CVS 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49 I 2007 Annual Report

Advertising Costs

Advertising costs are expensed when the related advertis-

ing takes place. Advertising costs, net of vendor funding,

(included in operating expenses), were $290.6 million in 2007,

$265.3 million in 2006 and $206.6 million in 2005.

Interest Expense, Net

Interest expense was $468.3 million, $231.7 million and

$117.0 million, and interest income was $33.7 million, $15.9 mil-

lion and $6.5 million in 2007, 2006 and 2005, respectively. Capitalized

interest totaled $23.7 million in 2007, $20.7 million in 2006 and

$12.7 million in 2005.

Accumulated Other Comprehensive Loss

Accumulated other comprehensive loss consists of changes in

the net actuarial gains and losses associated with pension and

other post retirement benefit plans, unrealized losses on deriva-

tives and adjustment to initially apply SFAS No. 158. In accordance

with SFAS No. 158, the amount included in accumulated other

comprehensive income related to the Company’s pension and

post retirement plans was $58.7 million pre-tax ($35.9 million

after-tax) as of December 29, 2007 and $87.4 million pre-tax

($55.4 million after-tax) as of December 30, 2006. The unrealized

loss on derivatives totaled $21.9 million pre-tax ($13.8 million

after-tax) and $27.2 million pre-tax ($17.2 million after-tax) as

of December 29, 2007 and December 30, 2006, respectively.

Stock-Based Compensation

On January 1, 2006, the Company adopted SFAS No. 123(R),

“Share-Based Payment,” using the modified prospective transi-

tion method. Under this method, compensation expense is

recognized for options granted on or after January 1, 2006 as

well as any unvested options on the date of adoption. As allowed

under the modified prospective transition method, prior period

financial statements have not been restated. Prior to January 1,

2006, the Company accounted for its stock-based compensation

plans under the recognition and measurement principles of

Accounting Principles Board (“APB”) Opinion No. 25, “Accounting

for Stock Issued to Employees,” and related interpretations. As

such, no stock-based employee compensation costs were reflected

in net earnings for options granted under those plans since they

had an exercise price equal to the fair market value of the under-

lying common stock on the date of grant. See Note 8 for further

information on stock-based compensation.

Income Taxes

The Company provides for federal and state income taxes

currently payable, as well as for those deferred because of timing

differences between reported income and expenses for financial

statement purposes versus tax purposes. Federal and state tax

credits are recorded as a reduction of income taxes. Deferred tax

assets and liabilities are recognized for the future tax consequences

attributable to differences between the carrying amount of assets

and liabilities for financial reporting purposes and the amounts

used for income tax purposes. Deferred tax assets and liabilities

are measured using the enacted tax rates expected to apply to

taxable income in the years in which those temporary differences

are expected to be recoverable or settled. The effect of a change

in tax rates is recognized as income or expense in the period of

the change. See Note 12 for further information on income taxes.

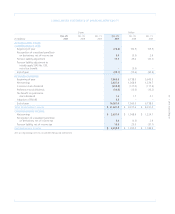

Earnings per Common Share

Basic earnings per common share is computed by dividing: (i) net

earnings, after deducting the after-tax Employee Stock Ownership

Plan (“ESOP”) preference dividends, by (ii) the weighted average

number of common shares outstanding during the year (the

“Basic Shares”).

When computing diluted earnings per common share, the

Company assumes that the ESOP preference stock is converted

into common stock and all dilutive stock awards are exercised.

After the assumed ESOP preference stock conversion, the ESOP

Trust would hold common stock rather than ESOP preference

stock and would receive common stock dividends ($0.22875

per share in 2007, $0.15500 per share in 2006 and $0.14500

per share in 2005) rather than ESOP preference stock dividends

(currently $3.90 per share). Since the ESOP Trust uses the dividends

it receives to service its debt, the Company would have to increase

its contribution to the ESOP Trust to compensate it for the

lower dividends. This additional contribution would reduce

the Company’s net earnings, which in turn, would reduce the

amounts that would be accrued under the Company’s incen-

tive compensation plans.