American Airlines 1998 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

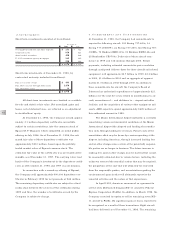

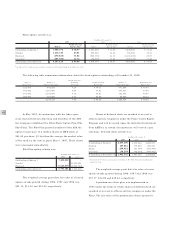

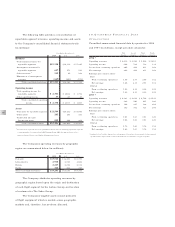

Year Ended December 31,

1998 1997 1996

Denominator:

Denominator for basic earnings

per share - weighted-average

shares 169 178 172

Effect of dilutive securities:

Convertible subordinated

debentures - - 8

Convertible preferred stock -- 1

Employee options and shares 13 14 7

Assumed treasury shares purchased

(7) (9) (4)

Dilutive potential common shares 65 12

Denominator for diluted earnings

per share - adjusted

weighted-average shares 175 183 184

Basic earnings per share from

continuing operations before

extraordinary loss $7.73 $5.45 $ 6.29

Diluted earnings per share from

continuing operations before

extraordinary loss $7.48 $5.32 $ 5.95

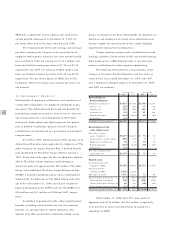

12.DISCONTINUED OPERATIONS

In September 1998, the Company announced plans to sell

three of the companies within the Management Services

Group that accounted for a substantial portion of that

group’s revenues and operating income: AMR Services, AMR

Combs and TeleService Resources. As of December 31,

1998, the Company had reached agreements to sell all three

companies and expects to complete the sales by the end of

the first quarter or early part of the second quarter of 1999.

As a result of the sales, the Company expects to record a

significant gain during the first quarter of 1999.

The results of operations for AMR Services, AMR

Combs and TeleService Resources have been reflected in the

consolidated statements of operations as discontinued oper-

ations. The amounts shown are net of income taxes of

approximately $6.7 million, $9.7 million and $14.8 million

for 1998, 1997 and 1996, respectively. Revenues from the

operations of AMR Services, AMR Combs and TeleService

Resources were $513 million, $517 million and $519 mil-

lion for 1998, 1997 and 1996, respectively.

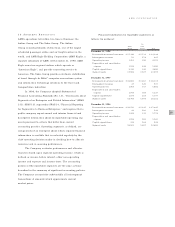

13.GAIN ON SALE

OF STOCK BY SUBSIDIARY

During October 1996, The Sabre Group completed an ini-

tial public offering of 23,230,000 shares of Sabre Common

Stock, representing 17.8 percent of its economic interest, at

$27 per share for net proceeds of approximately $589 mil-

lion. This transaction resulted in a reduction of the

Company’s economic interest in The Sabre Group from 100

percent to 82.2 percent. In accordance with the Company’s

policy of recognizing gains or losses on the sale of a sub-

sidiary’s stock based on the difference between the offering

price and the Company’s carrying amount of such stock, the

Company recorded a $497 million gain. The issuance of

stock by The Sabre Group was not subject to federal income

taxes. In accordance with Statement of Financial Accounting

Standards No. 109, “Accounting for Income Taxes,” no

income tax expense was recognized on the gain.

