American Airlines 1998 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

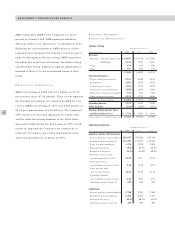

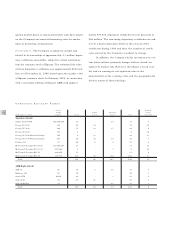

OPERATING EXPENSES

1998 COMPARED TO 1997 Airline Group operating

expenses of $15.5 billion in 1998 were up $164 million,

or 1.1 percent, versus 1997. American’s Jet Operations

cost per ASM decreased 0.2 percent to 9.25 cents. Wages,

salaries and benefits increased $283 million, or 5.2 per-

cent, due primarily to an increase in the average number

of equivalent employees, contractual wage rate and senior-

ity increases that are built into the Company’s labor

contracts and an increase in the provision for profit shar-

ing. Fuel expense decreased $319 million, or 16.6 percent,

due to an 18.2 percent decrease in American’s average

price per gallon, including taxes, partially offset by a 1.9

percent increase in American’s fuel consumption.

Commissions to agents decreased 4.1 percent, or $52 mil-

lion, despite a 3.2 percent increase in passenger revenues,

due to the continued benefit from the commission rate

reduction initiated during September 1997. Maintenance,

materials and repairs expense increased 8.5 percent, or

$73 million, due to an increase in airframe and engine

maintenance volumes at American’s maintenance bases as

a result of the maturing of its fleet. Other operating

expenses increased $179 million, or 3.8 percent, due pri-

marily to spending on the Company’s Year 2000 Readiness

program, an increase in outsourced services and higher

costs, such as credit card fees, resulting from higher pas-

senger revenues.

1997 COMPARED TO 1996 Airline Group operating

expenses of $15.3 billion in 1997 were up $565 million, or

3.8 percent, versus 1996. American’s Jet Operations cost per

ASM increased 4.0 percent to 9.27 cents. Wages, salaries

and benefits increased $289 million, or 5.6 percent, due

primarily to an increase in the average number of equivalent

employees, contractual wage rate and seniority increases

that are built into the Company’s labor contracts, including

a three percent rate increase granted to pilots effective

August 31, 1997, and an increase in the provision for profit

sharing. Fuel expense decreased $13 million, or 0.7 percent,

due to a 1.6 percent decrease in American’s average price

per gallon, including taxes, partially offset by a 1.4 percent

increase in American’s fuel consumption. Commissions to

agents increased 2.1 percent, or $26 million, due primarily

to increased passenger revenues. This increase was offset by

changes in the Company’s travel agency commission pay-

ment structure implemented in September 1997 which

lowered the base commission paid to travel agents from

10 percent to eight percent on all tickets purchased in the

U.S. and Canada for both domestic and international travel.

Maintenance, materials and repairs expense increased

25.5 percent, or $175 million, due to an increase in air-

frame and engine maintenance check volumes at American’s

maintenance bases as a result of the maturing of its fleet.

Other operating expenses increased $68 million, or 1.5 per-

cent, due primarily to an increase in outsourced services,

additional airport security requirements, and higher costs,

such as credit card fees, resulting from higher passenger

revenues. Other operating expenses in 1996 included a $26

million charge to write down the value of aircraft interiors.

OTHER EXPENSE

Other expense consists of interest income and expense,

interest capitalized and miscellaneous - net.

1998 COMPARED TO 1997 Interest expense decreased

$48 million, or 11.3 percent, due primarily to scheduled

debt repayments of approximately $400 million in 1998.

Interest capitalized increased $84 million, to $104 million,

due primarily to the increase in purchase deposits for

flight equipment.

1997 COMPARED TO 1996 Interest expense decreased

18.3 percent, or $95 million, due primarily to scheduled

debt repayments and the repurchase and/or retirement

prior to scheduled maturity of approximately $469 million

and $1.1 billion of long-term debt in 1997 and 1996,

respectively, and a reduction of $850 million of American’s

long-term debt owed to AMR as part of the reorganization

of The Sabre Group. Also, in 1996, the Company’s