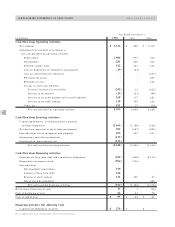

American Airlines 1998 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

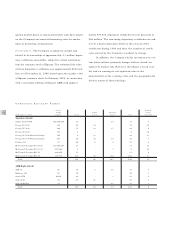

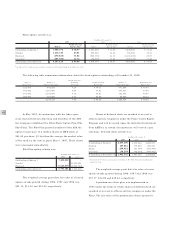

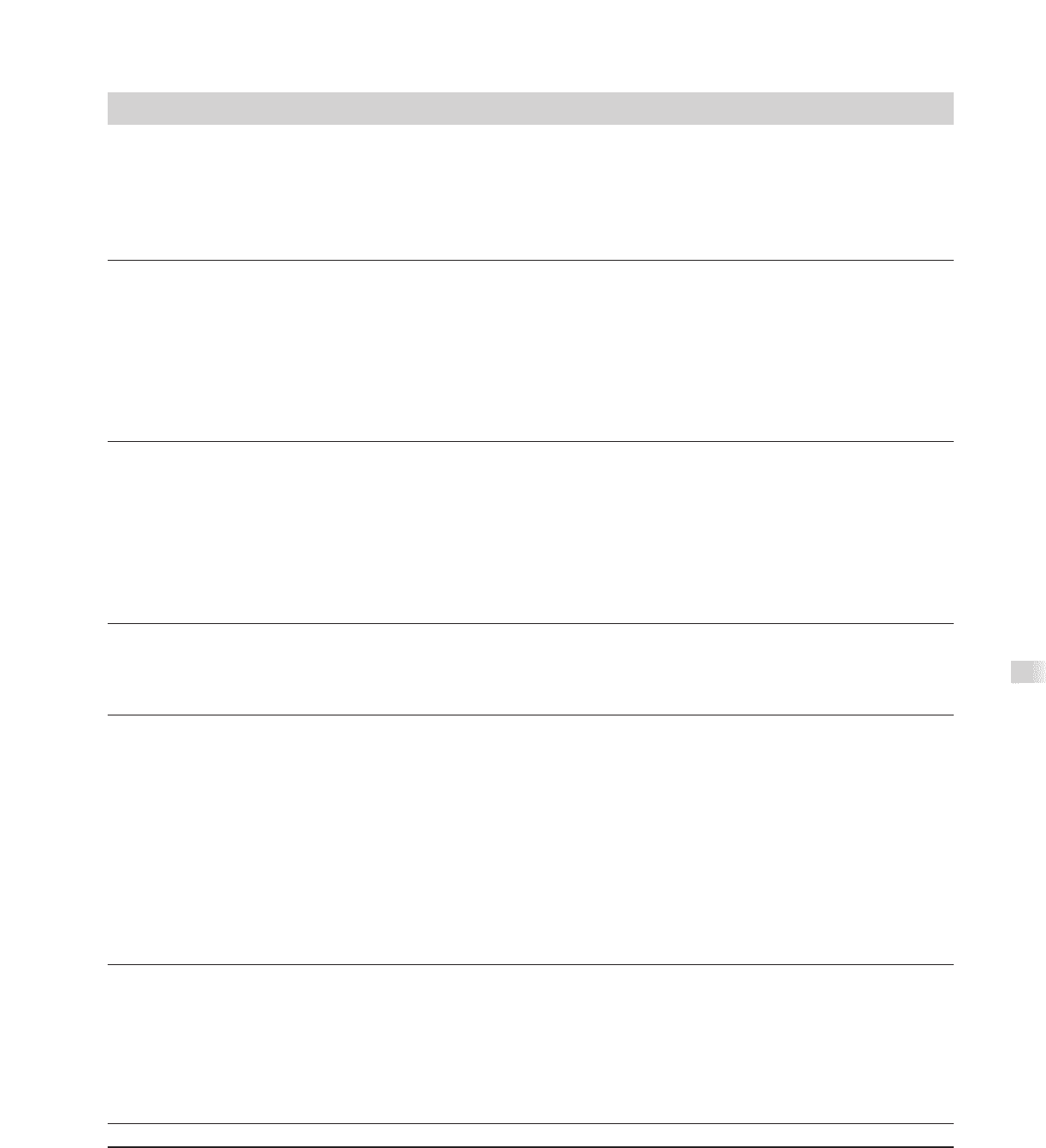

41

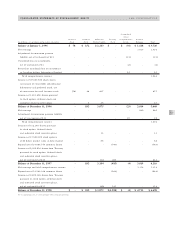

Accumulated

Other

Preferred Common Additional Treasury Comprehensive Retained

(in millions, except shares and per share amounts) Stock Stock Paid-in Capital Stock Income Earnings Total

Balance at January 1, 1996 $ 78 $ 152 $ 2,163 $ - $ (91) $ 1,418 $ 3,720

Net earnings - - - - - 1,016 1,016

Adjustment for minimum pension

liability, net of tax benefit of $13 - - - - (21) - (21)

Unrealized loss on investments,

net of tax benefit of $1 - - - - (2) - (2)

Reversal of unrealized loss on investment

in Canadian Airlines International Limited

- - - - 91 - 91

To tal comprehensive income 1,084

Issuance of 27,853,548 shares upon

conversion of convertible subordinated

debentures and preferred stock, net

of conversion fees and issuance costs (78) 28 867 - - - 817

Issuance of 1,403,656 shares pursuant

to stock option, deferred stock and

restricted stock incentive plans - 2 45 - - - 47

Balance at December 31, 1996 - 182 3,075 - (23) 2,434 5,668

Net earnings - - - - - 985 985

Adjustment for minimum pension liability,

net of tax expense of $13 - - - - 19 - 19

To tal comprehensive income 1,004

Issuance of 312,140 shares pursuant

to stock option, deferred stock

and restricted stock incentive plans - - 13 - - - 13

Issuance of 11,500,000 stock options

at $5 below market value at date of grant - - 58 - - - 58

Repurchase of 14,086,750 common shares - - - (740) - - (740)

Issuance of 5,005,918 shares from Treasury

pursuant to stock option, deferred stock

and restricted stock incentive plans,

net of tax benefit of $15 - - (42) 255 - - 213

Balance at December 31, 1997 - 182 3,104 (485) (4) 3,419 6,216

Net earnings and total comprehensive income - - - - - 1,314 1,314

Repurchase of 14,342,008 common shares - - - (944) - - (944)

Issuance of 2,495,148 shares from Treasury

pursuant to stock option, deferred stock

and restricted stock incentive plans,

net of tax benefit of $17 - - (29) 141 - - 112

Balance at December 31, 1998 $ - $ 182 $ 3,075 $(1,288) $ (4) $ 4,733 $ 6,698

The accompanying notes are an integral part of these financial statements.

CONSOLIDATED STATEM ENTS OF STOCKHOLDERS’ EQUITY AMR CORPORATION