American Airlines 1998 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

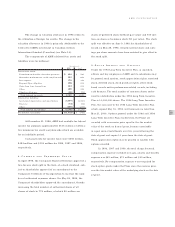

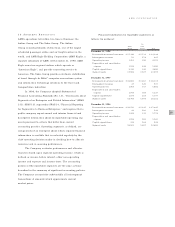

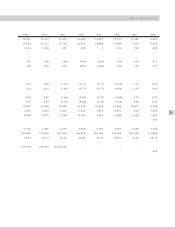

(in millions, except share and per share amounts) 1998* 1997* 1996*

Total operating revenues $19,205 18,184 17,364

Total operating expenses $16,867 16,277 15,557

Operating income (loss) $2,338 1,907 1,807

Earnings (loss) from continuing operations before

extraordinary loss and cumulative effect of

accounting changes $1,306 973 1,083

Net earnings (loss) $1,314 985 1,016

Earnings (loss) per common share from continuing

operations before extraordinary loss and cumulative

effect of accounting changes:1

Basic $7.73 5.45 6.29

Diluted $7.48 5.32 5.95

Net earnings (loss) per common share:1

Basic $7.78 5.52 5.90

Diluted $7.52 5.39 5.59

Total assets $22,303 20,859 20,451

Long-term debt, less current maturities $2,436 2,248 2,737

Obligations under capital leases, less current obligations $1,764 1,629 1,790

Non-redeemable preferred stock - - -

Convertible preferred stock, common stock and

other stockholders’ equity2$6,698 6,216 5,668

Common shares outstanding at year-end (in thousands)1161,300 173,200 182,000

Book value per common share1$41.53 35.89 31.14

Preferred shares outstanding at year-end:

Convertible preferred stock ---

Non-redeemable preferred stock ---

*The results for 1998, 1997 and 1996 have been restated for discontinued operations.

1All share and earnings per share amounts prior to 1998 have been restated to give effect to the stock split on June 9, 1998.

2No dividends have been paid on common stock for any period presented.

ELEVEN YEAR COM PARATIVE SUM M ARY