American Airlines 1998 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

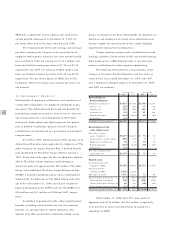

INTANGIBLE ASSETS Route acquisition costs and airport

operating and gate lease rights represent the purchase price

attributable to route authorities, airport take-off and landing

slots and airport gate leasehold rights acquired. These assets

are being amortized on a straight-line basis over 40 years

for route authorities, 25 years for airport take-off and

landing slots, and the term of the lease for airport gate

leasehold rights.

CAPITALIZED SOFTWARE In March 1998, the American

Institute of Certified Public Accountants issued Statement of

Position No. 98-1, “Accounting for the Costs of Computer

Software Developed or Obtained for Internal Use” (SOP 98-

1), effective for fiscal years beginning after December 15,

1998. SOP 98-1 requires the capitalization of certain costs

incurred during an internal-use development project. The

adoption of SOP 98-1 is not expected to have a material

impact on the Company’s financial position or results of

operations.

PASSENGER REVENUES Passenger ticket sales are initially

recorded as a component of air traffic liability. Revenue

derived from ticket sales is recognized at the time trans-

portation is provided. However, due to various factors,

including the complex pricing structure and interline

agreements throughout the industry, certain amounts are

recognized in revenue using estimates regarding both the

timing of the revenue recognition and the amount of rev-

enue to be recognized. Actual results could differ from

those estimates.

ELECTRONIC TRAVEL DISTRIBUTION REVENUES

Revenues for airline travel reservations are recognized at

the time of the booking of the reservation, net of estimated

future cancellations. Revenues for car rental and hotel book-

ings and other travel providers are recognized at the time the

reservation is used by the customer. Fees billed on service

contracts are recognized as revenue in the month earned.

INFORMATION TECHNOLOGY SOLUTIONS REVENUES

Revenues from information technology services are recognized

in the period earned. Revenues from software license fees for

standard software products are recognized when the software

is delivered, fees are fixed and determinable, no undelivered

elements are essential to the functionality of delivered software

and collection is probable. Revenues on long-term software

development and consulting contracts are recognized under

the percentage of completion method of accounting. Losses,

if any, on long-term contracts are recognized when the cur-

rent estimate of total contract costs indicates a loss on a

contract is probable. Fixed fees for software maintenance are

recognized ratably over the life of the contract.

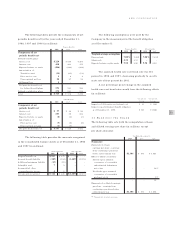

ADVERTISING COSTS The Company expenses the

costs of advertising as incurred. Advertising expense was

$216 million, $204 million and $203 million for the years

ended December 31, 1998, 1997 and 1996, respectively.

FREQUENT FLYER PROGRAM The estimated incremental

cost of providing free travel awards is accrued when such

award levels are reached. American sells mileage credits and

related services to companies participating in its frequent

flyer program. The portion of the revenue related to the sale

of mileage credits is deferred and recognized over a period

approximating the period during which the mileage credits

are used.

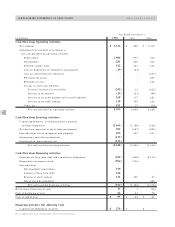

STATEMENTS OF CASH FLOWS Short-term investments,

without regard to remaining maturity at acquisition, are

not considered as cash equivalents for purposes of the

statements of cash flows.

STOCK OPTIONS The Company accounts for its stock-

based compensation plans in accordance with Accounting

Principles Board Opinion No. 25, “Accounting for Stock

Issued to Employees” (APB 25) and related Interpretations.

Under APB 25, no compensation expense is recognized for

stock option grants if the exercise price of the Company’s

stock option grants is at or above the fair market value of

the underlying stock on the date of grant.

AMR CORPORATION