CVS 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59 I 2007 Annual Report

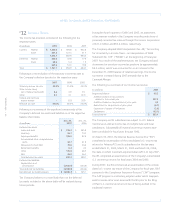

Following is a summary of the assumptions used to value the

ESPP awards for each of the respective periods:

2007 2006 2005

Dividend yield(1) 0.33% 0.26% 0.26%

Expected volatility(2) 21.72% 26.00% 16.40%

Risk-free interest rate(3) 5.01% 5.08% 3.35%

Expected life

(in years)

(4) 0.5 0.5 0.5

(1) The dividend yield is calculated based on semi-annual dividends

paid and the fair market value of the Company’s stock at the period

end date.

(2) The expected volatility is based on the historical volatility of the

Company’s daily stock market prices over the previous six-month period.

(3) The risk-free interest rate is based on the Treasury constant maturity

interest rate whose term is consistent with the expected term of ESPP

options (i.e., 6 months).

(4) The expected life is based on the semi-annual purchase period.

The Company’s 1997 Incentive Compensation Plan (the “ICP”)

provides for the granting of up to 152.8 million shares of

common stock in the form of stock options and other awards

to selected officers, employees and directors of the Company.

The ICP allows for up to 7.2 million restricted shares to be issued.

The Company’s restricted awards are considered nonvested share

awards as defined under SFAS 123(R). The restricted awards require

no payment from the employee. Compensation cost is recorded

based on the market price on the grant date and is recognized on

a straight-line basis over the requisite service period.

The Company granted 5,000 and 427,000 shares of restricted

stock with a weighted average per share grant date fair value

of $28.71 and $24.80, in 2006 and 2005, respectively. In addition,

the Company granted 1,129,000, 673,000 and 812,000 restricted

stock units with a weighted average fair value of $33.75, $29.40

and $26.02 in 2007, 2006 and 2005, respectively. Compensation

costs for restricted shares and units totaled $12.1 million in 2007,

$9.2 million in 2006 and $5.9 million in 2005.

In 2007, the Board of Directors adopted and shareholders

approved the 2007 Incentive Plan. The terms of the 2007

Incentive Plan provide for grants of annual incentive and long-

term performance awards that may be settled in cash or other

property to executive officers and other officers and employees

of the Company or any subsidiary of the Company. No awards

were granted from the 2007 Incentive Plan during 2007.

Following is a summary of the restricted share award activity under the ICP as of December 29, 2007:

2007 2006

Weighted Weighted

Average Grant Average Grant

Shares in thousands Shares Date Fair Value Shares Date Fair Value

Nonvested at beginning of year 306 $ 22.08 501 $ 20.80

Granted – – 5 28.71

Vested (129) 32.75 (197) 18.94

Forfeited (16) 22.00 (3) 24.71

Nonvested at end of year 161 $ 22.40 306 $ 22.08

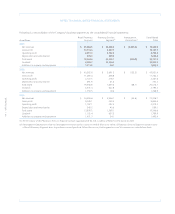

Following is a summary of the restricted unit award activity under the ICP as of December 29, 2007:

2007 2006

Weighted Weighted

Average Grant Average Grant

Units in thousands Units Date Fair Value Units Date Fair Value

Nonvested at beginning of year 2,009 $ 25.22 1,377 $ 23.10

Granted 1,129 33.75 673 29.40

Vested (198) 34.99 (16) 33.80

Forfeited (25) 23.24 (25) 25.22

Nonvested at end of year 2,915 $ 28.23 2,009 $ 25.22