CVS 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53 I 2007 Annual Report

The carrying amount of goodwill was $23.9 billion and

$3.2 billion as of December 29, 2007 and December 30, 2006,

respectively. During 2007, gross goodwill increased primarily in

the Pharmacy Services Segment due to the Caremark Merger.

There was no impairment of goodwill during 2007.

The carrying amount of indefinitely-lived assets was $6.4 billion

as of December 29, 2007. The Company had no indefinitely-lived

assets as of December 30, 2006. The increase in the Company’s

indefinitely-lived assets during 2007 was due to the recognition of

trademarks associated with the Caremark Merger.

Intangible assets with finite useful lives are amortized over their

estimated useful lives. The increase in the gross carrying amount

of the Company’s amortizable intangible assets during 2007 was

primarily due to the Caremark Merger and adjustments related

to the Standalone Drug Business. The amortization expense for

intangible assets totaled $344.1 million in 2007, $161.2 million

in 2006 and $128.6 million in 2005. The anticipated annual

amortization expense for these intangible assets is $387.2 million

in 2008, $373.8 million in 2009, $361.5 million in 2010,

$352.7 million in 2011 and $334.5 million in 2012.

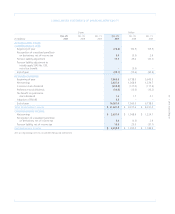

Following is a summary of the Company’s intangible assets as of the respective balance sheet dates:

Dec. 29, 2007 Dec. 30, 2006

Gross Gross

Carrying Accumulated Carrying Accumulated

In millions Amount Amortization Amount Amortization

Trademarks (indefinitely-lived) $ 6,398.0 $ – $ – $ –

Customer contracts and relationships and Covenants

not to compete 4,444.1 (876.9) 1,457.6 (563.4)

Favorable leases and Other 623.0 (158.6) 552.2 (128.2)

$ 11,465.1 $ (1,035.5) $ 2,009.8 $ (691.6)

Share Repurchase Program

In connection with the Caremark Merger, on March 28, 2007, the

Company commenced a tender offer to purchase up to 150 mil-

lion common shares, or about 10%, of its outstanding common

stock at a price of $35.00 per share. The tender offer expired on

April 24, 2007 and resulted in approximately 10.3 million shares

being tendered. The shares were placed into the Company’s

treasury account.

On May 9, 2007, the Board of Directors of the Company

authorized a share repurchase program for up to $5.0 billion

of the Company’s outstanding common stock.

On May 13, 2007, the Company entered into a $2.5 billion fixed

dollar accelerated share repurchase (the “May ASR”) agreement

with Lehman Brothers, Inc. (“Lehman”). The May ASR agreement

contained provisions that established the minimum and maximum

number of shares to be repurchased during the term of the May

ASR agreement. Pursuant to the terms of the May ASR agreement,

on May 14, 2007, the Company paid $2.5 billion to Lehman in

exchange for Lehman delivering 45.6 million shares of common

stock to the Company, which were placed into its treasury account

upon delivery. On June 7, 2007, upon establishment of the mini-

mum number of shares to be repurchased, Lehman delivered an

additional 16.1 million shares of common stock to the Company.

The May ASR program concluded on October 5, 2007 and

resulted in the Company receiving an additional 5.8 million

shares of common stock during the fourth quarter of 2007.

As of December 29, 2007 the aggregate 67.5 million shares of

common stock received pursuant to the $2.5 billion May ASR

agreement had been placed into the Company’s treasury account.

On October 8, 2007, the Company commenced an open market

repurchase program. The program concluded on November 2,

2007 and resulted in 5.3 million shares of common stock being

repurchased for $211.9 million. The shares were placed into the

Company’s treasury account upon delivery.

On November 6, 2007, the Company entered into a $2.3 billion

fixed dollar accelerated share repurchase agreement (the “November

ASR”) with Lehman. The November ASR agreement contained

provisions that established the minimum and maximum number

of shares to be repurchased during the term of the November

#4