CVS 2007 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2007 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.8 I CVS Caremark

“ In the short time since completing our merger, we’ve made substantial

progress in integrating our two companies. We brought PharmaCare,

CVS’ legacy PBM business, under the Caremark umbrella, connected all

our back-end systems, and are set to achieve more than $700 million in

cost-saving synergies in 2008. That’s over 50 percent higher than our

original target at the time we rst announced the merger.”

$700 million in cost-saving syner-

gies in 2008. That’s over 50 percent

higher than our original target at the

time we first announced the merger.

We’ve also made important progress

in developing differentiated offerings

that we believe will lead to enhanced

growth for our company over time.

Obviously, we’re offering payors and

patients all the services they would

expect from a world-class PBM;

however, we plan to take those

services a step further.

For example, let’s take the area

of compliance. One of the simplest

ways for a PBM to control payor

costs and improve outcomes is

by encouraging patients to take the

medicine prescribed to them and to

renew their prescriptions promptly.

Any PBM has the capability to do

this by contacting these patients

over the telephone or by mail.

However, face-to-face interaction

is far more effective, and our

CVS/pharmacy stores give us the

unique capability to get closer to

the consumer. We’re developing

programs that tap into the com-

bined 23,000 pharmacists and

MinuteClinic practitioners in our

locations across the country.

We also intend to build upon our

No. 1 position in the high-growth

specialty pharmacy market, lever-

age our ExtraCare card and all its

unique benefits among our millions

of covered lives, enhance our health

management programs, and increase

use of MinuteClinic by our PBM

clients. We’ll implement some of

our initiatives relatively quickly;

others will happen over time.

We’re leveraging opportunities for

greater protability in the pharmacy.

In both our retail and mail order

pharmacies, we are benefiting from

the aging population, greater utiliza-

tion among seniors due to Medicare

Part D, and the increasing use of

generic drugs. Although their lower

prices depress revenue growth

and we continue to see pressure

on pharmacy reimbursement rates,

generics are more profitable than

brand name drugs and help drive

margin expansion. Moreover,

CVS Caremark is now the largest

purchaser of generic drugs in

the United States, which enables

us to drive down costs.

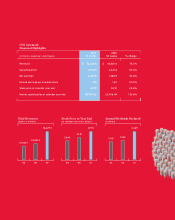

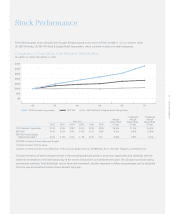

In 2007, the company had a

63 percent generic dispensing

rate at retail. With approximately

$70 billion in branded drug sales

coming off patent in the next

five years, we expect that figure

to rise to 75 percent by 2012.

We should see similar gains for

Caremark’s PBM business, whose

generic dispensing rate is currently

at 60 percent.