American Airlines 1998 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 1998 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

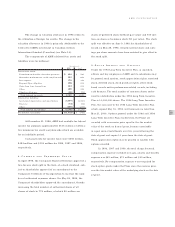

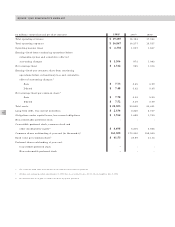

SFAS 123 is applicable only to options and stock-based

awards granted subsequent to December 31, 1994, its

pro forma effect will not be fully reflected until 1999.

The Company’s pro forma net earnings and earnings

per share assuming the Company had accounted for its

employee stock options using the fair value method would

have resulted in 1998 net earnings of $1,311 million and

basic and diluted earnings per share of $7.76 and $7.51,

respectively, and 1997 net earnings of $960 million and

basic and diluted earnings per share of $5.38 and $5.25,

respectively. The pro forma impact of SFAS 123 on the

Company’s 1996 net earnings and earnings per share was

not material.

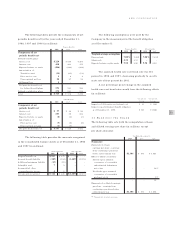

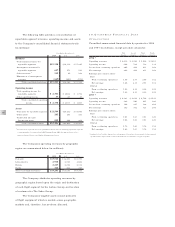

10.RETIREMENT BENEFITS

Substantially all employees of American and employees of

certain other subsidiaries are eligible to participate in pen-

sion plans. The defined benefit plans provide benefits for

participating employees based on years of service and aver-

age compensation for a specified period of time before

retirement. Airline pilots and flight engineers also partici-

pate in defined contribution plans for which Company

contributions are determined as a percentage of participant

compensation.

In October 1997, American spun off the portion of its

defined benefit pension plan applicable to employees of The

Sabre Group to the Legacy Pension Plan, a defined benefit

plan established by The Sabre Group effective January 1,

1997. At the date of the spin-off, the net obligation attribut-

able to The Sabre Group employees participating in

American’s plan was approximately $20 million. The Sabre

Group also established The Sabre Group Retirement Plan

(SGRP), a defined contribution plan. Upon establishment,

substantially all employees of The Sabre Group under the

age of 40 at December 31, 1996 and all new employees

began participating in the SGRP. Costs for the SGRP were

$16 million and $11 million in 1998 and 1997, respec-

tively.

In addition to pension benefits, other postretirement

benefits, including certain health care and life insurance

benefits, are also provided to retired employees. The

amount of health care benefits is limited to lifetime maxi-

mums as outlined in the plan. Substantially all employees of

American and employees of certain other subsidiaries may

become eligible for these benefits if they satisfy eligibility

requirements during their working lives.

Certain employee groups make contributions toward

funding a portion of their retiree health care benefits during

their working lives. AMR funds benefits as incurred and

makes contributions to match employee prefunding.

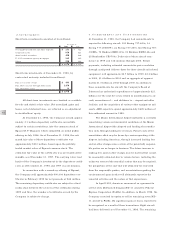

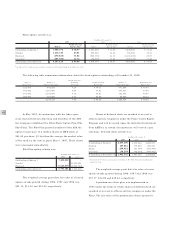

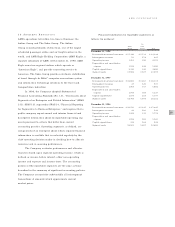

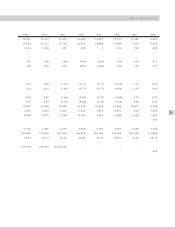

The following table provides a reconciliation of the

changes in the plans’ benefit obligations and fair value of

assets for the years ended December 31, 1998 and 1997,

and a statement of funded status as of December 31, 1998

and 1997 (in millions):

Pension Benefits Other Benefits

1998 1997 1998 1997

Reconciliation of

benefit obligation

Obligation at January 1 $5,825 $5,166 $1,398 $1,213

Service cost 224 189 57 48

Interest cost 430 403 103 95

Actuarial loss 330 475 81 109

Benefit payments (464) (408) (66) (67)

Settlements (16) - --

Obligation at December 31 $6,329 $5,825 $1,573 $1,398

Reconciliation of fair

value of plan assets

Fair value of plan

assets at January 1 $5,219 $4,617 $56$39

Actual return on plan assets 858 977 58

Employer contributions 78 33 76 76

Benefit payments (464) (408) (66) (67)

Settlements (16) - --

Fair value of plan assets

at December 31 $5,675 $5,219 $71$56

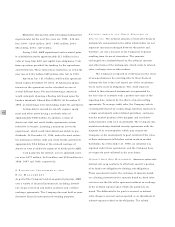

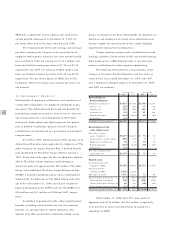

Funded status

Accumulated benefit

obligation (ABO) $5,187 $4,859 $1,573 $1,398

Projected benefit

obligation (PBO) 6,329 5,825 --

Fair value of assets 5,675 5,219 71 56

Funded status at December 31 (654) (606) (1,502) (1,342)

Unrecognized loss (gain) 709 788 (101) (179)

Unrecognized prior service cost 68 63 (46) (52)

Unrecognized transition asset (11) (20) --

Prepaid (accrued) benefit cost $112 $225 $(1,649) $(1,573)

At December 31, 1998 and 1997, plan assets of

approximately $111 million and $92 million, respectively,

were invested in shares of mutual funds managed by a

subsidiary of AMR.

189

403

475

977

33

(408)

5,825

5,219