CVS 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29 I 2007 Annual Report

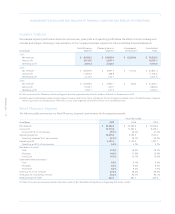

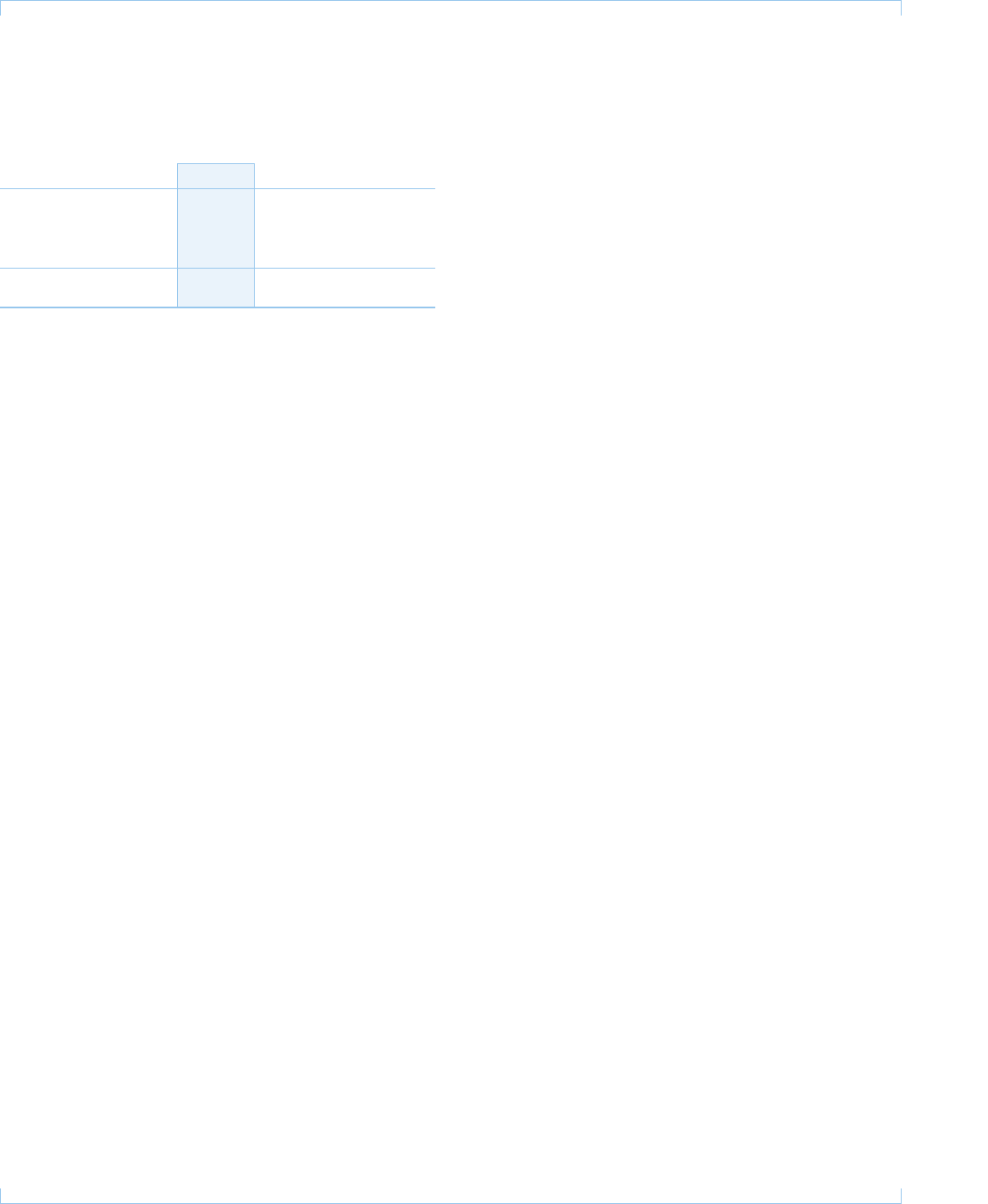

Following is a summary of our store development activity for the

respective years:

2007 2006 2005

Total stores

(beginning of year) 6,205 5,474 5,378

New and acquired stores 140 848 166

Closed stores (44) (117) (70)

Total stores (end of year) 6,301 6,205 5,474

Relocated stores(1) 137 118 131

(1) Relocated stores are not included in new or closed store totals.

