American Airlines 1998 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

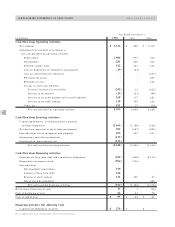

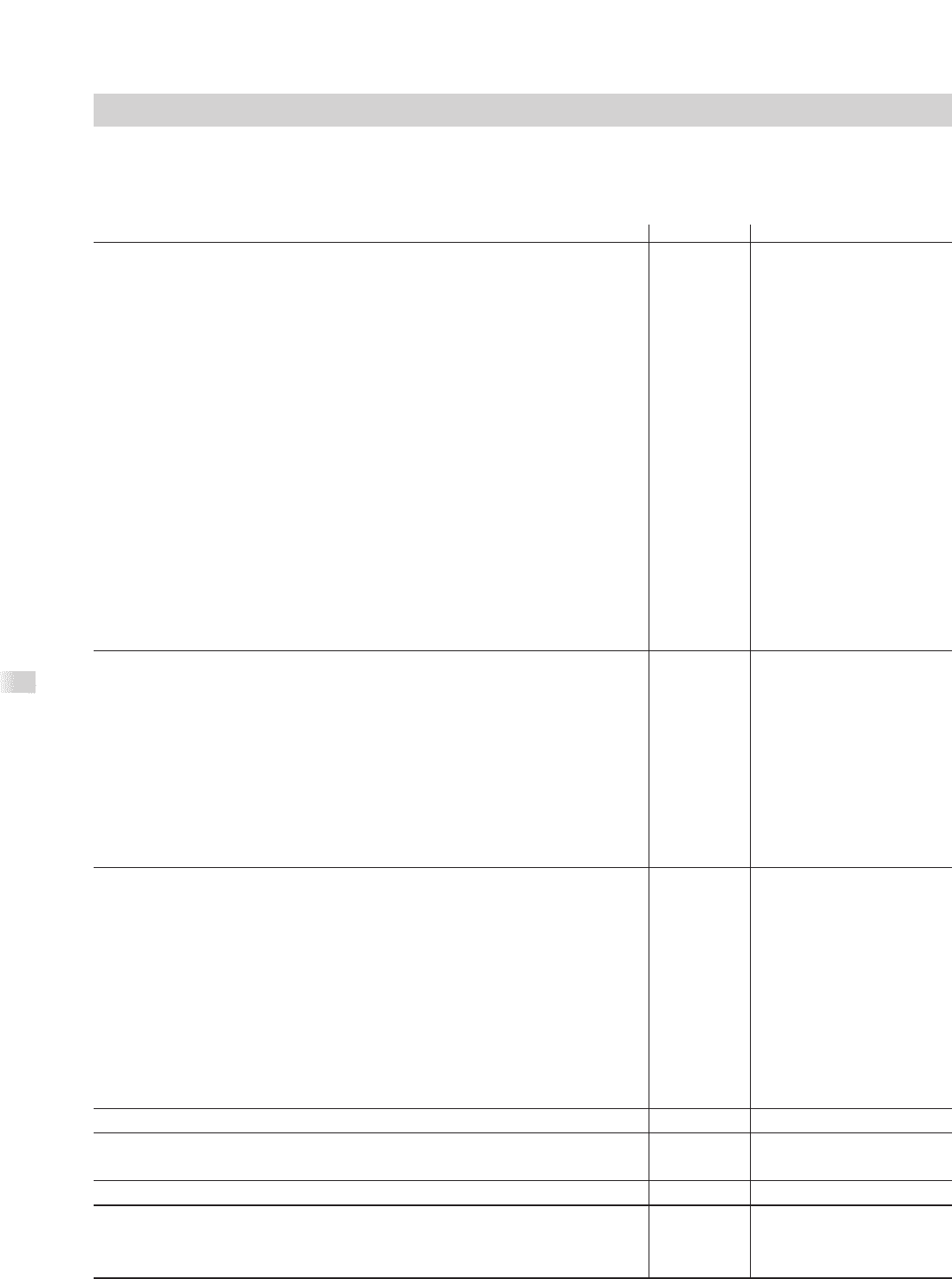

40

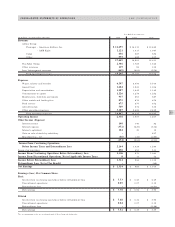

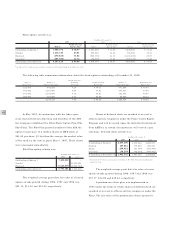

Year Ended December 31,

(in millions) 1998 1997 1996

Cash Flow from Operating Activities:

Net earnings $1,314 $985 $ 1,016

Adjustments to reconcile net earnings to

net cash provided by operating activities:

Depreciation 1,006 977 948

Amortization 281 248 237

Deferred income taxes 312 363 217

Gain on disposition of equipment and property (19) (24) -

Gain on sale of stock by subsidiary -- (497)

Provisions for losses -- 251

Extraordinary loss -- 136

Change in assets and liabilities:

Decrease (increase) in receivables (242) 12 (225)

Increase in inventories (35) (41) (66)

Increase in accounts payable and accrued liabilities 268 117 261

Increase in air traffic liability 119 155 423

Other, net 191 77 (13)

Net cash provided by operating activities 3,195 2,869 2,688

Cash Flow from Investing Activities:

Capital expenditures, including purchase deposits

on flight equipment (2,661) (1,358) (523)

Net decrease (increase) in short-term investments 392 (627) (924)

Proceeds from sale of equipment and property 293 305 257

Acquisitions and other investments (137) - -

Investment in joint ventures, net (135) - -

Net cash used for investing activities (2,248) (1,680) (1,190)

Cash Flow from Financing Activities:

Payments on long-term debt and capital lease obligations (547) (648) (2,130)

Repurchase of common stock (994) (740) -

Proceeds from:

Sale-leaseback transactions 270 - -

Issuance of long-term debt 246 - -

Exercise of stock options 111 200 25

Sale of stock by subsidiary -- 589

Net cash used for financing activities (914) (1,188) (1,516)

Net increase (decrease) in cash 33 1 (18)

Cash at beginning of year 62 61 79

Cash at end of year $95$62 $ 61

Financing Activities Not Affecting Cash

Capital lease obligations incurred $270 $- $-

The accompanying notes are an integral part of these financial statements.

CONSOLIDATED STATEM ENTS OF CASH FLOW S AMR CORPORATION