American Airlines 1998 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

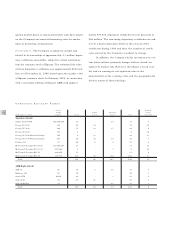

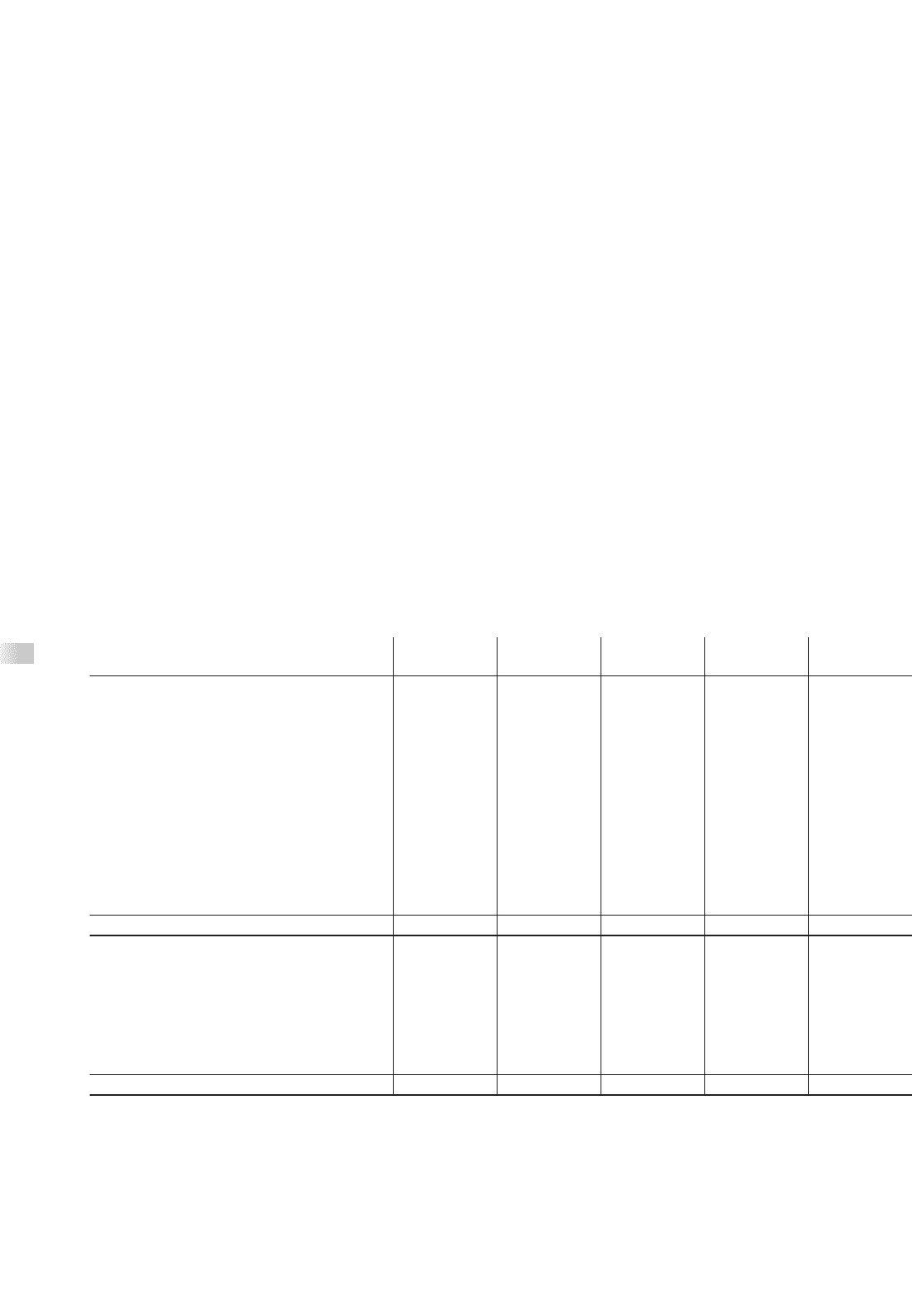

OPERATING AIRCRAFT FLEETS

Current Weighted-

Seating Capital Operating Average

(At December 31, 1998) Capacity Owned Leased Leased Total Age (Years)

American Aircraft

Airbus A300-600R 192/266/267 10 - 25 35 9

Boeing 727-200 150 64 14 - 78 22

Boeing 757-200 188 51 14 31 96 6

Boeing 767-200 172 8 - - 8 16

Boeing 767-200 Extended Range 165 9 13 - 22 13

Boeing 767-300 Extended Range 207 20 15 10 45 7

Fokker 100 97 66 5 4 75 6

McDonnell Douglas DC-10-10 237/290/297 13 - - 13 21

McDonnell Douglas DC-10-30 271/282 4 - 1 5 24

McDonnell Douglas MD-11 238/255 11 - - 11 6

McDonnell Douglas MD-80 133/139 119 25 116 260 11

Total 375 86 187 648 11

AMR Eagle Aircraft

ATR 42 46 18 2 15 35 9

Embraer 145 50 20 - - 20 1

Super ATR 64/66 40 - 3 43 4

Saab 340B 34 29 61 - 90 7

Saab 340B Plus 34 - - 21 21 3

Total 107 63 39 209 6

1The fleet table does not include 2 owned aircraft and 25 operating leased aircraft operated by Reno Air.

36

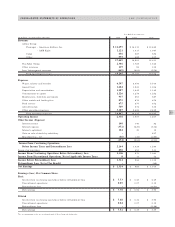

quoted market prices or discounted future cash flows based

on the Company’s incremental borrowing rates for similar

types of borrowing arrangements.

INVESTMENTS The Company is subject to market risk

related to its ownership of approximately 3.1 million depos-

itory certificates convertible, subject to certain restrictions,

into the common stock of Equant. The estimated fair value

of these depository certificates was approximately $210 mil-

lion as of December 31, 1998, based upon the market value

of Equant common stock. In February 1999, in connection

with a secondary offering of Equant, AMR sold approxi-

mately 900,000 depository certificates for net proceeds of

$66 million. The remaining depository certificates are sub-

ject to a final reallocation between the owners of the

certificates during 1999 and thus, the number of certifi-

cates owned by the Company is subject to change.

In addition, the Company holds investments in cer-

tain other entities, primarily foreign airlines, which are

subject to market risk. However, the impact of such mar-

ket risk on earnings is not significant due to the

immateriality of the carrying value and the geographically

diverse nature of these holdings.