American Airlines 1998 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

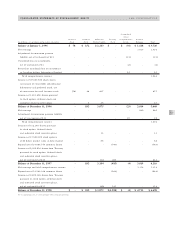

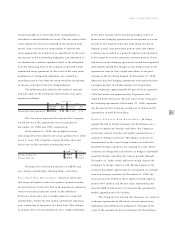

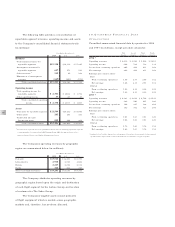

equal to the market price of the Company’s stock at the date

of grant. The shares vest over a three-year performance

period based upon AMR’s ratio of cash flow to adjusted

gross assets. Performance share activity was:

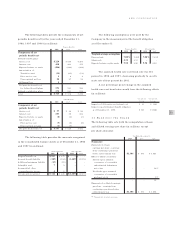

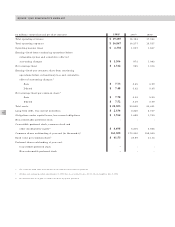

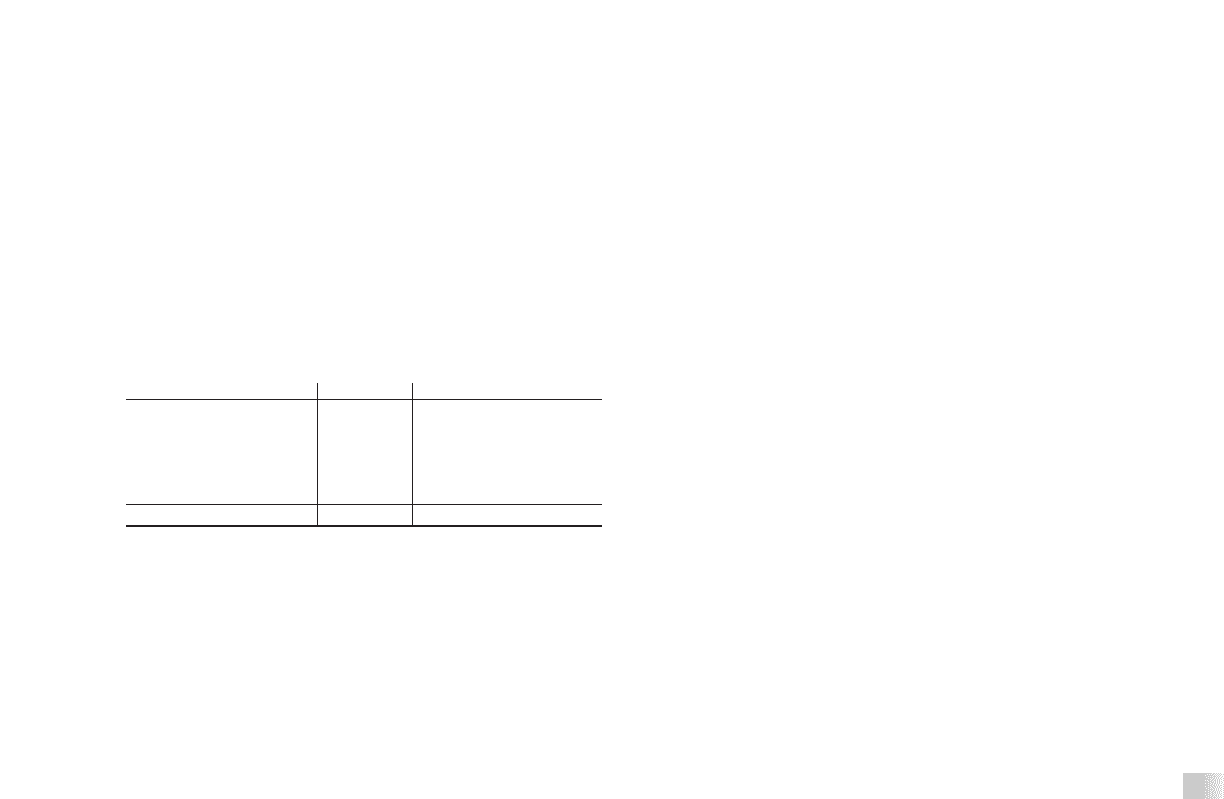

Year Ended December 31,

1998 1997 1996

Outstanding at January 1 1,737,274 1,679,460 1,648,822

Granted 644,680 808,736 764,614

Issued (205,458) (190,766) (137,008)

Awards settled in cash (522,234) (513,064) (356,176)

Canceled1(88,646) (47,092) (240,792)

Outstanding at December 31 1,565,616 1,737,274 1,679,460

1Includes 181,102 shares canceled upon conversion to The Sabre Group stock awards for 1996.

