American Airlines 1998 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

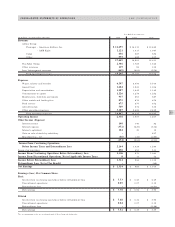

AIRCRAFT FUEL The Company’s earnings are affected by

changes in the price and availability of aircraft fuel. In order

to provide a measure of control over price and supply, the

Company trades and ships fuel and maintains fuel storage

facilities to support its flight operations. The Company also

manages the price risk of fuel costs primarily utilizing fuel

swap and fuel option contracts. Market risk is estimated as a

hypothetical 10 percent increase in the December 31, 1998

and 1997 cost per gallon of fuel. Based on projected 1999

fuel usage, such an increase would result in an increase to

aircraft fuel expense of approximately $73 million in 1999,

net of fuel hedge instruments outstanding at December 31,

1998. Comparatively, based on projected 1998 fuel usage,

such an increase would have resulted in an increase to air-

craft fuel expense of approximately $110 million in 1998, net

of fuel hedge instruments outstanding at December 31, 1997.

The change in market risk is due primarily to the Company

having more hedge instruments outstanding at December 31,

1998 as compared to December 31, 1997. As of December

31, 1998, the Company had hedged approximately 48 per-

cent of its 1999 fuel requirements and approximately 19

percent of its 2000 fuel requirements, compared to approxi-

mately 23 percent of its 1998 fuel requirements hedged at

December 31, 1997.

FOREIGN CURRENCY The Company is exposed to the effect

of foreign exchange rate fluctuations on the U.S. dollar

value of foreign currency-denominated operating revenues

and expenses. The Company’s largest exposure comes from

the British pound, Japanese yen, and various Latin and

South American currencies. The Company uses options to

hedge a portion of its anticipated foreign currency-denomi-

nated net cash flows. The result of a uniform 10 percent

strengthening in the value of the U.S. dollar from

December 31, 1998 and 1997 levels relative to each of the

currencies in which the Company has foreign currency

exposure would result in a decrease in operating income of

approximately $22 million and $24 million for the years

ending December 31, 1999 and 1998, respectively, net of

hedge instruments outstanding at December 31, 1998 and

1997, due to the Company’s foreign-denominated revenues

exceeding its foreign-denominated expenses. This sensitivity

analysis was prepared based upon projected 1999 and 1998

foreign currency-denominated revenues and expenses as of

December 31, 1998 and 1997. Furthermore, this calculation

assumes that each exchange rate would change in the same

direction relative to the U.S. dollar.

INTEREST The Company’s earnings are also affected by

changes in interest rates due to the impact those changes

have on its interest income from cash and short-term invest-

ments and its interest expense from variable-rate debt

instruments. The Company has variable-rate debt instru-

ments representing approximately six percent and five

percent, respectively, of its total long-term debt, and interest

rate swaps on notional amounts of approximately $1.1 bil-

lion and $1.4 billion, respectively, at December 31, 1998

and 1997. If interest rates average 10 percent more in 1999

than they did during 1998, the Company’s interest expense

would increase by approximately $6 million and interest

income from cash and short-term investments would

increase by approximately $12 million. In comparison, at

December 31, 1997, the Company estimated that if interest

rates averaged 10 percent more in 1998 than they did dur-

ing 1997, the Company’s interest expense would have

increased by approximately $10 million and interest income

from cash and short-term investments would have increased

by approximately $14 million. These amounts are deter-

mined by considering the impact of the hypothetical interest

rates on the Company’s variable-rate long-term debt, interest

rate swap agreements, and cash and short-term investment

balances at December 31, 1998 and 1997.

Market risk for fixed-rate long-term debt is estimated

as the potential increase in fair value resulting from a hypo-

thetical 10 percent decrease in interest rates, and amounts

to approximately $96 million and $105 million as of

December 31, 1998 and 1997, respectively. The fair values

of the Company’s long-term debt were estimated using

AMR CORPORATION