CVS 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 I CVS Caremark

Standalone Drug Business

On June 2, 2006, CVS acquired certain assets and assumed

certain liabilities from Albertson’s, Inc. (“Albertson’s”) for

$4.0 billion. The assets acquired and the liabilities assumed

included approximately 700 standalone drugstores and a

distribution center (collectively the “Standalone Drug Business”).

In conjunction with the acquisition of the Standalone Drug

Business, during fiscal 2006, the Company recorded a

$49.5 million liability for the estimated costs associated with

the non-cancelable lease obligations of 94 acquired stores that

the Company does not intend to operate. As of December 29,

2007, 81 of these locations have been closed and $3.6 million

of this liability has been settled with cash payments. The

$47.5 million remaining liability, which includes $3.1 million

of interest accretion, will require future cash payments through

2033, unless settled prior thereto. The Company believes the

remaining liability is adequate to cover the remaining costs

associated with the related activities.

The following unaudited pro forma combined results of opera-

tions have been provided for illustrative purposes only and do

not purport to be indicative of the actual results that would

have been achieved by the combined companies for the periods

presented or that will be achieved by the combined companies

in the future:

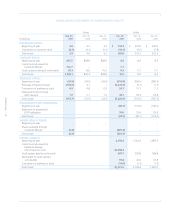

In millions, except per share amounts 2007 2006

Pro forma:(1)(2)(3)(4)

Net revenues $ 83,798.6 $ 78,668.9

Net earnings 2,906.6 2,167.5

Basic earnings per share $ 1.76 $ 1.41

Diluted earnings per share 1.72 1.37

(1) The pro forma combined results of operations assume that the

Caremark Merger and the acquisition of the Standalone Drug Business

occurred at the beginning of each period presented. These results have

been prepared by adjusting the historical results of the Company to

include the historical results of Caremark and the Standalone Drug

Business, incremental interest expense and the impact of the prelimi-

nary purchase price allocation discussed above. The historical results

of Caremark are based on a calendar period end, whereas the historical

results of the Pharmacy Services Segment of CVS are based on a 52 week

fiscal year ending on the Saturday nearest to December 31.

(2) Inter-company revenues that occur when a Caremark customer uses

a CVS/pharmacy retail store to purchase covered products were

eliminated. These adjustments had no impact on pro forma net

earnings or pro forma earnings per share.

(3) The pro forma combined results of operations do not include any

cost savings that may result from the combination of the Company

and Caremark or any estimated costs that will be incurred by the

Company to integrate the businesses.

(4) The pro forma combined results of operations for fiscal year ended

December 29, 2007, exclude $80.3 million pre-tax ($48.6 million

after-tax) of stock option expense associated with the accelerated

vesting of certain Caremark stock options, which vested upon

consummation of the merger due to change in control provisions

included in the underlying Caremark stock option plans. The pro

forma combined results for the fiscal year ended December 29, 2007

also exclude $42.9 million pre-tax ($25.9 million after-tax) related

to change in control payments due upon the consummation of the

merger due to change in control provisions in certain Caremark

employment agreements. In addition, the pro forma combined results

of operations for the fiscal year ended December 29, 2007, exclude

merger-related costs of $150.1 million pre-tax ($101.7 million after-

tax), which primarily consist of investment banker fees, legal fees,

accounting fees and other merger-related costs incurred by Caremark.

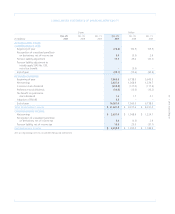

Goodwill and Other Intangibles

The Company accounts for goodwill and intangibles under

SFAS No. 142, “Goodwill and Other Intangible Assets.” Under

SFAS No. 142, goodwill and other indefinitely-lived assets are not

amortized, but are subject to annual impairment reviews, or more

frequent reviews if events or circumstances indicate an impair-

ment may exist.

When evaluating goodwill for potential impairment, the

Company first compares the fair value of the reporting unit,

based on estimated future discounted cash flows, to its carrying

amount. If the estimated fair value of the reporting unit is less

than its carrying amount, an impairment loss calculation is

prepared. The impairment loss calculation compares the implied

fair value of a reporting unit’s goodwill with the carrying amount

of its goodwill. If the carrying amount of the goodwill exceeds

the implied fair value, an impairment loss is recognized in an

amount equal to the excess. During the third quarter of 2007,

the Company performed its required annual goodwill impairment

tests, and concluded there were no goodwill impairments.

Indefinitely-lived intangible assets are tested by comparing

the estimated fair value of the asset to its carrying value. If the

carrying value of the asset exceeds its estimated fair value, an

impairment loss is recognized and the asset is written down to

its estimated fair value.

#3