American Airlines 1998 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

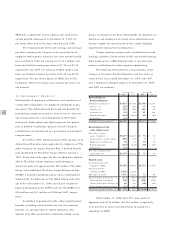

Maturities of long-term debt (including sinking fund

requirements) for the next five years are: 1999 - $48 mil-

lion; 2000 - $244 million; 2001 - $451 million; 2002 -

$83 million; 2003 - $47 million.

During 1996, AMR repurchased and/or retired prior

to scheduled maturity approximately $1.1 billion in face

value of long-term debt and capital lease obligations. Cash

from operations provided the funding for the repurchases

and retirements. These transactions resulted in an extraordi-

nary loss of $136 million ($89 million after tax) in 1996.

American has a $1.0 billion credit facility agreement

which expires December 19, 2001. At American’s option,

interest on the agreement can be calculated on one of

several different bases. For most borrowings, American

would anticipate choosing a floating rate based upon the

London Interbank Offered Rate (LIBOR). At December 31,

1998, no borrowings were outstanding under the agreement.

Certain debt is secured by aircraft, engines, equip-

ment and other assets having a net book value of

approximately $929 million. In addition, certain of

American’s debt and credit facility agreements contain

restrictive covenants, including a minimum net worth

requirement, which could limit American’s ability to pay

dividends. At December 31, 1998, under the most restric-

tive provisions of those debt and credit facility agreements,

approximately $2.6 billion of the retained earnings of

American were available for payment of dividends to AMR.

Cash payments for interest, net of capitalized inter-

est, were $277 million, $410 million and $520 million for

1998, 1997 and 1996, respectively.

6.FINANCIAL INSTRUMENTS AND

RISK MANAGEMENT

As part of the Company’s risk management program, AMR

uses a variety of financial instruments, including interest

rate swaps, fuel swap and option contracts and currency

exchange agreements. The Company does not hold or issue

derivative financial instruments for trading purposes.

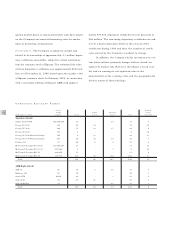

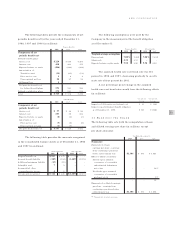

NOTIONAL AMOUNTS AND CREDIT EXPOSURES OF

DERIVATIVES The notional amounts of derivative financial

instruments summarized in the tables which follow do not

represent amounts exchanged between the parties and,

therefore, are not a measure of the Company’s exposure

resulting from its use of derivatives. The amounts

exchanged are calculated based on the notional amounts

and other terms of the instruments, which relate to interest

rates, exchange rates or other indices.

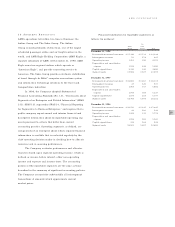

The Company is exposed to credit losses in the event

of non-performance by counterparties to these financial

instruments, but it does not expect any of the counterpar-

ties to fail to meet its obligations. The credit exposure

related to these financial instruments is represented by

the fair value of contracts with a positive fair value at the

reporting date, reduced by the effects of master netting

agreements. To manage credit risks, the Company selects

counterparties based on credit ratings, limits its exposure to

a single counterparty under defined guidelines, and moni-

tors the market position of the program and its relative

market position with each counterparty. The Company also

maintains industry-standard security agreements with the

majority of its counterparties which may require the

Company or the counterparty to post collateral if the value

of these instruments falls below certain mark-to-market

thresholds. As of December 31, 1998, no collateral was

required under these agreements, and the Company does

not expect to post collateral in the near future.

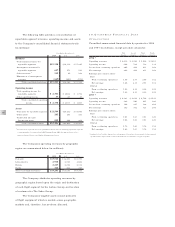

INTEREST RAT E RISK MANAGEMENT American enters into

interest rate swap contracts to effectively convert a portion

of its fixed-rate obligations to floating-rate obligations.

These agreements involve the exchange of amounts based

on a floating interest rate for amounts based on fixed inter-

est rates over the life of the agreement without an exchange

of the notional amount upon which the payments are

based. The differential to be paid or received as interest

rates change is accrued and recognized as an adjustment of

interest expense related to the obligation. The related