CVS 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

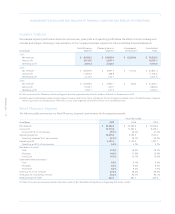

28 I CVS Caremark

We anticipate that our generic dispensing rates will increase in

future periods which benefits our customers, plan participants

and our financial performance. However, our gross profits

are continually impacted by our ability to profitably retain our

existing customers and win new business, and maintain and

enhance our drug purchase discounts from manufacturers,

wholesalers and retail pharmacies.

• During 2007, on a comparable basis, our gross profit rate was

negatively impacted by the recording of PharmaCare contracts

on a gross basis as previously discussed. The recording of these

revenues on a gross basis did not impact the actual gross profit

amount, however, it did decrease the gross profit margin.

Total operating expenses, which include selling, general

and administrative expenses (including integration and other

related expenses), depreciation and amortization related to

selling, general and administrative activities and retail specialty

pharmacy store and administrative payroll, employee benefits

and occupancy costs decreased to 2.6% of net revenues in 2007,

compared to 3.8% in 2006 and 4.2% in 2005.

As you review our Pharmacy Services Segment’s performance

in this area, we believe you should consider the following

important information:

• During 2007, the Caremark Merger significantly affected our

operating expenses. Total operating expenses for 2007 include

$81.7 million of merger, integration and other related expenses

and $162.6 million of incremental amortization expense resulting

from the preliminary intangible assets recorded in connection

with the Caremark Merger. Please see Note 2 to the consoli-

dated financial statements for additional information.

• During 2007, on a comparable basis, total operating expenses

increased 1.6% to $998.4 million or 2.3% of net revenue,

compared to $982.2 million or 2.4% of net revenue during

2006. 2007 and 2006 comparable results include incremental

depreciation and amortization resulting from the preliminary

fixed and intangible assets recorded in connection with the

Caremark Merger and exclude merger-related expenses and

integration costs.

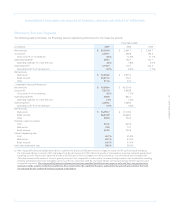

Liquidity and Capital Resources

We anticipate that our cash flow from operations, supplemented

by commercial paper and long-term borrowings will continue to

fund the future growth of our business.

Net cash provided by operating activities increased to

$3.2 billion in 2007. This compares to $1.7 billion in 2006 and

$1.6 billion in 2005. The increase in net cash provided by opera-

tions during 2007 primarily resulted from increased cash receipts

from revenues due to the Caremark Merger. The increase in

net cash provided by operations during 2006 primarily resulted

from an increase in cash receipts from revenues.

Net cash used in investing activities decreased to

$3.1 billion in 2007. This compares to $4.6 billion in 2006 and

$0.9 billion in 2005. The $3.1 billion of net cash used in investing

activities during 2007 was primarily due to the Caremark Merger.

The increase in net cash used in investing activities during 2006

was primarily due to the acquisition of the Standalone Drug

Business. Gross capital expenditures totaled $1.8 billion during

2007, compared to $1.8 billion in 2006 and $1.5 billion in 2005.

During 2007, approximately 54.6% of our total capital expendi-

tures were for new store construction, 21.7% for store expansion

and improvements and 23.7% for technology and other corporate

initiatives. During 2008, we currently plan to invest over $2.0 bil-

lion in gross capital expenditures, which will include spending for

approximately 300–325 new or relocated stores.

We finance a significant portion of our new store development

program through sale-leaseback transactions. Proceeds from

sale-leaseback transactions totaled $601.3 million in 2007. This

compares to $1.4 billion in 2006, which included approximately

$800 million in proceeds associated with the sale and leaseback

of properties acquired as part of the acquisition of the Standalone

Drug Business, and $539.9 million in 2005. Under the transac-

tions, the properties are sold at net book value and the resulting

leases qualify and are accounted for as operating leases.