American Airlines 1998 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

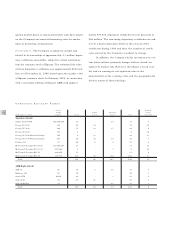

1997 COMPARED TO 1996 Operating expenses increased

14.0 percent, or $181 million, due primarily to increases

in salaries, benefits and employee-related costs and sub-

scriber incentive expenses. Salaries, benefits and

employee-related costs increased due to an increase in the

average number of equivalent employees necessary to sup-

port The Sabre Group’s revenue growth, and wage and

salary increases for existing employees. Subscriber incen-

tive expenses increased in order to maintain and expand

The Sabre Group’s travel agency subscriber base.

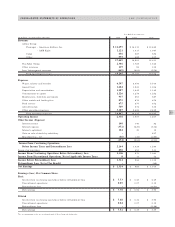

OTHER INCOME (EXPENSE)

1998 COMPARED TO 1997 Other income (expense)

increased $10 million due primarily to a favorable

court judgment.

1997 COMPARED TO 1996 Other income (expense)

increased $35 million due to an increase in interest

income of $17 million due to higher investment balances,

an increase in other income of $13 million primarily due

to losses in 1996 from a subsidiary of The Sabre Group

not active in 1997, and a decrease in interest expense of

approximately $6 million primarily due to a lower princi-

pal balance outstanding on the subordinated debenture

payable to AMR and lower interest rates.

LIQUIDITY AND CAPITAL RESOURCES

Operating activities provided net cash of $3.2 billion in

1998, $2.9 billion in 1997 and $2.7 billion in 1996. The

$326 million increase from 1997 to 1998 resulted primarily

from an increase in net earnings. The $181 million increase

from 1996 to 1997 resulted primarily from an increase in

the air traffic liability due to higher advanced sales.

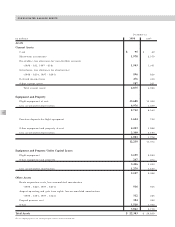

Capital expenditures in 1998 totaled $2.7 billion,

compared to $1.4 billion in 1997 and $523 million in

1996, and included purchase deposits on new aircraft

orders of $870 million, aircraft acquisitions of approxi-

mately $850 million, and purchases of computer-related

equipment totaling approximately $360 million. In 1998,

American took delivery of 10 jet aircraft – six Boeing 757-

200s and four Boeing 767-300ERs. American Eagle took

delivery of 20 Embraer EMB-145s and five Super ATR air-

craft. These expenditures, as well as the expansion of

certain airport facilities, were funded primarily with inter-

nally generated cash, except for (i) the Embraer aircraft

acquisitions which were funded through secured debt

agreements, and (ii) five Boeing 757-200 aircraft which

were financed through sale-leaseback transactions. During

1998, The Sabre Group invested approximately $140 mil-

lion for a 35 percent interest in ABACUS International Ltd.

The Company made acquisitions and other investments of

$137 million, which relate primarily to the acquisition of

Reno Air in December 1998. Proceeds from the sale of

equipment and property of $293 million in 1998 include

proceeds received upon the delivery of two of American’s

McDonnell Douglas MD-11 aircraft to Federal Express

Corporation (FedEx) in accordance with the 1995 agree-

ment between the two parties, 10 ATR 42 aircraft, and

other aircraft equipment sales.

At December 31, 1998, the Company had commit-

ments to acquire the following aircraft: 100 Boeing

737-800s, 34 Boeing 777-200IGWs, six Boeing 757-200s,

four Boeing 767-300ERs, 75 Embraer EMB-135s, 30

Embraer EMB-145s and 25 Bombardier CRJ-700s.

Deliveries of these aircraft commence in 1999 and will

continue through 2005. Future payments, including esti-

mated amounts for price escalation through anticipated

delivery dates for these aircraft and related equipment, will

approximate $2.7 billion in 1999, $2.0 billion in 2000,

$1.6 billion in 2001 and an aggregate of approximately

$1.5 billion in 2002 through 2005. In addition to these

commitments for aircraft, the Company expects to spend

approximately $1.5 billion related to modifications to air-

craft, renovations of -- and additions to -- airport and

office facilities, and the acquisition of various other equip-

ment and assets in 1999, of which approximately $625

million has been authorized by the Company’s Board of

Directors. The Company expects to fund the majority of

its 1999 capital expenditures from the Company’s existing