The weighted-average grant date fair value of perfor-

mance share awards granted during 1998, 1997 and 1996

was $62.06, $52.28 and $39.41, respectively.

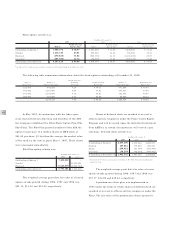

There were approximately 21 million shares of AMR’s

common stock at December 31, 1998 reserved for the

issuance of stock upon the exercise of options and the

issuance of stock awards.

The Sabre Group has established the 1996 Long

Term Incentive Plan (1996 Plan), whereby its officers and

other key employees may be granted stock options and

other stock-based awards. Initially, 13 million shares of

The Sabre Group’s Class A Common Stock (Sabre

Common Stock) were authorized to be issued under the

1996 Plan. At December 31, 1998, approximately five mil-

lion options for Sabre Common Stock were outstanding

under the 1996 Plan.

In January 1998, in connection with the information

technology services agreement executed between The Sabre

Group and US Airways, The Sabre Group granted two

tranches of stock options to US Airways, each to acquire

three million shares of Sabre Common Stock. During cer-

tain periods, US Airways may select an alternative vehicle of

substantially equivalent value in place of receiving stock.

The first tranche of options is exercisable during the six

month period ending two years after the transfer of US

Airways’ information technology assets, which occurred in

January 1998, has an exercise price of $27 per share and

is subject to a cap on share price of $90. The second

tranche of options is exercisable during the 10-year period

51

AMR CORPORATION

beginning on the fifth anniversary of the asset transfer

date, has an exercise price of $27 per share and is subject

to a cap on share price of $127. During 1998, a long-term

liability and a related deferred asset equal to the number

of options outstanding multiplied by the difference

between the exercise price of the options and the market

price of Sabre Common Stock were recorded. The asset

and liability are adjusted based on changes in the market

price of Sabre Common Stock. As of December 31, 1998,

the liability relating to these options was $105 million.

The deferred asset is being amortized over the 11-year

non-cancelable portion of the agreement.

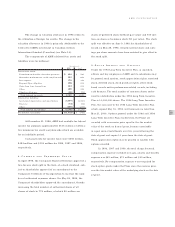

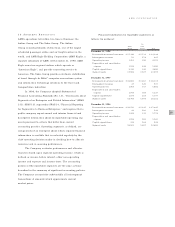

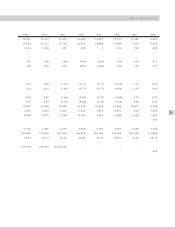

The Company has adopted the pro forma disclosure

features of Statement of Financial Accounting Standards

No. 123, “Accounting for Stock-Based Compensation”

(SFAS 123). As required by SFAS 123, pro forma informa-

tion regarding net earnings and earnings per share has been

determined as if the Company and The Sabre Group had

accounted for its employee stock options and awards

granted subsequent to December 31, 1994 using the fair

value method prescribed by SFAS 123. The fair value for

the stock options was estimated at the date of grant using a

Black-Scholes option pricing model with the following

weighted-average assumptions for 1998, 1997 and 1996:

risk-free interest rates ranging from 5.01% to 6.70%; divi-

dend yields of 0%; expected stock volatility ranging from

25.4% to 32.0%; and expected life of the options of 4.5

years for all Plans, with the exception of The Pilot Plan

which was 1.5 years.

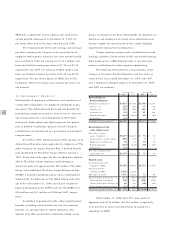

The Black-Scholes option valuation model was devel-

oped for use in estimating the fair value of traded options

which have no vesting restrictions and are fully transferable.

In addition, option valuation models require the input of

highly subjective assumptions including the expected stock

price volatility. Because the Company’s employee stock

options have characteristics significantly different from those

of traded options, and because changes in the subjective

input assumptions can materially affect the fair value esti-

mate, in management’s opinion the existing models do

not necessarily provide a reliable single measure of the fair

value of its employee stock options. In addition, because