American Airlines 1998 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

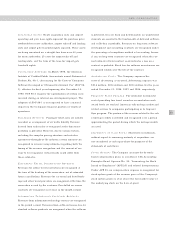

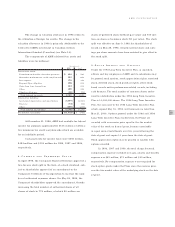

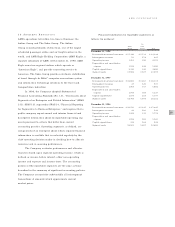

The following assumptions were used by the

Company in the measurement of the benefit obligation

as of December 31:

Pension Benefits Other Benefits

1998 1997 1998 1997

Weighted-average assumptions

Discount rate 7.00% 7.25% 7.00% 7.25%

Salary scale 4.32 4.19 --

Expected return on plan assets 9.50 9.50 9.50 9.50

The assumed health care cost trend rate was five

percent in 1998 and 1997, decreasing gradually to an ulti-

mate rate of four percent by 2001.

A one percentage point change in the assumed

health care cost trend rates would have the following effects

(in millions):

One percent One percent

increase decrease

Impact on 1998 service and interest cost $ 23 $ (24)

Impact on postretirement benefit obligation

as of December 31, 1998 $ 141 $ (148)

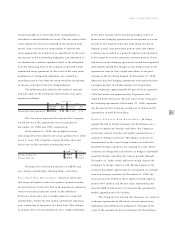

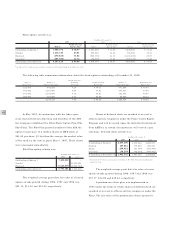

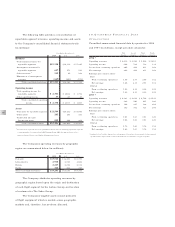

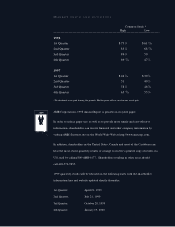

11.EARNINGS PER SHARE

The following table sets forth the computation of basic

and diluted earnings per share (in millions, except

per share amounts):

Year Ended December 31,

1998 1997 1996

Numerator:

Numerator for basic

earnings per share - earnings

from continuing operations

before extraordinary loss $1,306 $973 $ 1,083

Effect of dilutive securities:

Interest upon assumed

conversion of convertible

subordinated debentures,

net of tax - - 14(a)

Dividends upon assumed

conversion of convertible

preferred stock - - 1(a)

- - 15

Numerator for diluted earnings

per share - earnings from

continuing operations before

extraordinary loss $1,306 $973 $ 1,098

(a) Through date of actual conversion

53

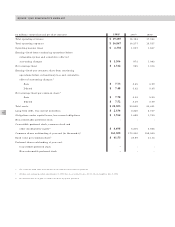

AMR CORPORATION

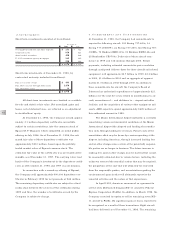

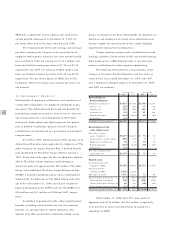

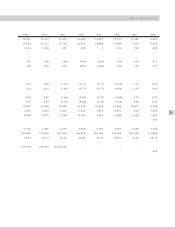

The following tables provide the components of net

periodic benefit cost for the years ended December 31,

1998, 1997 and 1996 (in millions):

Pension Benefits

1998 1997 1996

Components of net

periodic benefit cost

Defined benefit plans:

Service cost $224 $189 $ 204

Interest cost 430 403 375

Expected return on assets (486) (429) (422)

Amortization of:

Transition asset (11) (11) (11)

Prior service cost 44 4

Unrecognized net loss 24 27 16

Settlement loss 6- -

Net periodic benefit cost

for defined benefit plans 191 183 166

Defined contribution plans 174 153 132

Total $365 $336 $ 298

Other Benefits

1998 1997 1996

Components of net

periodic benefit cost

Service cost $57 $48 $ 58

Interest cost 103 95 102

Expected return on assets (6) (4) (3)

Amortization of:

Prior service cost (5) (5) (5)

Unrecognized net gain (2) (9) -

Net periodic benefit cost $147 $125 $ 152

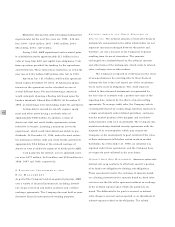

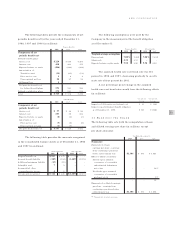

The following table provides the amounts recognized

in the consolidated balance sheets as of December 31, 1998

and 1997 (in millions):

Pension Benefits Other Benefits

1998 1997 1998 1997

Prepaid benefit cost $297 $377 $-$-

Accrued benefit liability (185) (152) (1,649) (1,573)

Additional minimum liability (13) (11) --

Intangible asset 75 --

Accumulated other

comprehensive income 66 --

Net amount recognized $112 $225 $(1,649) $(1,573)