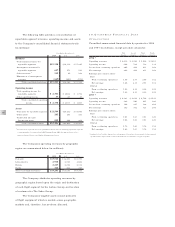

American Airlines 1998 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

amount payable to or receivable from counterparties is

included in current liabilities or assets. The fair values of the

swap agreements are not recognized in the financial state-

ments. Gains and losses on terminations of interest rate

swap agreements are deferred as an adjustment to the carry-

ing amount of the outstanding obligation and amortized as

an adjustment to interest expense related to the obligation

over the remaining term of the original contract life of the

terminated swap agreement. In the event of the early extin-

guishment of a designated obligation, any realized or

unrealized gain or loss from the swap would be recognized

in income coincident with the extinguishment.

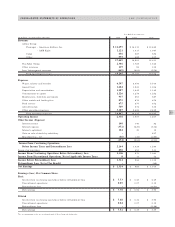

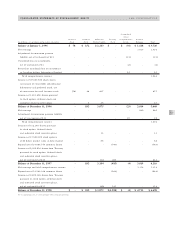

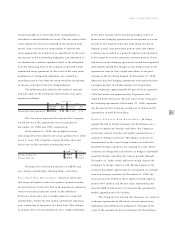

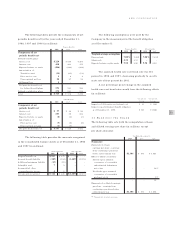

The following table indicates the notional amounts

and fair values of the Company’s interest rate swap agree-

ments (in millions):

December 31,

1998 1997

Notional Fair Notional Fair

Amount Value Amount Value

Interest rate swap agreements $1,054 $ 38 $1,410 $ 12

The fair values represent the amount the Company

would receive if the agreements were terminated at

December 31, 1998 and 1997, respectively.

At December 31, 1998, the weighted-average

remaining life of the interest rate swap agreements in effect

was 4.2 years. The weighted-average floating rates and

fixed rates on the contracts outstanding were:

December 31,

1998 1997

Average floating rate 5.599% 5.844%

Average fixed rate 6.277% 5.901%

Floating rates are based primarily on LIBOR and

may change significantly, affecting future cash flows.

FUEL PRICE RISK MANAGEMENT American enters into

fuel swap and option contracts to protect against increases

in jet fuel prices. Under the fuel swap agreements, American

receives or makes payments based on the difference

between a fixed price and a variable price for certain fuel

commodities. Under the fuel option agreements, American

pays a premium to cap prices at a fixed level. The changes

in market value of such agreements have a high correlation

to the price changes of the fuel being hedged. Gains or

losses on fuel hedging agreements are recognized as a com-

ponent of fuel expense when the underlying fuel being

hedged is used. Any premiums paid to enter into option

contracts are recorded as a prepaid expense and amortized

to fuel expense over the respective contract periods. Gains

and losses on fuel hedging agreements would be recognized

immediately should the changes in the market value of the

agreements cease to have a high correlation to the price

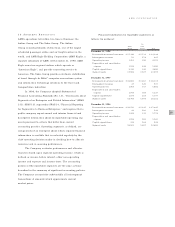

changes of the fuel being hedged. At December 31, 1998,

American had fuel hedging agreements with broker-dealers

on approximately two billion gallons of fuel products,

which represents approximately 48 percent of its expected

1999 fuel needs and approximately 19 percent of its

expected 2000 fuel needs. The fair value of the Company’s

fuel hedging agreements at December 31, 1998, represent-

ing the amount the Company would pay to terminate the

agreements, totaled $108 million.

FOREIGN EXCHANGE RISK MANAGEMENT To hedge

against the risk of future exchange rate fluctuations on a

portion of American’s foreign cash flows, the Company

enters into various currency put option agreements on a

number of foreign currencies. The option contracts are

denominated in the same foreign currency in which the

projected foreign cash flows are expected to occur. These

contracts are designated and effective as hedges of probable

quarterly foreign cash flows for various periods through

December 31, 1999, which otherwise would expose the

Company to foreign currency risk. Realized gains on the

currency put option agreements are recognized as a compo-

nent of passenger revenues. At December 31, 1998, the

notional amount related to these options totaled approxi-

mately $597 million and the fair value, representing the

amount AMR would receive to terminate the agreements,

totaled approximately $10 million.

The Company has entered into Japanese yen currency

exchange agreements to effectively convert certain lease

obligations into dollar-based obligations. Changes in the

value of the agreements due to exchange rate fluctuations

AMR CORPORATION