American Airlines 1998 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

11 aircraft will be delivered between 2000 and 2002. The

carrying value of the 11 remaining aircraft American has

committed to sell was approximately $711 million as of

December 31, 1998.

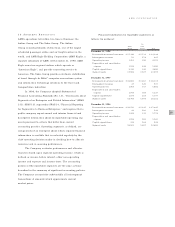

AMR and American have included an event risk

covenant in approximately $3.0 billion of debt and lease

agreements. The covenant permits the holders of such instru-

ments to receive a higher rate of return (between 50 and 700

basis points above the stated rate) if a designated event, as

defined, should occur and the credit rating of the debentures

or the debt obligations underlying the lease agreements is

downgraded below certain levels.

Special facility revenue bonds have been issued by

certain municipalities, primarily to purchase equipment

and improve airport facilities which are leased by American.

In certain cases, the bond issue proceeds were loaned to

American and are included in long-term debt. Certain bonds

have rates that are periodically reset and are remarketed by

various agents. In certain circumstances, American may be

required to purchase up to $437 million of the special facility

revenue bonds prior to scheduled maturity, in which case

American has the right to resell the bonds or to use the

bonds to offset its lease or debt obligations. American may

borrow the purchase price of these bonds under standby let-

ter of credit agreements. At American’s option, these letters of

credit are secured by funds held by bond trustees and by

approximately $519 million of short-term investments.

In early February 1999, some members of the APA

engaged in certain activities (increased sick time and declin-

ing to fly additional trips) that resulted in numerous

cancellations across American’s system. These actions were

taken in response to the acquisition of Reno Air in December

1998. In an attempt to resolve the dispute, the Company

and the APA have agreed to non-binding mediation. These

actions adversely impacted the Company’s first quarter

1999 net earnings.

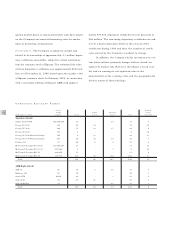

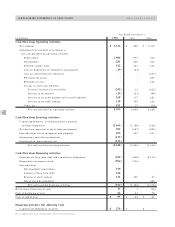

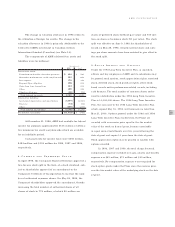

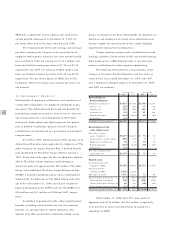

4.LEASES

AMR’s subsidiaries lease various types of equipment and

property, including aircraft, passenger terminals, equipment

and various other facilities. The future minimum lease pay-

ments required under capital leases, together with the present

value of net minimum lease payments, and future minimum

lease payments required under operating leases that have

initial or remaining non-cancelable lease terms in excess of

one year as of December 31, 1998, were (in millions):

Capital Operating

Year Ending December 31, Leases Leases

1999 $ 273 $ 1,012

2000 341 951

2001 323 949

2002 274 904

2003 191 919

2004 and subsequent 1,261 12,480

2,663 1$17,215 2

Less amount representing interest 745

Present value of net minimum

lease payments $ 1,918

1 Future minimum payments required under capital leases include $192 million guaranteed by

AMR relating to special facility revenue bonds issued by municipalities.

2 Future minimum payments required under operating leases include $6.1 billion guaranteed by

AMR relating to special facility revenue bonds issued by municipalities.

At December 31, 1998, the Company had 187 jet

aircraft and 39 turboprop aircraft under operating leases,

and 86 jet aircraft and 63 turboprop aircraft under capital

leases. The aircraft leases can generally be renewed at rates

based on fair market value at the end of the lease term for

one to five years. Most aircraft leases have purchase options

at or near the end of the lease term at fair market value, but

generally not to exceed a stated percentage of the defined

lessor’s cost of the aircraft or at a predetermined fixed

amount.

Rent expense, excluding landing fees, was $1.2 bil-

lion for 1998, 1997 and 1996.

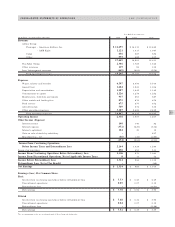

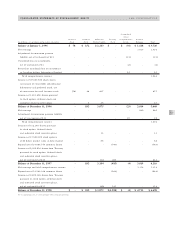

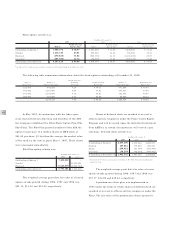

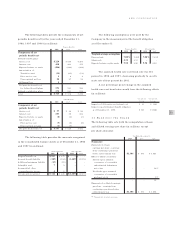

5.INDEBTEDNESS

Long-term debt (excluding amounts maturing within one

year) consisted of (in millions):

December 31,

1998 1997

8.05% - 10.62% notes due through 2021 $865 $874

Secured debt due through 2015

(effective rates from 6.317% - 9.957%

at December 31, 1998) 857 644

9.0% - 10.20% debentures due through 2021 437 437

6.0% - 7.10% bonds due through 2031 176 176

Variable rate indebtedness due through 2024

(3.55% at December 31, 1998) 86 86

Other 15 31

Long-term debt, less current maturities $2,436 $2,248

AMR CORPORATION

2,663 1

745