for Uncertainty in Income Taxes – an interpretation of FASB

Statement No. 109” (“FIN 48”), at the beginning of fiscal year

2007. As a result of the implementation, the Company reduced

its reserves for uncertain income tax positions by approximately

$4.0 million, which was accounted for as an increase to the

December 31, 2006 balance of retained earnings. The income

tax reserve increased during 2007 primarily due to the

Caremark Merger.

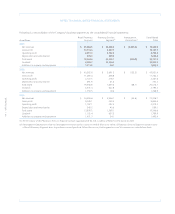

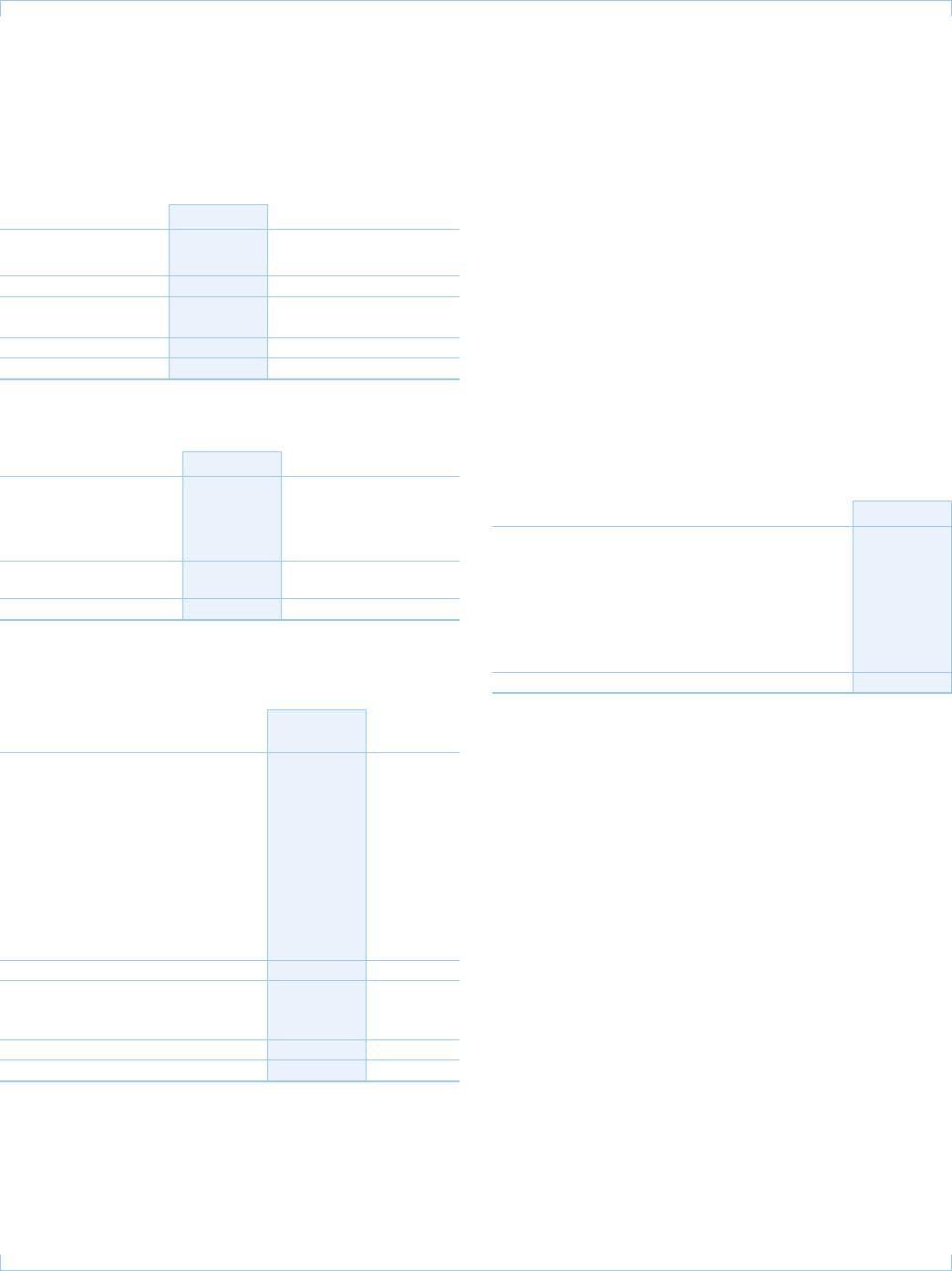

The following is a summary of our income tax reserve:

In millions 2007

Beginning Balance $ 43.2

Additions based on tax positions

related to the current year 207.5

Additions based on tax positions of prior years 4.5

Reductions for tax positions of prior years (6.7)

Expiration of statute of limitations (2.0)

Settlements (13.1)

Ending Balance $ 233.4

The Company and its subsidiaries are subject to U.S. federal

income tax as well as income tax of multiple state and local

jurisdictions. Substantially all material income tax matters have

been concluded for fiscal years through 1992.

On March 30, 2007, the Internal Revenue Service (the “IRS”)

completed an examination of the consolidated U.S. income tax

returns for AdvancePCS and its subsidiaries for the tax years

ended March 31, 2002, March 31, 2003 and March 24, 2004,

the date on which Caremark acquired AdvancePCS. In July 2007,

the IRS completed an examination of the Company’s consolidated

U.S. income tax returns for fiscal years 2004 and 2005.

During 2007, the IRS commenced an examination of the consoli-

dated U.S. income tax return of the Company for fiscal year 2007

pursuant to the Compliance Assurance Process (“CAP”) program.

The CAP program is a voluntary program under which taxpayers

seek to resolve all or most issues with the IRS prior to the filing

of their U.S. income tax returns in lieu of being audited in the

traditional manner.

#12