CVS 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57 I 2007 Annual Report

Pension Plans and

Other Postretirement Benefits

Defined Contribution Plans

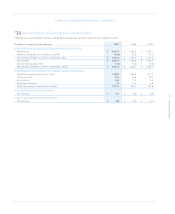

The Company sponsors voluntary 401(k) Savings Plans that cover

substantially all employees who meet plan eligibility requirements.

The Company makes matching contributions consistent with

the provisions of the plans. At the participant’s option, account

balances, including the Company’s matching contribution, can be

moved without restriction among various investment options,

including the Company’s common stock. The Company also

maintains a nonqualified, unfunded Deferred Compensation Plan

for certain key employees. This plan provides participants the

opportunity to defer portions of their compensation and receive

matching contributions that they would have otherwise received

under the 401(k) Savings Plan if not for certain restrictions and

limitations under the Internal Revenue Code. The Company’s

contributions under the above defined contribution plans totaled

$80.6 million in 2007, $63.7 million in 2006 and $64.9 million in

2005. The Company also sponsors an Employee Stock Ownership

Plan. See Note 8 for further information about this plan.

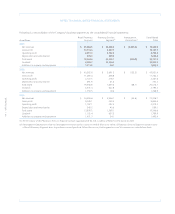

Other Postretirement Benefits

The Company provides postretirement healthcare and life

insurance benefits to certain retirees who meet eligibility require-

ments. The Company’s funding policy is generally to pay covered

expenses as they are incurred. For retiree medical plan account-

ing, the Company reviews external data and its own historical

trends for healthcare costs to determine the healthcare cost trend

rates. As of December 31, 2007, the Company’s postretirement

medical plans have an accumulated postretirement benefit obliga-

tion of $18.2 million. Net periodic benefit costs related to these

postretirement medical plans were $0.8 million and $0.3 million

for 2007 and 2006, respectively. As of December 31, 2006, the

Company’s postretirement medical plans had an accumulated

postretirement benefit obligation of $10.2 million.

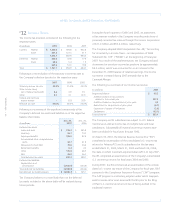

Pension Plans

The Company sponsors nine non-contributory defined benefit

pension plans that cover certain full-time employees, which were

frozen in prior periods. These plans are funded based on actuarial

calculations and applicable federal regulations. As of December 31,

2007, the Company’s qualified defined benefit plans have a

projected benefit obligation of $517.5 million and plan assets

of $420.7 million. As of December 31, 2006, the Company’s

qualified defined benefit plans had a projected benefit obligation

of $419.0 million and plan assets of $313.6 million. Net periodic

pension costs related to these qualified benefit plans were

$13.6 million and $17.2 million in 2007 and 2006, respectively.

The discount rate is determined by examining the current

yields observed on the measurement date of fixed-interest, high

quality investments expected to be available during the period

to maturity of the related benefits on a plan by plan basis. The

discount rate for the plans ranged from 5.25% to 6.25% in 2007

and was 6.00% in 2006. The expected long-term rate of return

is determined by using the target allocation and historical returns

for each asset class on a plan-by-plan basis. The expected long-

term rate of return for all plans was 8.5% in 2007 and 2006.

The Company uses an investment strategy, which emphasizes

equities in order to produce higher expected returns, and in the

long run, lower expected expense and cash contribution require-

ments. The pension plan assets allocation targets for the Retail

Pharmacy Segment are 70% equity and 30% fixed income. The

pension plan asset allocation targets for the Pharmacy Services

Segment are 77% equity, 19% fixed income and 4% cash

equivalents. The Retail Pharmacy Segment’s qualified defined

benefit pension plans asset allocations as of December 31,

2007 were 72% equity, 27% fixed income and 1% other. The

Pharmacy Services Segment qualified defined benefit pension

plans asset allocations as of December 31, 2007 were 75%

equity, 23% fixed income and 2% other.

The Company utilized a measurement date of December 31 to

determine pension and other postretirement benefit measure-

ments. The Company plans to make a $1.5 million contribution

to the pension plans during the upcoming year.

Pursuant to various labor agreements, the Company is also

required to make contributions to certain union-administered

pension and health and welfare plans that totaled $40.0 million

in 2007, $37.6 million in 2006 and $15.4 million in 2005. The

Company also has nonqualified supplemental executive retire-

ment plans in place for certain key employees.

The Company adopted SFAS No. 158, “Employer’s Accounting

for Defined Benefit Pension and Other Postretirement Plans-an

amendment of FASB Statements No. 87, 88, 106, and 132(R),”

#9