CVS 2007 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2007 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.9 I 2007 Annual Report

“ We’ve done so much more than just combine

two very successful businesses. We’ve literally

created a rst-of-its-kind company — one with

the ability to grow faster than either of its

components would have on its own.”

Generic versions of bioengineered

drugs represent another opportunity.

Currently, the United States has no

procedure for approving generic

versions of bioengineered drugs

when they come off patent. However,

we expect to see Congress enact

legislation at some point in the

future to create a biogeneric approval

process at the U.S. Food and Drug

Administration. We will be well

positioned if or when this occurs.

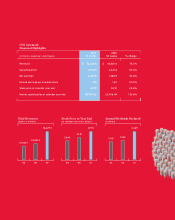

We continue to open new stores and

make the most of recent acquisitions.

Despite the past year’s merger

activity, we continued to execute

our organic growth strategy at

retail. CVS/pharmacy square footage

grew by 3 percent, in line with our

annual target. Of the 275 stores we

opened, 139 were new locations and

136 were relocations. Factoring in

closings, we enjoyed net unit growth

of 95 stores. We continued to expand

in our newer, high-growth areas such

as Los Angeles, San Diego, Phoenix,

Las Vegas, and Minneapolis.

The former Eckerd® locations that

we acquired in 2004 still enjoyed

same store sales growth that out-

paced our overall numbers. These

stores are benefiting from their

locations in high-growth markets –

mainly Florida and Texas – and

they continue to gain share from

competitors as well.

We’re also very pleased with

the performance of the stand-

alone Sav-on® and Osco® stores

we purchased from Albertsons.

This acquisition strengthened

our presence in the Midwest and

provided us with an immediate

leadership position in Southern

California, the country’s second-

largest drugstore market. In fact,

our Southern California CVS/

pharmacy stores now lead the

entire chain in sales. These new

CVS/pharmacy stores are benefit-

ing from an improved merchandise

assortment and category focus.

The introduction of the ExtraCare

card is encouraging customer

loyalty and helping drive an

increase in sales and margins.

In the front of the store, we’re

seeing sales growth across our core

categories, especially in beauty,

personal care, general merchandise,

and digital photo. CVS store brands

and proprietary brands have been

important drivers of gross margins.

As solid as our front-end business

is, it’s worth noting that it accounts

for 30 percent of our retail sales

compared with 70 percent for the

pharmacy. The front-end percent-

age becomes even smaller in the

context of CVS Caremark’s overall

revenues. That’s why we expect

any impact on CVS/pharmacy from

a softer economy to be limited and

manageable. After all, our average

front-end purchase is a little under

$12, and we don’t anticipate that

consumers will buy less cough

medicine, analgesics, or any of

the other non-discretionary