CVS 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 I CVS Caremark

ASR agreement. Pursuant to the terms of the November ASR

agreement, on November 7, 2007, the Company paid $2.3 billion

to Lehman in exchange for Lehman delivering 37.2 million shares

of common stock to the Company, which were placed into its

treasury account upon delivery. On November 26, 2007, upon

establishment of the minimum number of shares to be repur-

chased, Lehman delivered an additional 14.4 million shares

of common stock to the Company. As of December 29, 2007,

the aggregate 51.6 million shares of common stock, received

pursuant to the November ASR agreement, had been placed into

the Company’s treasury account. The Company may receive up to

5.7 million of additional shares of common stock, depending on

the market price of the common stock, as determined under the

November ASR agreement, over the term of the November ASR

agreement, which is currently expected to conclude during the

first quarter of 2008.

Borrowing and Credit Agreements

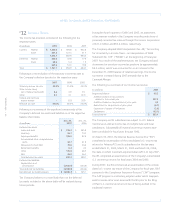

Following is a summary of the Company’s borrowings as of the

respective balance sheet dates:

Dec. 29, Dec. 30,

In millions 2007 2006

Commercial paper $ 2,085.0 $ 1,842.7

3.875% senior notes due 2007 – 300.0

4.0% senior notes due 2009 650.0 650.0

Floating rate notes due 2010 1,750.0 –

5.75% senior notes due 2011 800.0 800.0

4.875% senior notes due 2014 550.0 550.0

6.125% senior notes due 2016 700.0 700.0

5.75% senior notes due 2017 1,750.0 –

6.25% senior notes due 2027 1,000.0 –

8.52% ESOP notes due 2008(1) 44.5 82.1

6.302% Enhanced Capital Advantage

Preferred Securities 1,000.0 –

Mortgage notes payable 7.3 11.7

Capital lease obligations 145.1 120.9

10,481.9 5,057.4

Less:

Short-term debt (2,085.0) (1,842.7)

Current portion of long-term debt (47.2) (344.3)

$ 8,349.7 $ 2,870.4

(1) See Note 8 for further information about the Company’s ESOP Plan.

In connection with its commercial paper program, the Company

maintains a $675 million, five-year unsecured back-up credit

facility, which expires on June 11, 2009, a $675 million, five-year

unsecured back-up credit facility, which expires on June 2, 2010,

a $1.4 billion, five-year unsecured back-up credit facility, which

expires on May 12, 2011 and a $1.3 billion, five-year unsecured

back-up credit facility, which expires on March 12, 2012. The

credit facilities allow for borrowings at various rates depending

on the Company’s public debt ratings and requires the Company

to pay a quarterly facility fee of 0.1%, regardless of usage. As of

December 29, 2007, the Company had no outstanding borrow-

ings against the credit facilities. The weighted average interest

rate for short-term debt was 5.3% as of December 29, 2007 and

December 30, 2006.

On May 22, 2007, the Company issued $1.75 billion of floating

rate senior notes due June 1, 2010, $1.75 billion of 5.75%

unsecured senior notes due June 1, 2017, and $1.0 billion of

6.25% unsecured senior notes due June 1, 2027 (collectively

the “2007 Notes”). Also on May 22, 2007, the Company entered

into an underwriting agreement with Lehman Brothers, Inc.,

Morgan Stanley & Co. Incorporated, Banc of America Securities

LLC, BNY Capital Markets, Inc., and Wachovia Capital Markets,

LLC, as representatives of the underwriters pursuant to which

the Company agreed to issue and sell $1.0 billion of Enhanced

Capital Advantaged Preferred Securities (“ECAPS”) due June 1,

2062 to the underwriters. The ECAPS bear interest at 6.302%

per year until June 1, 2012 at which time they will pay interest

based on a floating rate. The 2007 Notes and ECAPS pay interest

semi-annually and may be redeemed at any time, in whole or in

part at a defined redemption price plus accrued interest. The net

proceeds from the 2007 Notes and ECAPS were used to repay the

bridge credit facility and commercial paper borrowings.

On August 15, 2006, the Company issued $800 million

of 5.75% unsecured senior notes due August 15, 2011 and

$700 million of 6.125% unsecured senior notes due August 15,

2016 (collectively the “2006 Notes”). The 2006 Notes pay interest

semi-annually and may be redeemed at any time, in whole or

in part at a defined redemption price plus accrued interest. Net

proceeds from the 2006 Notes were used to repay a portion of

the outstanding commercial paper issued to finance the acquisi-

tion of the Standalone Drug Business.

#5