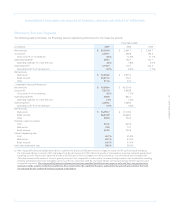

Net cash provided by financing activities was $0.4 billion in

2007, compared to net cash provided by financing activities of

$2.9 billion in 2006 and net cash used in financing activities of

$0.6 billion in 2005. Net cash provided by financing activities

during 2007 was primarily due to increased long-term borrowings

to fund the special cash dividend paid to Caremark shareholders

and was offset, in part, by the repayment of short-term borrow-

ings and the repurchase of common shares. Net cash provided by

financing activities during 2006 was primarily due to the financ-

ing of the acquisition of the Standalone Drug Business, including

issuance of the 2006 Notes (defined below), during the third

quarter of 2006. This increase was offset, in part, by the repay-

ment of the $300 million, 5.625% unsecured senior notes, which

matured during the first quarter of 2006. Fiscal 2005 reflected

a reduction in short-term borrowings. During 2007, we paid

common stock dividends totaling $308.8 million, or $0.22875

per common share.

We believe that our current cash on hand and cash provided by

operations, together with our ability to obtain additional short-

term and long-term financing, will be sufficient to cover our

working capital needs, capital expenditures, debt service require-

ments and dividend requirements for at least the next twelve

months and the foreseeable future.

We had $2.1 billion of commercial paper outstanding at a

weighted average interest rate of 5.1% as of December 29, 2007.

In connection with our commercial paper program, we maintain

a $675 million, five-year unsecured back-up credit facility, which

expires on June 11, 2009, a $675 million, five-year unsecured

back-up credit facility, which expires on June 2, 2010, a $1.4 bil-

lion, five-year unsecured back-up credit facility, which expires

on May 12, 2011 and a $1.3 billion, five-year unsecured back-up

credit facility, which expires on March 12, 2012. The credit

facilities allow for borrowings at various rates that are dependent

in part on our public debt rating. As of December 29, 2007, we

had no outstanding borrowings against the credit facilities.

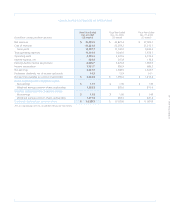

In connection with the Caremark Merger, on March 28, 2007,

we commenced a tender offer to purchase up to 150 million

common shares, or about 10%, of our outstanding common

stock at a price of $35.00 per share. The offer to purchase

shares expired on April 24, 2007 and resulted in approximately

10.3 million shares being tendered. The shares were placed into

our treasury account.

On May 9, 2007, our Board of Directors authorized a share

repurchase program for up to $5.0 billion of our outstanding

common stock.

On May 13, 2007, we entered into a $2.5 billion fixed dollar

accelerated share repurchase agreement (the “May ASR agree-

ment”) with Lehman Brothers, Inc. (“Lehman”). The May ASR

agreement contained provisions that established the minimum

and maximum number of shares to be repurchased during the

term of the May ASR agreement. Pursuant to the terms of the

May ASR agreement, on May 14, 2007, we paid $2.5 billion to

Lehman in exchange for Lehman delivering 45.6 million shares

of common stock to us, which were placed into our treasury

account upon delivery. On June 7, 2007, upon establishment

of the minimum number of shares to be repurchased, Lehman

delivered an additional 16.1 million shares of common stock to

us. The final settlement under the May ASR agreement occurred

on October 5, 2007 and resulted in us receiving an additional

5.8 million shares of common stock during the fourth quarter

of 2007. As of December 29, 2007, the aggregate 67.5 million

shares of common stock received pursuant to the $2.5 billion

May ASR agreement had been placed into our treasury account.

On October 8, 2007, we commenced an open market repurchase

program. The program concluded on November 2, 2007 and

resulted in 5.3 million shares of common stock being repurchased

for $211.9 million. The shares were placed into our treasury

account upon delivery.

On November 6, 2007, we entered into a $2.3 billion fixed

dollar accelerated share repurchase agreement (the “November

ASR agreement”) with Lehman. The November ASR agreement

contained provisions that established the minimum and maxi-

mum number of shares to be repurchased during the term of