CVS 2007 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2007 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7 I 2007 Annual Report

The past year set the stage for

a new chapter in our company’s

history as we completed the

transformational merger of CVS

Corporation and Caremark Rx, Inc.

We are now the largest integrated

provider of prescriptions and related

health services in the United States,

filling or managing more than a

quarter of all prescriptions in the

nation. Beyond the sheer scale

of our operations, CVS Caremark

is positioned to improve access

for patients, promote better health

outcomes, and control payor costs

in a way that no pharmacy retailer

or PBM could do separately. Our

unique model provides us with a

significant opportunity to gain share

and create new sources of growth

going forward.

It was a very successful year on

a number of other fronts as well.

Here are some highlights of our

key accomplishments:

• CVS Caremark posted record

revenue and earnings, driven

by solid performance in

both the retail and pharmacy

services segments.

• We opened 275 new or relocated

CVS/pharmacy stores and saw

continued improvement in sales

and profits in the stores we

acquired from Albertson’s, Inc.,

in 2006, and from J.C. Penney

in 2004.

• Caremark Pharmacy Services

signed up $2.1 billion in new

business, a clear sign that payors

understand the potential benefits

of our combination.

• We opened 316 MinuteClinics,

increasing our total at year-

end to 462 clinics in 25 states.

That’s about four times the

number operated by our nearest

competitor.

• We attained our goal of generat-

ing $2 billion in free cash flow,

and we launched a $5 billion

share repurchase program that

we completed in the first quarter

of 2008.

• Even in the midst of all this

activity, we remained keenly

focused on service, execution,

and expense control across

the company.

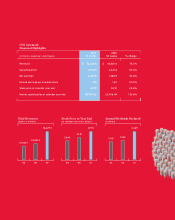

Total revenues rose 74.2 percent

to a record $76.3 billion. In our

CVS/pharmacy segment, same

store sales rose 5.3 percent. Gross

margins increased in both our retail

and PBM businesses, due largely to

significant generic drug introductions

and purchasing synergies resulting

from the merger. Net earnings

climbed 92.6 percent to $2.6 billion,

or $1.92 per diluted share.

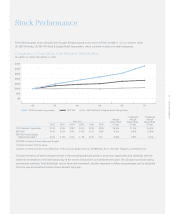

Turning to CVS Caremark’s stock

performance, the 29.3 percent total

return on our shares far surpassed

the modest numbers posted by the

S&P 500 Index and the Dow Jones

Industrial Average (DJIA) in 2007.

Our three-year performance is just

as impressive. While the S&P 500

and the DJIA returned 21.2 percent

and 23.0 percent, respectively, CVS

shares returned 78.4 percent.

We’re going to offer services that

no other competitor can match.

In the short time since completing

our merger, we’ve made substantial

progress in integrating our two

companies. We brought Pharma-

Care, CVS’ legacy PBM business,

under the Caremark umbrella,

connected all our back-end systems,

and are set to achieve more than

Dear Shareholder: