American Airlines 1998 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

AMR CORPORATION

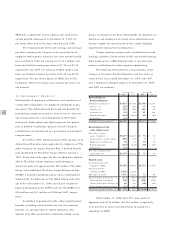

15.SEGMENT REPORTING

AMR’s operations fall within two lines of business: the

Airline Group and The Sabre Group. The Airline

Group consists primarily of American, one of the largest

scheduled passenger airline and air freight carriers in the

world, and AMR Eagle Holding Corporation (AMR Eagle), a

separate subsidiary of AMR. At December 31, 1998, AMR

Eagle owns two regional airlines which operate as

“American Eagle”, and provide connecting service to

American. The Sabre Group provides electronic distribution

of travel through its Sabre® computer reservations system

and information technology solutions to the travel and

transportation industries.

In 1998, the Company adopted Statement of

Financial Accounting Standards No. 131, “Disclosures about

Segments of an Enterprise and Related Information” (SFAS

131). SFAS 131 supersedes SFAS 14, “Financial Reporting

for Segments of a Business Enterprise,” and requires that a

public company report annual and interim financial and

descriptive information about its reportable operating seg-

ments pursuant to criteria that differ from current

accounting practice. Operating segments, as defined, are

components of an enterprise about which separate financial

information is available that is evaluated regularly by the

chief operating decision maker in deciding how to allocate

resources and in assessing performance.

The Company evaluates performance and allocates

resources based upon segment operating income, which is

defined as income before interest, other non-operating

income and expense and income taxes. The accounting

policies of the reportable segments are the same as those

described in the summary of significant accounting policies.

The Company accounts for substantially all intersegment

transactions at amounts which approximate current

market prices.

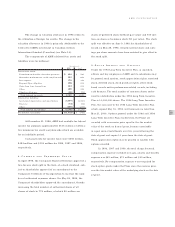

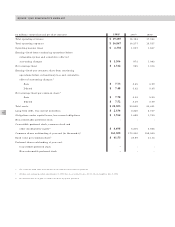

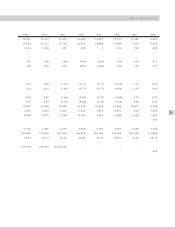

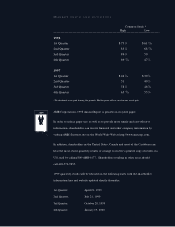

Financial information by reportable segment is as

follows (in millions):

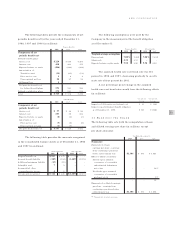

The

Airline Sabre

Group Group Total

December 31, 1998

Revenues from external customers $ 17,396 $ 1,732 $ 19,128

Intersegment revenues 53 574 627

Operating income 1,951 350 2,301

Depreciation and amortization

expense 1,038 248 1,286

Capital expenditures 2,340 320 2,660

Segment assets 19,582 1,927 21,509

December 31, 1997

Revenues from external customers $ 16,856 $ 1,263 $ 18,119

Intersegment revenues 47 526 573

Operating income 1,569 313 1,882

Depreciation and amortization

expense 1,038 185 1,223

Capital expenditures 1,139 218 1,357

Segment assets 18,708 1,504 20,212

December 31, 1996

Revenues from external customers $ 16,170 $ 1,125 $ 17,295

Intersegment revenues 41 500 541

Operating income 1,442 330 1,772

Depreciation and amortization

expense 1,018 165 1,183

Capital expenditures 338 184 522

Segment assets 18,519 1,287 19,806

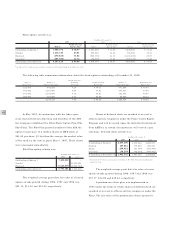

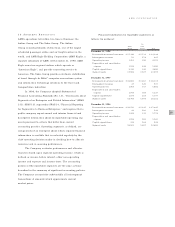

The

Sabre

Group