CVS 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 I CVS Caremark

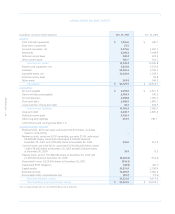

Diluted earnings per common share is computed by dividing:

(i) net earnings, after accounting for the difference between the

dividends on the ESOP preference stock and common stock and

after making adjustments for the incentive compensation plans,

by (ii) Basic Shares plus the additional shares that would be

issued assuming that all dilutive stock awards are exercised

and the ESOP preference stock is converted into common stock.

Options to purchase 10.7 million, 4.7 million and 6.9 million

shares of common stock were outstanding as of December 29,

2007, December 30, 2006 and December 31, 2005, respectively,

but were not included in the calculation of diluted earnings per

share because the options’ exercise prices were greater than the

average market price of the common shares and, therefore, the

effect would be antidilutive.

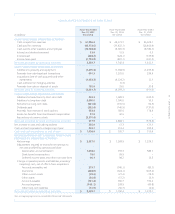

New Accounting Pronouncements

The Company adopted Financial Accounting Standards

Board Interpretation No. 48, “Accounting for Uncertainty in

Income Taxes – an interpretation of FASB Statement No. 109”

(“FIN 48”) effective December 31, 2006. FIN 48 addresses the

uncertainty about how certain income tax positions taken or

expected to be taken on an income tax return should be reflected

in the financial statements before they are finally resolved. As

a result of the implementation, the Company recognized a

decrease to reserves for uncertain income tax positions of

approximately $4.0 million, which was accounted for as an

increase to the December 31, 2006 balance of retained earnings.

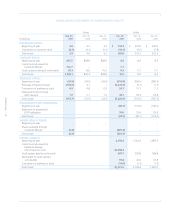

The Company adopted SFAS No. 157, “Fair Value Measurement.”

SFAS No. 157 defines fair value, establishes a framework for

measuring fair value in generally accepted accounting principles

and expands disclosures regarding fair value measurements. SFAS

No. 157 is effective for fiscal years beginning after November 15,

2007 and interim periods within those fiscal years. The adoption

of this statement did not have a material impact on its consoli-

dated results of operations, financial position or cash flows.

In June 2006, the Emerging Issues Task Force of the Financial

Accounting Standards Board (“FASB”) reached a consensus

on EITF Issue No. 06-4, “Accounting for Deferred Compensation

and Postretirement Benefit Aspects of Endorsement Split-Dollar

Life Insurance Arrangements” (“EITF 06-4”), which requires the

application of the provisions of SFAS No. 106, “Employers’

Accounting for Postretirement Benefits Other Than Pensions”

(“SFAS 106”) (if, in substance, a postretirement benefit plan

exists), or Accounting Principles Board Opinion No. 12 (if the

arrangement is, in substance, an individual deferred compensation

contract) to endorsement split-dollar life insurance arrangements.

SFAS 106 would require the Company to recognize a liability

for the discounted value of the future benefits that it will

incur through the death of the underlying insureds. EITF 06-4 is

currently effective for fiscal years beginning after December 15,

2007. The Company is currently evaluating the potential impact

the adoption of EITF 06-4 may have on its consolidated results of

operations, financial position and cash flows.

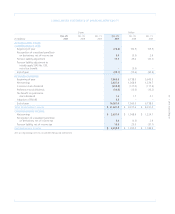

In March 2007, the FASB issued Emerging Issues Task Force Issue

No. 06-10 “Accounting for Collateral Assignment Split-Dollar

Life Insurance Agreements” (“EITF 06-10”). EITF 06-10 provides

guidance for determining a liability for the postretirement

benefit obligation as well as recognition and measurement of

the associated asset on the basis of the terms of the collateral

assignment agreement. EITF 06-10 is effective for fiscal years

beginning after December 15, 2007. The Company is currently

evaluating the potential impact the adoption of EITF 06-10 may

have on its consolidated results of operations, financial position

and cash flows.

In December 2007, the FASB issued SFAS No. 141 (revised 2007),

“Business Combinations” (“SFAS 141R”), which replaces FASB

Statement No. 141. SFAS 141R establishes the principles and

requirements for how an acquirer recognizes and measures in its

financial statements the identifiable assets acquired, the liabilities

assumed, any non controlling interest in the acquiree and the

goodwill acquired. The Statement also establishes disclosure

requirements which will enable users to evaluate the nature and

financial effects of business combinations. SFAS 141R is effective

for fiscal years beginning after December 15, 2008. The Company

is currently evaluating the potential impact, if any, the adoption

of SFAS 141R may have on its consolidated results of operations,

financial position and cash flows.