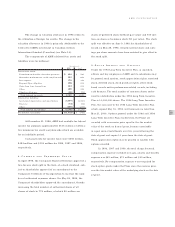

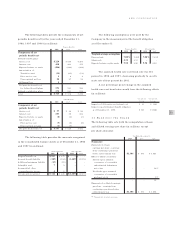

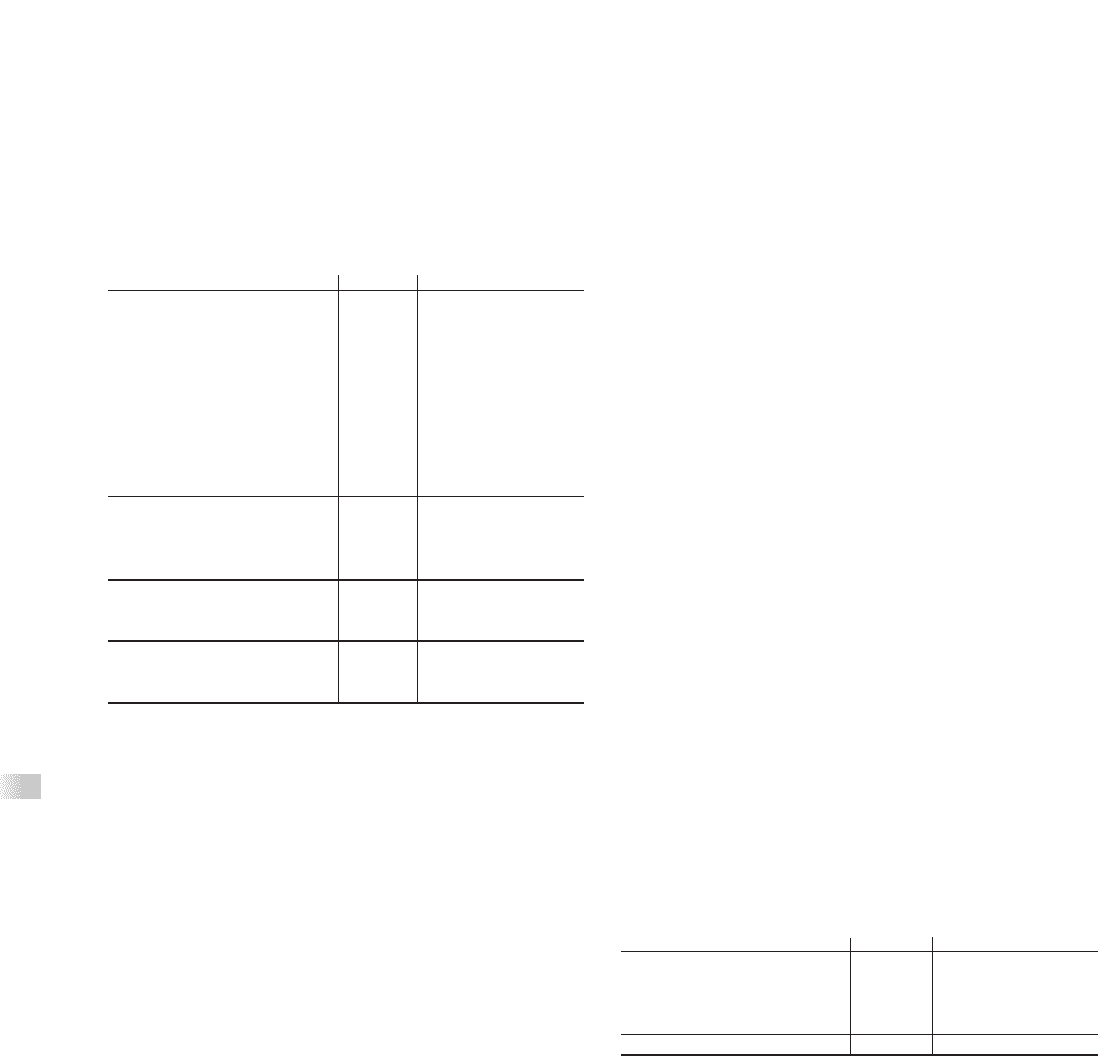

14.OTHER INCOME (EXPENSE)-

MISCELLANEOUS

Other income (expense) - miscellaneous, net included the

following (in millions):

Year Ended December 31,

1998 1997 1996

Minority interest $(40) $(36) $ (2)

Canadian Airlines charges -- (251)

Litigation settlement/judgment 14)- (21)

Other, net (20) 13)(12)

$(46) $(23) $ (286)

During 1996, the Company determined that the

decline in the value of its investment in the cumulative

mandatorily redeemable convertible preferred stock of

Canadian was not temporary and, in accordance with

Statement of Financial Accounting Standards No. 115,

“Accounting for Certain Investments in Debt and Equity

Securities,” recorded a $192 million charge to write-off the

investment. Additionally, the Company recorded a charge

of $59 million to write-off certain deferred costs relating to

the Company’s agreement to provide a variety of services

to Canadian.

--

-